Under the present market scenario in India, most foreign investors and non-resident Indians wish to establish a company in the Indian subcontinent to take advantage of cheap resources and quality infrastructure. Business structures in India include Private Limited Companies, LLP or Limited Liability Partnerships, and Public Limited Companies, and these are some of the most favoured business structures for foreigners to do business in the country. It is mandatory to have at least one Indian partner to register a business in India.

Foreign investment in the country is allowed under two segments, the automatic route and the approval route. Under the automatic route, FDI or foreign direct investment is permitted for a Public and Private Limited Company. FDI for Limited Liability Partnership requires the consent of the Reserve Bank of India. While the business registration procedure in India is stringent, you can take the help of veteran business service providers such as VJM & Associates LLP to form a company and expand in India.

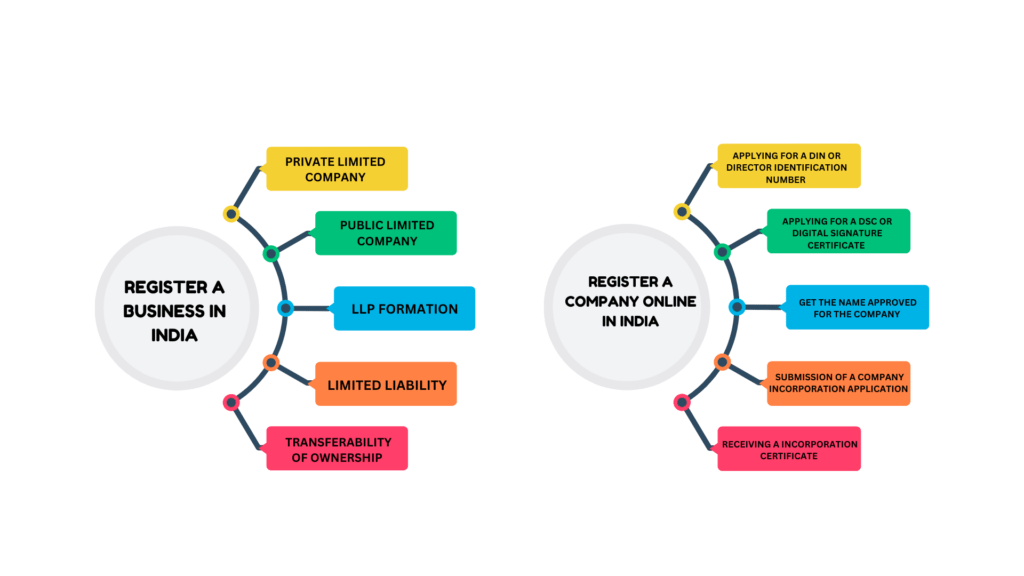

There are Different Types of Limited Liability Business Enterprises in India

- Private Limited Company – A private limited company signifies a private business enterprise lawfully formed under the Companies Act 2013. It should have a minimum of 2 and a maximum of 200 members and the company name should end with the words ‘Private Limited’.

A company that has been incorporated outside the country seeking permission to start its business operations in India as a fresh start-up company can incorporate as a private limited organization with reduced compliance and rules as compared to a public limited firm.

- Public Limited Company – To register a business in India as a public limited company or firm is a business enterprise formed under law as per the Company Act provisions 2013, which is not a private limited company. A public company must have a minimum of 7 members and unlimited members (maximum) and the name of the firm must end necessarily with the word limited.

A company that is incorporated in foreign country wanting to start Indian operations as a start-up can become a public limited company with an alternative to secure capital from the public. You can partner with reputed company VJM & Associates LLP to start a public limited company in India.

- LLP Formation – Limited Liability Partnership, also called LLP is a corporate body formed and duly registered under the 2008 Limited Liability Partnership Act. It is considered as a separate legal entity from its partners. LLP is provided with perpetual succession, which means a change in the partners will not affect the existence of the LLP company, its rights and liabilities.

Every limited liability partnership has typically two nominated partners and one of the partners has to be a resident Indian. If an LLP has all partners as corporate bodies, or any one partner is a body corporate, then two persons who are authentic partners of the LLP or bodies corporate must act as designated partners.

The primary benefits of registering a company in India by foreign parties are as follows:

- Separate Legal Status – The company and its designated members can enjoy special and separate legal identity, which is distinct from each other.

- Perpetual Succession – Limited company’s existence is seemingly uninterrupted because even in the face of death or insolvency regarding one partner or partners cannot affect the perpetual continuity of the business.

- Limited Liability – The members liability of any limited entity is limited to the share capital amount that remains unpaid on those shares that are held by them.

- Transferability of Ownership – The limited entity’s ownership can be transferred through transfer of shares from one director member to another.

- Transparent Business – A limited company’s ethics stands on transparent policies. It focusses on transparency to instill confidence, solid support, and amicable participation of all members or parties concerned with the limited company.

Some Must-Have Features of a Limited Company

- Unique Name – To register a business in India, the company name chosen should be separate and unique from other company names. It should not be similar to the name of any other company or LLP.

- Share Capital – A company’s share capital is subdivided into 4 parts. The share capital is authorized, which means that it is passed by the Memorandum of a company to be the optimum or maximum share capital amount that can be raised by any company. An issued share capital means that the capital issued by the company for subscription purposes (at regular intervals).

- Paid-up and Subscribed Share Capital – Subscribed capital signifies that part of the capital is being subscribed by company members. Paid-up capital signifies the aggregate paid-up amount of capital that is credited is equal to the money that is received for such shares. For a private limited company, there is nothing as minimum paid-up share capital.

Who is a Subscriber in a Limited Company?

A subscriber is an individual who has fallen in agreement to subscribe to the necessary share capital of the entity during its formation as a company and on its registration. A subscriber’s name is written as a member of the Register of Members and at least two subscribers are needed to start a private limited company for a public limited company at least 6 subscribers are needed to register a business in India and incorporate it. Company subscribers can be Indian or foreign. There is absolutely no restriction on a subscriber being a director of a private limited company.

A Registered Office

It is compulsory for all start-up companies to have an authentic registered office to receive and acknowledge all sundry communications and other notifications that may be addressed to their names. A registered office of a private or public limited company must be located within India. All legal and other formalities to start a company in India can be fulfilled by associating with established service provider VJM & Associates LLP. Designated Partners of LLP. Every Limited Liability Partnership must have a minimum of two designated partners, who are actual persons and one of the partners must be an Indian resident.

To Register a Company Online in India

- Applying for a DIN or Director Identification Number

- Applying for a DSC or Digital Signature Certificate

- Get the name approved for the company

- Submission of a company incorporation application

- Receiving a Incorporation Certificate

You can also apply to register a company online in India via the MCA or Ministry of Corporate Affairs website. You may register as a authentic user or a business user.

The Board of Directors

The director is an individual duly appointed to be part of the company board. The Board of Directors of an enterprise are permitted to exercise certain powers and do some acts as authorized by the company rules except for those things that have to be permitted by a company in its general body meeting. To register a business in India as a private limited company has to be incorporated by a minimum of 2 directors and in the case of a public limited company, by a minimum of 3 directors, out of those at least one director must be an Indian resident.