Income Tax Due Dates Extension for AY 2021-22

CBDT has decided to extend the due date of filing of various income tax returns and audit reports for FY 2020-21 (A.Y. 2021-22) vide Circular No. 17/2021 dated 9th September, 2021.

CBDT has decided to extend the due date of filing of various income tax returns and audit reports for FY 2020-21 (A.Y. 2021-22) vide Circular No. 17/2021 dated 9th September, 2021.

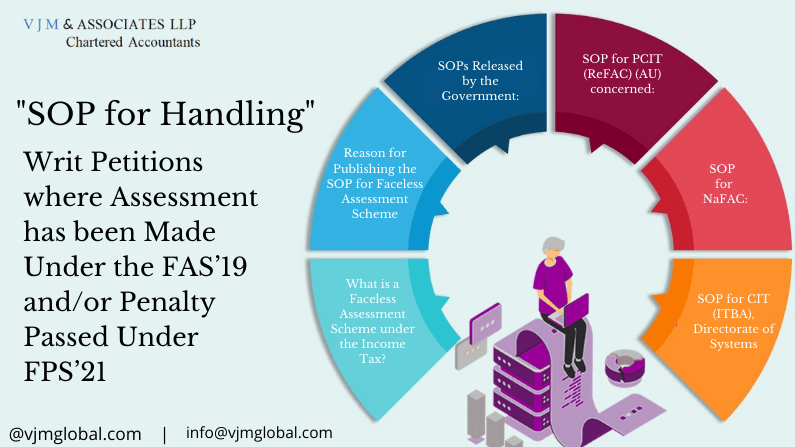

CBDT has prescribed complete Standard Operating Procedures (“SOP”) for penalties under FPS, 2021 vide document issued on 9th August, 2021.

If payment is made to the advertising agency then TDS should be deducted u/s 194C @ 1%/2% irrespective of written contract.

Major changes in TDS & TCS provisions introduced by the Finance Act, 2021 that are becoming applicable with effect from 1st July 2021.

The Central Government observed that National Faceless Assessment Centres (NaFAC) is one of the biggest respondent-litigants in taxation matters.

Since NaFAC has no primary role in defending the writ except in cases where the scheme itself is challenged, the Pr. CIT (Jurisdictional) has been appointed as the authority to defend the case before the Hon’ble High Courts.

G20 Finance Ministers summit was a much anticipated global event before the G20 Global Summit in October, 2021. Italy hosted the G-20 Finance Ministers’ meeting to discuss the fight against COVID-19 and how to speed up the recovery of the global economy.

PAN is an identity provided by the income tax authorities to each taxpaying individual , which is necessary for each one who is needed to file income tax return, and for people who wish to deal in the financial transaction. Expatriates wanting to work in India or to indulge in any business transaction with a company based in India would also need a PAN for such transactions.

Payment made by INDIAN residents to either foreign non-resident distributor or manufacturer / supplier for further sale or use of such software through distribution agreements is not a royalty for use of copyright in the computer software. Hence are not liable to TDS under section 195 of Income tax act.

One of the biggest impacts of the new labour law will be on the take-home salaries, which is expected to reduce, owing to the fact that the government is eyeing increasing contributions towards provident fund (PF) and other post-retirement schemes. The new laws are expected to come into play soon, which will force employers to modify their employee compensations

CBDT via circular has explained following issues for FY 2020-21. How to determine residential status of NRIs.

How income would be taxable in India in case of changing residential status of NRIs. How TIE Breaker rule of DTAA would play important role to avoid double taxation. In which country income would be tax for FY 2020-21 due to covid – 19.

Want to talk to us

Leave your Name, email, Phone number along with what you are looking for in message box or you can call us at 011-41715118

Keep up to date — get updates with latest topics. Signup for our newsletter today.

We serve on FDI advisory, cross-border accounting, International tax planning and Management consulting needs of our overseas clients all over the world.

Corporate Office: 601, 6th Floor, GMIT Park, Sector 142, Noida Exp Way, Noida – 201305

Registered Office: 44, Backary Portion, 2nd Floor, Regal Building, New Delhi 110001

Landline: 0120-4415477-78

info@vjmglobal.com

+91 9891576441, 9213397070, 9911887030

Mon – Fri: 09:00am – 06:00pm

Closed on Weekends

V J M & Associates LLP