GSTR-1 is a monthly/quarterly return that is required to be filed by every registered dealer in India. The GSTR-01 return contains details about outward supplies.

Based on your turnover, the due dates of filing GSTR-1 vary. Industries with aggregate turnover more than Rs. 1.5 crore, will have to file the GSTR-01 return on a monthly basis. However, businesses with aggregate turnover up to 1.5 crores have an option to file the return on quarterly basis..

1. Features of GSTR-1 Form

- All the registered taxpayers need to file the Form GSTR-1 to fill the sale details of their business irrespective of any profit gained or lost in a month.

- All the taxpayers liable to file GSTR-01 on a monthly basis need to fill the form by 11th of the following month of the filing date of the return.

- Taxpayers have to provide the invoice wise details in the designated fields

- The sales of the taxpayers’ business cover supplies to unregistered persons , registered persons , credit Notes, debit notes, export, amendment to sales detailed given in earlier GST return,

2. Significance of GSTR-1

Under the pre-GST regime, in many cases, departmental authorities were needed to obtain confirmation from suppliers to check authenticity of purchase invoice and also buyer had no option to check whether supplier has paid his output liability properly or not or whether he has uploaded his invoice details or not.

However, under the GST regime, this process has become online. As a supplier when you file GSTR 1 with party wise and invoice wise details, such sales reflect in GSTR-2A of corresponding buyer as purchase and they become entitled to take credit on such amount.

3. Who Should file GSTR-1

All the taxpayers and businesses who are registered under GST should file a GSTR 1 except for the followings-

- Input Service Distributor

- Composition Dealers

- Non-resident Taxable Person

- Taxpayer liable to collect TCS and deduct TDS

- Suppliers of OIDAR (Online Information and Database Access or Retrieval)

4. Due Date and Penalty for GSTR-1

The due dates of filling GSTR-1 are clearly based on your business turnover. Businesses having aggregate turnover of INR 1.5 crore or more need to file GSTR-1 on monthly basis . However, business entities with aggregate turnover upto 1.5 crore have an option to file GSTR-1 on quarterly basis.

5. Quarterly GSTR-1 Filing: Annual Turnover upto Rs. 1.5 Crore

| Quarter | Due Date |

| Oct-Dec 2019 | 31st January 2020 |

| Jan-Mar 2020 | 30th April 2020 |

6. Monthly GSTR-1 Return: Annual Turnover More Than Rs. 1.5 Crore

| Period | Due Date |

| October 2019 | 11th November 2019 |

| November 2019 | 11th December 2019 |

| December 2019 | 11th January 2020 |

| January 2020 | 11th February 2020 |

If any taxpayer fails to file GSTR 1, a late fee will be applicable worth of Rs. 200 per day of delay. Rs. 100 for CGST and Rs. 100 SGST. Late fees will be counted from the due date to the date of filing GSTR 1.

However,such late fees have been reduced to Rs. 50 per day (INR 25-CGST & INR 25 SGST) and Rs. 20 (INR 10-CGST & INR-10 SGST) per day for nil returns.

Government has released a notification (Notification No. 74/2019 – Central Tax Date of Notification Published: 26th December 2019) to waive off the amount of late fee. As per the notification, the taxpayers who have failed to file the GSTR-1 for the period of July-2017 to November 2019 but have successfully filed GSTR-1 return with all the correct details within the period of 19th December 2019 to 10th January 2020 will be waived from the late fee payable under section 47 of the CGST act.

7. Information You Need to Furnish While Filing GSTR-1 Return

Following are the details you need to submit while filing return through GSTR-1:

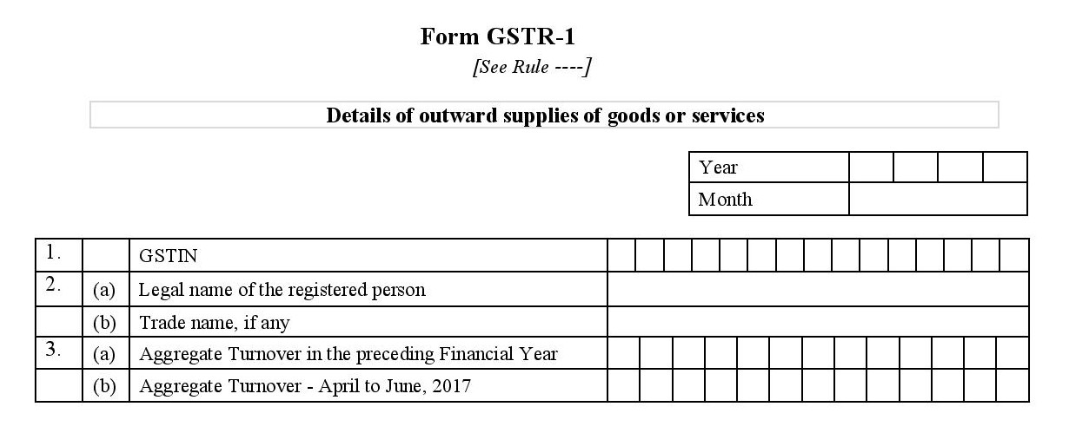

7.1 Table – 1, 2 and 3

Table – 1, 2 and 3 capture basic detail of registered person filing return. Below we have all the details you will have to describe under table 1, 2, and 3.

| Table Reference | Column | Details Required |

| 1. | GSTIN | Goods and Service Tax Identification number of the registered person. It will auto-populate post login at GST portal |

| 2.(a) | Legal name of the registered person | Name of the registered taxpayer. It will auto-populate post login at GST portal |

| 2.(b) | Trade name, if any | If the registered person has any trade he needs to enter that here. It will auto-populate post login at GST portal |

| 3.(a) | Aggregate Turnover in the foregoing Financial Year | You will have to enter the total Turnover in the last Financial Year. You will have to submit this information in the case of the first year return filing only. From then it will get auto-populated. |

| 3.(b) | Aggregate Turnover – April to June, 2017 | The taxpayer needs to provide the Aggregate Turnover – April to June, 2017 in this column. . This provision is related to transition from pre-GST regime to GST Regime. |

7.2 Table 4: Details of Outward Supplies

- Taxpayers Need to Provide Tax Rate wise detail for following:

- All the supplies except the one related to reverse charge/ done through any e-commerce dealer under Table 4A

- All the supplies that attracts reverse charge under Table 4B. Outward supplies liable to reverse charge will be reported here. If a recipient is liable to pay GST on RCM basis then such recipient shall not disclose his inward supplies liable to RCM in this table.

- Supplies effected via e-commerce dealer attracting tax collection at source under the section 52 of the Act under Table 4C

- Operator Wise Details for The Following:

- Supplies made via e-commerce attract TCS under section 52 of the Act under Table 4C.

- Enter the Place of Supply only if the same is different from the region from where the recipient belongs.

- Table 4 capturing information relating to B2B supplies only. No B2C supplies would be provided under table 4 of GSTR – 1.

- Supplies as Zero rated supplies and deemed export shall be provided under Table 6 of GSTR – 1

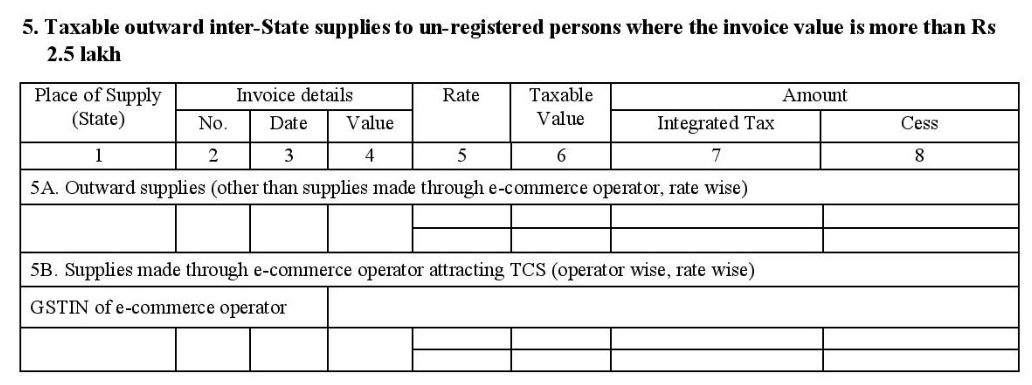

7.3 Table 5: Information Regarding Outward Inter-State Supplies with Invoice Value More Than 2.5 Lakh

You need to submit the following details under table 5 of Form GSTR-01,

- Detail of outward supplies in the course of inter-state outward supplies.

- Information of supplies to an unregistered person where invoice value is bigger than Rs. 2,50,000.

- The Place where the supply is made, which is mandatory to mention in this case.

- Tax Rate wise detail for the following:

- Outward supplies to unregistered person other than the supplies via e-commerce dealer

- Operator wise and rate wise supplies via e-commerce dealer where tax collected at source

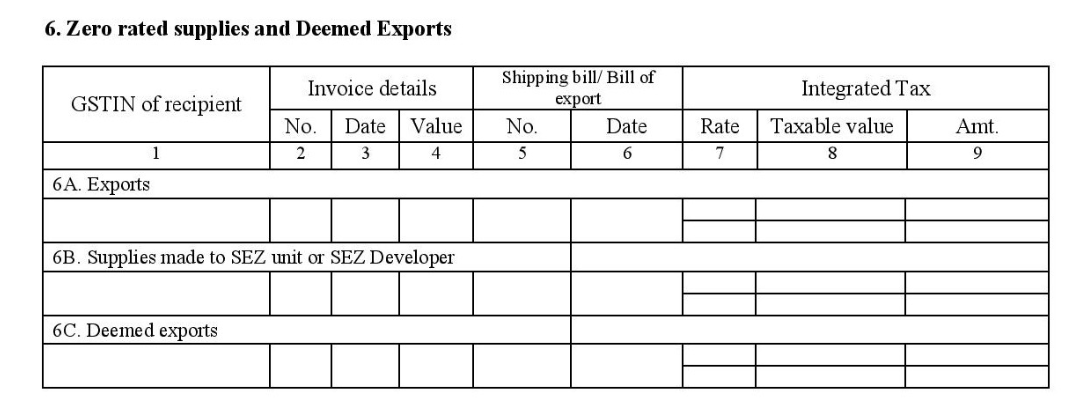

7.4 Table 6: Details Regarding Deemed Exports and Zero-rated Supplies

Taxpayers need to provide rate wise detail for the following:

- Furnish all the details of supplies relating export under Table 6A

- Supplies made to SEZ Developer or SEZ unit under Table 6B

- Under table 6C supplies relating to Deemed export

- Shipping bill wise detail along with the date of the bill to be provided under Table – 6.

Note: In case details of the shipping bill is not available, you can leave that blank. You need to furnish the details of Shipping Bill in 7 digits with port code captured (6 digits) along with the number of shipping bill.

- For export transactions, the recipient GSTIN will not be available. Therefore, it will be left blank.

- In Table 6A and 6B under the heading of “ without payment of tax ” taxpayers choose this option only in case of where IGST payment is not done (under Letter of Undertaking (LUT) or Bond). In this case, export transactions should also be reported rate wise

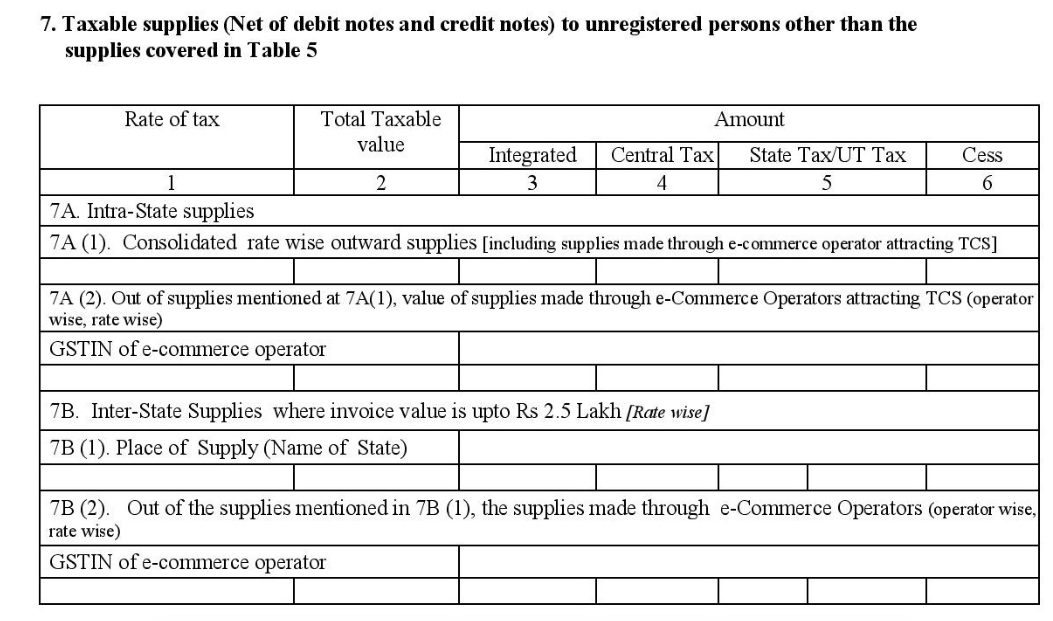

7.5 Table 7: Taxable Supplies to Unregistered persons

- Table 7A captures following details:

- All supplies done to an unregistered person within the state needs to be reported here irrespective of invoice value.

- Rate wise detail to be provided In table 7.

- Supplies made with e-commerce dealer shall be provided separately along with GSTIN number of each e-commerce

- Table 7B captures following details:

- Table 7B captures details of supplies to unregistered person for all supplies made outside the state. However, such detail to be provided for invoice value up to Rs. 2,50,000.

- Rate wise detail to be provided in this table.

- Supplies made via e-commerce shall be provided separately along with GSTIN number of each e-commerce

- State-wise information to be provided for supplies made outside the state under Table 7B.

- Negative value can be mentioned in this table, if required

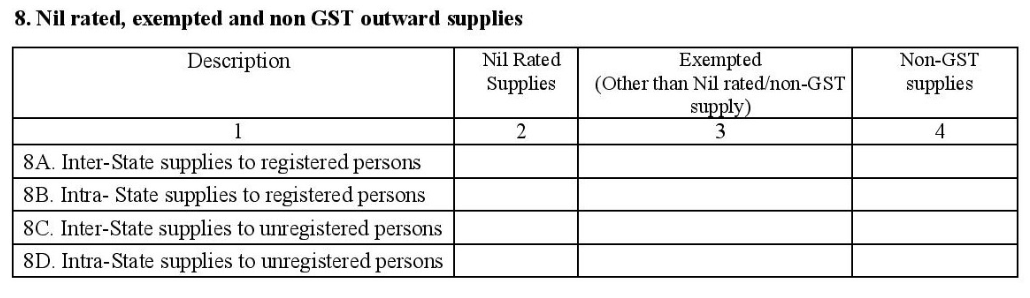

7.6 Table 8: Details Related to Exempted, Non-GST and Nil rated Supplies

This table requires you to furnish all the mentioned supplies (Inter-State & Intra- State) to registered and unregistered person related to exempted supplies, Non-GST supplies and Nil rated supplies.

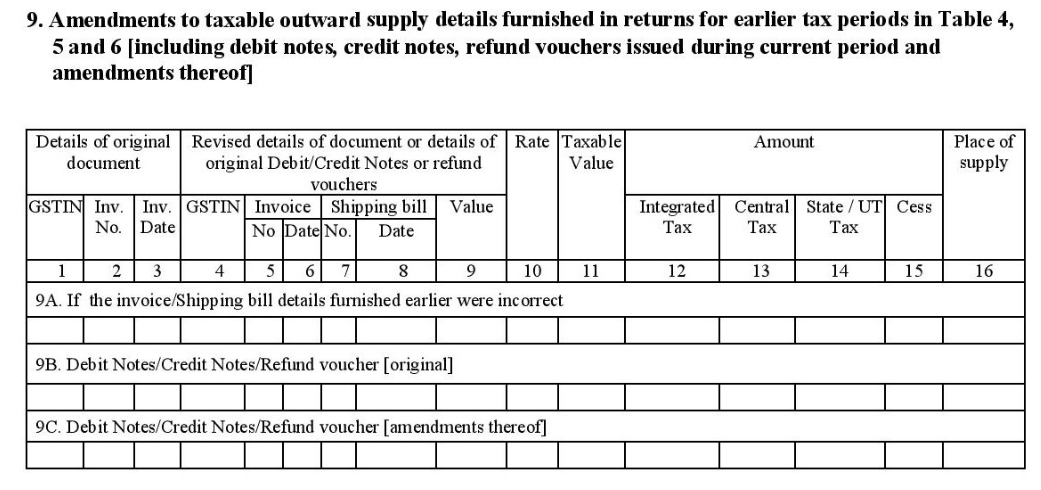

7.7 Table 9: Corrections in the Details Furnished Related to Outward Supplies in Earlier Tax Periods

Amendments of supplies with respect to following:

- Details related to supplies to registered person furnished in Table 4,

- Supplies to unregistered persons where invoice value is more than 2,50,000 and supplies made outside the state.

- Supplies with SEZ unit or SEZ developer / exports / deemed exports furnished in Table 6;

- Rate wise Information needs to be furnished here.

- It includes actual details of debit or credit note issued and report of amendment done to the details furnished in the earlier tax periods. At the time of entering details related to original debit note or credit note taxpayers will have to mention the invoice detail within the first three columns. In case of revision of a credit note or debit note the information of actual debit note or credit note needs to be mentioned in the other three columns of the table.

- Place of Supply only if the location is different from the region from where the recipient belongs.

- Any debit/ credit note related to the bill issued before the designated day under the law existing needs to be reported in this table.

- Only in case of amendment in exports transactions taxpayers have to provide shipping bills.

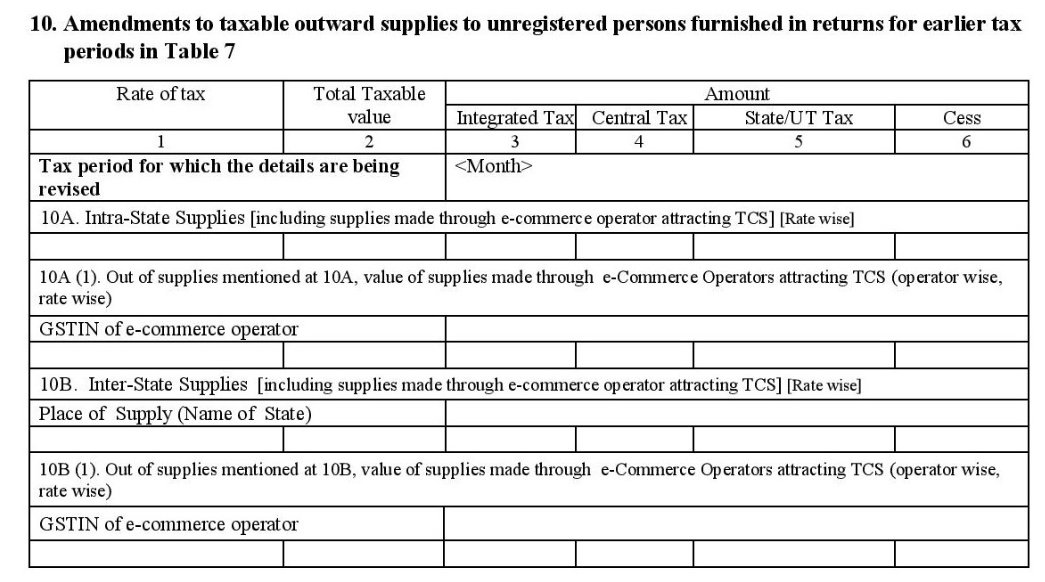

7.8 Table 10: Corrections in the Details Furnished Related to Outward Supplies Made to Unregistered Persons in Earlier Tax Periods

Taxable value net of debit/ credit note raised in a particular tax period and information pertaining to previous tax periods which was not reported earlier, shall be furnished in Table 10. Alongside, rate wise information to be provided under this table.

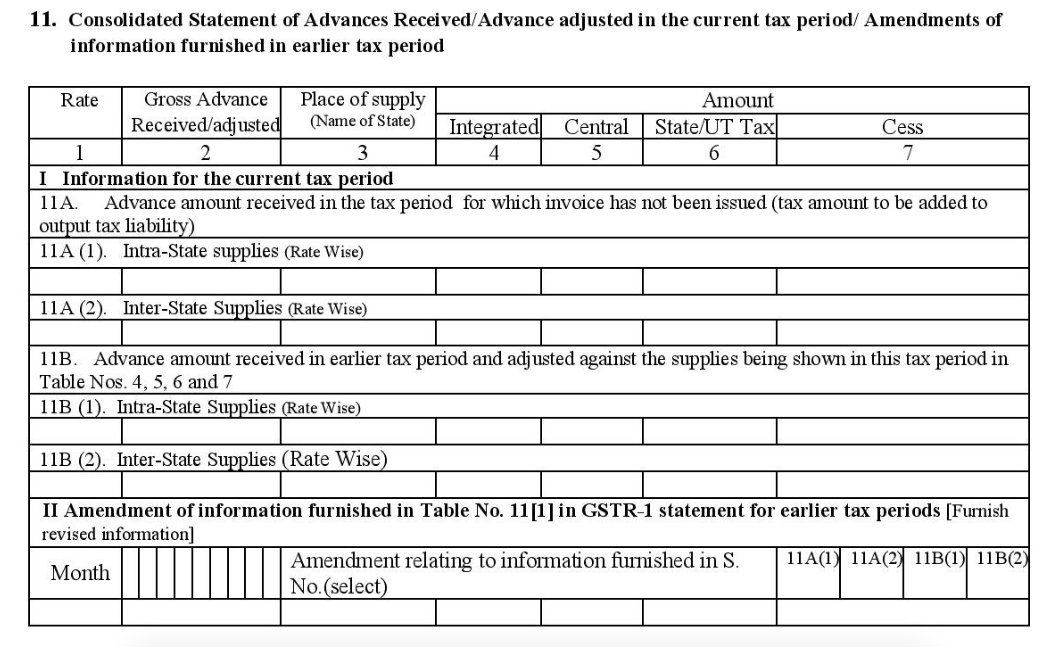

7.9 Table 11: Consolidated Statements of Advances Received or Adjusted

In the table 11 you need to furnish the following details,

- Furnish details related to the advance amount you have received in the tax period for which yet the invoice has not been issued under table 11A. In this case, output tax liabilities will be increased for registered person.

- Advance amount received in previous tax period and adjusted against the supplies being shown in this tax period in Table Nos. 4, 5, 6 and 7 under table 11B.

- Amendment of information furnished in Table No. 11 in GSTR-1 statement for earlier tax periods to be provided under table – 11B.

- Rate wise information to be provided under table 11 of GSTR – 1

- Separate information for inter-state supplies and intra-state supplies to be provided.

- The Place of Supply to be provided under this table.

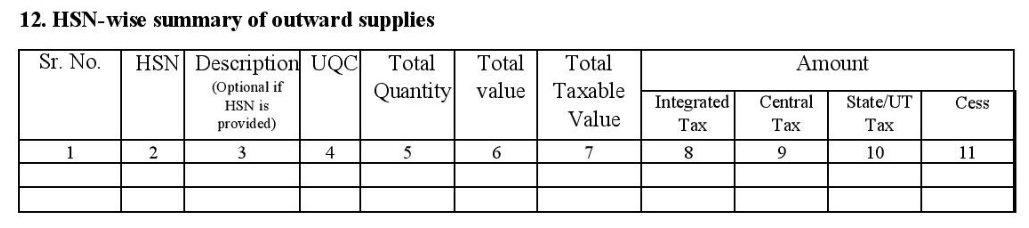

7.10 Table 12: HSN or SAC Wise Information of Outward Supplies

This table shall contain a summary with the details of supplies made against a specific HSN code. You need to provide the HSN Code as per given turnover slab.

| Turnover | HSN Code | Remark |

| Up to 1.5 cr | No HSN/SAC code | HSN / SAC code is optional however description of goods is mandatory in this case. |

| More than 1.5 cr but up to 5 cr | First 2 digit of HSN/SAC code | HSN / SAC code is Mandatory |

| More than 5 crore | First 4 digit of HSN/SAC Code | HSN / SAC code is Mandatory |

| In case of Export & Import | Eight Digit of HSN/SAC code in Mandatory | HSN/SAC code is Mandatory |

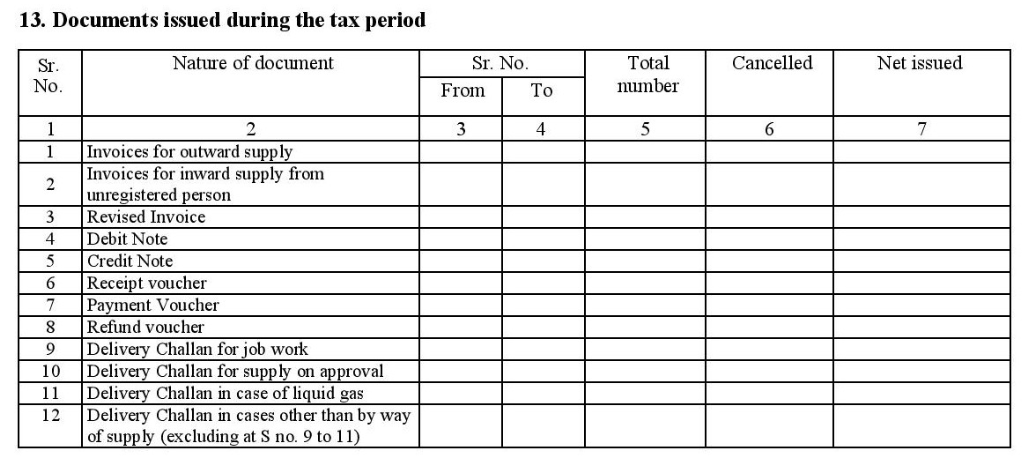

7.11 Table 13: Furnish Details Related to Documents Submitted During The Tax Period

This section requires you to furnish all the information related to the invoices uploaded in the tax period, revised invoice, credit notes, debit notes etc.

It’s time for signing off! If you’ve got further queries, get in touch with our experts or comment in the box below. To know more about GST returns, go through our other articles.

8. FAQs

1. Should I file GSTR-1 even if there are no sales in a month?

Yes, you have to file GSTR-1 even if you had no business in a month or a quarter under a tax period.

2. Do I need to file GSTR-1 after filing GSTR-3B?

Filing GSTR-3B is a simple summary of computation of GST Liability on monthly basis. However, GSTR-1 contains invoice wise and party wise details of outward supply. So, you need to file the GSTR-1 on a quarterly or monthly basis in addition to GSTR-3B.

3. I have opted for a composition scheme. Should I file GSTR-1?

No, you don’t have to file GSTR-1. But it’s mandatory to file GST CMP-08 for taxpayers under composition scheme or who opted for benefit of N/No. 2/2019-Central tax (Rates), every quarter.

4. I have filed GSTR-1 for July 2017. My annual sales are below Rs. 1.5 Crores . Should I file a quarterly or monthly return?

At the beginning of every Financial Year, you need to select whether you want to file GSTR-1 on monthly basis or quarterly basis as per your aggregate turnover of preceding year and expected turnover of current year. Once selected, option can’t be changed during the year.

Further, If your aggregate turnover is exceed during financial year, GST portal will automatically convert your quarterly return into monthly return and you have to file all GSTR-1 from beginning to till date for that financial year

5.Can I upload the invoice only while filing the return?

There is full leverage provided for uploading invoices. But, we are advising you to upload the invoices at a regular interval, because bulk upload consumes a lot of time while filing GSTR-1.

6. Can I correct wrong Invoice details filed in earlier GSTR-1?

Small amendments are allowed in each invoice while filing GSTR-1. It can be done within deadline and at the summary level as well. But both types of amendment come with their own limitations.

7. Can I consider any invoice left out in GSTR-1 of earlier period?

Yes, if you have failed to consider any invoice in GSTR-1 of earlier period, then you can consider the same in current month.

However, you can consider such invoice only upto due date of filing of GSTR-3B of September month of the following year or date of filing of annual return, whichever is earlier.

E.g. you have not considered an invoice in GSTR-1 of January, 2020. Then such invoice can be added upto due date of filing of return of GSTR-3B of September, 2020, i.e. 20th October, 2020, or date of filing of annual return, whichever is earlier.

8. What is the time limit to make corrections in details given in GSTR-1?

Time limit of rectification and considering left out invoices is same as mentioned in point no. 7 above, i.e., due date of filing of GSTR-3B of September month of the following year or date of filing of annual return, whichever is earlier.

9. What amendments are not permitted or non-permitted under GSTR-1?

Following amendments are not permitted or non-permitted under GSTR-1:

a. You can not change a tax invoice to bill of supply

b. Credit Debit NotesInformation such as place of supply, customer

c. GSTIN, reverse charge applied is clearly based on the Invoice associated with the detail.

Therefore, those details must have to be the same with the detail of the associated invoice.

If the goods receiver has already taken actions as per the details furnished by you then you are not allowed amend such invoice.

10. Is it mandatory to enter HSN wise summary by all suppliers?

Yes, it is mandatory to enter HSN wise summary by all suppliers in case of return filing through GSTR-1 Subject to following exemptions:

1. Exemption is given to supplier having aggregate turnover of less than 1.50 crores from requirement of furnishing HSN wise summary,.

2. Further, suppliers with aggregate turnover of more than 1.50 crores but less than 5 crores may furnish HSN wise summary upto 2 digits.

3. Suppliers with aggregate turnover of more than 5 crores may furnish HSN summary upto 4 digits.

However, in case of export and import of goods 8 digit HSN summary is mandatory

Read more about Various Returns under GST