Goods and Service Tax (“GST”) clearly functions on the concept of “Export the Goods/Services and not the taxes”. Therefore, all taxes paid on goods/services exported out of India must be refunded to the exporter without any failure. Under GST, a refund of IGST paid on exported goods is provided automatically on the filing of shipping Bills to avoid funds blocking of the exporter.

In case of export made with payment of IGST, shipping bill filed for export of goods is automatically considered as Refund application and upon processing of shipping bills on IECGATE, the system will automatically process the refund of IGST.

1. Challenges in IGST refund on goods exported through Courier

- Where goods are exported through courier, shipping bills are not filed online. Rather a manual shipping bill is filed in form CSB-V Form (Courier Shipping Bill-V).

- However, since CSB-V are filed manually, therefore, details of CSB-V are not processed on ICEGATE automatically. Non-processing of Shipping Bill information on ICEGATE does not allow automatic processing of refund of IGST paid on export.

2. Steps taken to resolve refund issues with respect to goods exported through courier

- To resolve the issue of paper work and manual intervention in courier export cases, Central Board of Indirect Taxes and Customer has developed a new application namely ECCS (Express Cargo Clearance System).

- The ECCS was launched in 2017 for the electronic clearance of courier consignments.

3. Advisory issued by CBIC on IGST Refund module for Exports in ECCS Application

- Initially Office of the Additional Director General (Systems) issued an Advisory on Roll Out of IGST Module for Export in ECCS Application vide F.No. I(9)/1/2020-Sys(W) dated 20th January, 2020.

- Later on an ICES advisory 21/2020 dated 20th June, 2020 was issued with respect to IGST refund processing of Courier Export in ICES (Indian Customs EDI System).

- Office of the Commissioner of Customs II issued Public No. 07/2020-21 dated 2nd July, 2017 on IGST refund module for Export in ECCS Application.

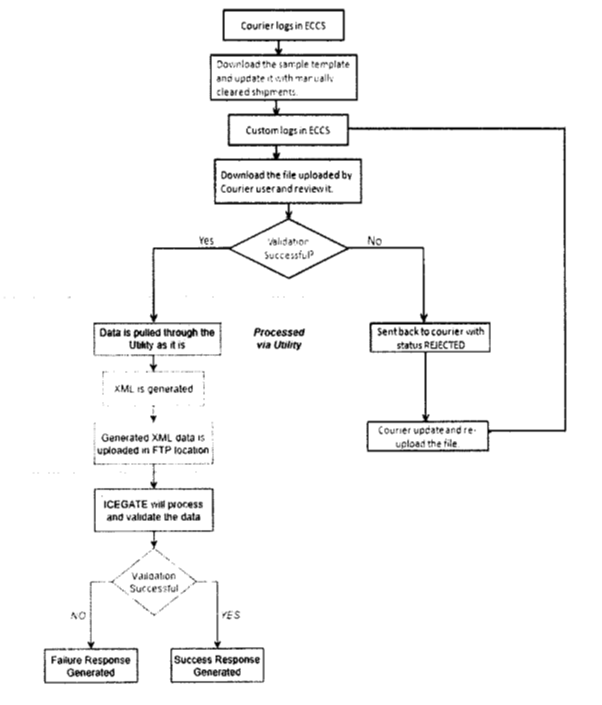

This advisory explains the IGST refund workflow in ECCS (Express Cargo Clearance System).

4. Process of IGST Refund on Courier Export through ECCS Application

- IGST refund processing for exports through courier shipment has been enabled in ICES.

- As a pre-requisite, Courier companies are required to upload data related to Manual Courier Shipping Bills in ECCS and also required to register/update Bank details of Exporter in ICES (Indian Customs EDI System).

In this article, we will understand the process of uploading the Manual courier shipping on ECCS with the approval of the customs officer and processing of IGST refund on the Exported goods.

4.1 Upload Manual Courier Shipping Bills by Courier Company

- Every Courier company is required to create login credentials at https://eccsidm.cbic.gov.in.

- Only 89 courier companies are registered as “Authorised Couriers” on ECCS portal. List of such companies can be access at https://courier.cbic.gov.in/courierTerminalList.jsp.

- Post Login, Courier company shall download the Sample Template file and will update the file with manually cleared shipments.

- Courier company shall upload the updated file at “Export>Manually Cleared Data Upload”.

- Uploaded details of manually cleared shipping Bills will move to Customs for approval.

4.2 Approval/Rejection of Shipping Bills by Custom Officer

- Custom officer shall login on ECCS portal and will be able to see data of manually cleared Shipping Bills under “Export>Approve Manually Cleared Shipping Data”

- Custom officer will have the two options, i.e., either to approve or Reject.

4.3 Status of Manual Shipping Bills by Courier Companies

- Action by Custom officer will appear on ECCS portal of courier company and courier company will be able to access the data at “Export>Manually Cleared Shipment>View”.

- Files Validation unsuccessful and rejected: In this case the courier company is required to amend the file as per custom officers comments. After updating the file, the same be resent to custom for approval.

- Files Validation successful and accepted: Approved data will be converted into XML through utility and same shall be transmitted to IECGATE for further processing of IGST refund.

4.4 Processing of data by ICEGATE

- Data transmitted to ICEGATE will be process and ICEGATE shall further process the data.

- If ICEGATE validation is successful then the Success Response Generated and data is further transmitted to ICES.

- If ICEGATE validation is unsuccessful then the Failure Response Generated and data is sent back to ECCS.

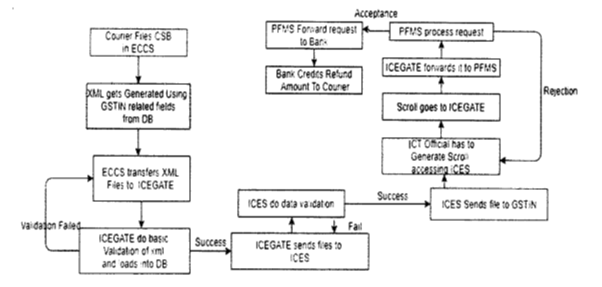

Flowchart of uploading Manual Courier Shipping Bill

4.5 Processing of IGST Refund in ICES

- Files forward to ICES by ICEGATE are revalidated by ICES and successfully validated files are transferred to GSTIN.

- Further the ICT (Information and Communication Technology) official is required to generate scroll accessing ICES and send it to ICEGATE.

- ICEGATE forwards it to PFMS (public financial management system) for IGST refund amount transfer.

- PFMS process requests and if satisfied with the authenticity forward the request to the Bank.

- Bank credits the refund amount to the exporter.

4.6 Data validation done at ICES for processing refund

Once the data is transmitted to ICES through the above-mentioned procedure, ICES performs the following validation checks on data to ensure correct and eligible refund amount is processed:

- Verification and approval through IGST_VFN role –

- Once data is available in ICES, an existing IGST_VFN module should be used for final verification and approval of the uploaded data. This is the same module which is used for IGST refund related verification of manual/non- EDI shipping bills.

- The System manager (SM) or Alternate System Manager (ASM) is required to map the officer(s) dealing with courier IGST refunds for IGST_VFN role.

- Mapping of concerned officers is a prerequisite.

- The officer shall login at Cargo Site and shall verify the details of Shipping Bills.

- Unless a shipping bills is verified and submitted in this role at ICES, the same shall not be considered for IGST refund procedure.

- Account details submission – The account details of the exporter should be updated in ICES by the exporter.

- IGST validation procedure – once the steps 1 and 2 are completed the system runs the validation process of matching the received data with the corresponding data of GSTR-1. If any mismatch between the data the error code (enclosed below) will be generated and available on ICEGATE to the exporter and on IGST_VFN role to the office in ICES. If the error is related to incorrect filing of return, then the same is advised to the exporter to amend in GSTR-1.

- Refund Scroll – Finally temporary and final scrolls options will be available. Officers of the concerned Air Cargo Commissionerate can generate the successfully validated shipping Bills.

Flow chart of process of IGST refund