Goods and service Tax (“GST”) is a consumption/destination based tax, i.e., GST revenue generated out of supply of goods/services accrues to that state wherein such goods/services gets consumed. Information about consuming states is collected by government from data provided by the taxpayers in their GST returns.

Accordingly, in case of inter-state supply (from one state to another), to ensure correct allocation of revenue among states, details of consuming states (i.e., place of supply) is required to be correctly reported in GST returns.

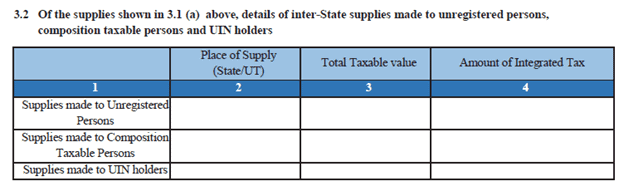

However, it has been noticed by the department under GST Audit that taxpayers have failed to report inter-state supplies to unregistered persons appropriately. Such supplies are reportable grossly in Table 3.2 of Form GSTR-3B and rate-wise in Table 7B of GSTR-1 (invoice value less than INR 2.5 Lacs).

As observed, registered taxpayers have disclosed details of such supply in GSTR-1 properly but failed to report the Interstate supply to unregistered person in GSTR-3B which consequent in:

- Incorrect allocation of IGST amount to consuming states

- Mis-match between the quantum of goods or services actually supplied in a state and corresponding allocation of tax against such goods/services.

Accordingly, department has issued circular 89/08/2019-GST dated 18th February, 2019 instructing all registered taxpayers to report details of such inter-state supplies to unregistered dealer properly as:

Table 3.2 of GSTR-3B wherein details required for Interstate supply to unregistered person are:

- Place of supply (Refer Section 10 & 12 of Integrated Goods and Service Tax Act, 2017),

- Total Taxable Value and

- Amount of IGST.

Below is the screen shot of Table 3.2 of GSTR-3B Return

Table 3.2 of GSTR 3B Return

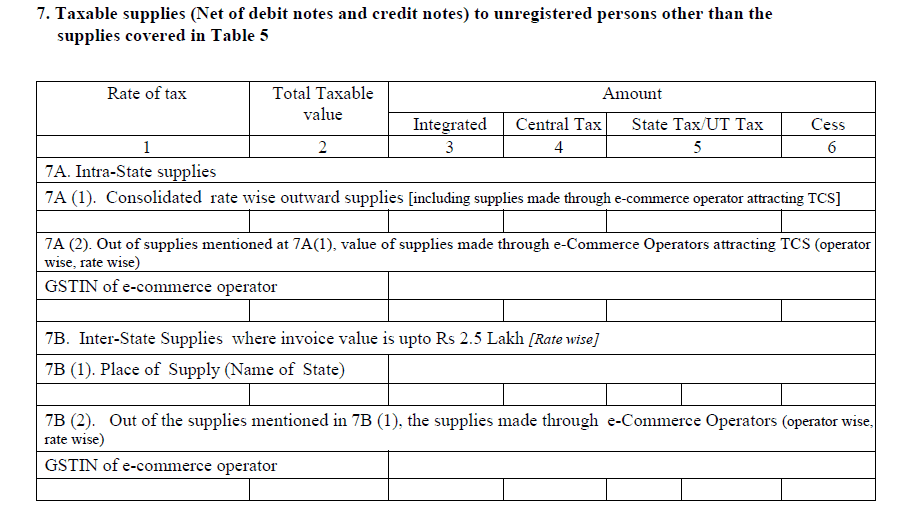

Table 7 of GSTR-1 (Value of invoice less than INR 2.5 Lacs) contains following details:

- Place of supply

- GST Rate

- Taxable Value

- Amount of IGST

Incorrect reporting will lead to invocation of penalty proceeding under Section 125 of Central Goods and Service Tax Act, 2017 against such taxpayers.

Read our article on Amendment, Corrections and Rectifications of GSTR-3B returns

Also find more detail on Various Returns under Goods and Service Tax (GST)