SOP (Standard Operating Procedure) For penalties under Faceless Penalty Scheme-2021

CBDT has prescribed complete Standard Operating Procedures (“SOP”) for penalties under FPS, 2021 vide document issued on 9th August, 2021.

CBDT has prescribed complete Standard Operating Procedures (“SOP”) for penalties under FPS, 2021 vide document issued on 9th August, 2021.

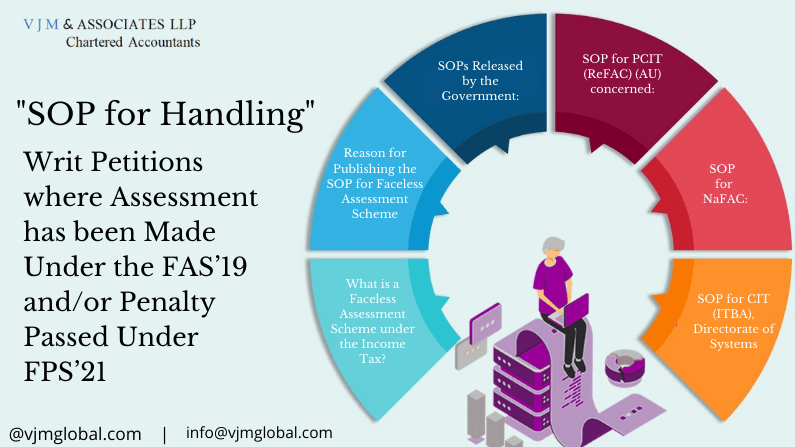

The Central Government observed that National Faceless Assessment Centres (NaFAC) is one of the biggest respondent-litigants in taxation matters.

Since NaFAC has no primary role in defending the writ except in cases where the scheme itself is challenged, the Pr. CIT (Jurisdictional) has been appointed as the authority to defend the case before the Hon’ble High Courts.

As per Faceless Assessment scheme procedure under Income Tax Act, National e-Assessment Center (NeAC) which shall act as the major managing authority and it will act as a mediator between Assessment Unit, Assessee and other parties.

Faceless assessment is a “big step in reducing Department’s interference from people’s lives” and ensures speedy assessment of cases. Further, another major cause is that the I-T department has been progressively reducing the percentage of cases picked up for scrutiny assessment so as to establish the fact that the department places trust on the taxpayer.

Want to talk to us

Leave your Name, email, Phone number along with what you are looking for in message box or you can call us at 011-41715118

Keep up to date — get updates with latest topics. Signup for our newsletter today.

We serve on FDI advisory, cross-border accounting, International tax planning and Management consulting needs of our overseas clients all over the world.

Corporate Office: 601, 6th Floor, GMIT Park, Sector 142, Noida Exp Way, Noida – 201305

Registered Office: 44, Backary Portion, 2nd Floor, Regal Building, New Delhi 110001

Landline: 0120-4415477-78

info@vjmglobal.com

+91 9891576441, 9213397070, 9911887030

Mon – Fri: 09:00am – 06:00pm

Closed on Weekends

V J M & Associates LLP