GST portal provides facility for GST number search by PAN and GST number search by GSTIN on GSTIN portal so that person may not get deceived by using incorrect GST Number. However There is no feature for GST number search by Name on the GSTIN portal. GST portal also provided seperate procedure to GSTIN Search of Dealer opted for Composition Scheme

Two method of search GSTIN are as follows.

Insome cases, supplier or recipient may unintentionally mention his GSTINincorrect. So, corresponding party may check his GSTIN upfront.

GSTportal provides facility to check correctness of GST number by using GSTIN.GSTIN may be verified at https://www.gst.gov.in/. On GST portal, GSTIN may be check on followingpath:

Search Taxpayer>Search by GSTIN/UIN

Upon entering of GSTIN and captcha, details of registered person will appear in following way:

However in case of incorrectGSTIN, GST portal will pop up a message as “TheGSTIN/UIN that you have entered is invalid. Please enter a valid GSTIN/UIN.”

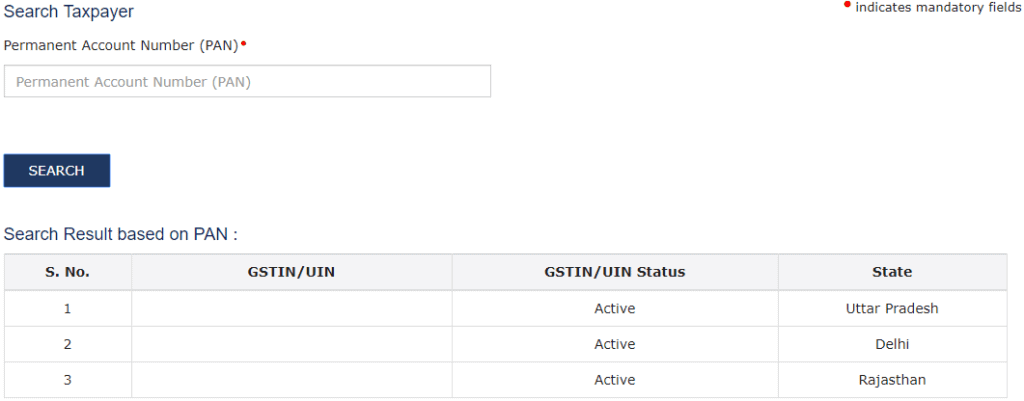

GST Portal also provides facilityof verification of GSTIN based on PAN. Upon entering of correct PAN, GST portalwill populate all GSTIN registered with such PAN in one or more states.

GSTIN may be searched in “https://www.gst.gov.in/” at following path:

SearchTaxpayer>Search by PAN

After entering correct PAN andcaptcha, GST portal will display all GSTIN registered under such PAN.

Upon clicking of any GSTIN, GSTportal will divert to “Search by GSTIN” with GSTIN prefilled. However, in caseof incorrect GSTIN, system will not display any details

GST Portal provides a separate tabfor dealers opted for composition scheme. Facility to search composition schemedealer is available on following path at

SearchTaxpayer>Search Composition Taxpayer

Upon clicking of “SearchComposition Taxpayer” tab, GST portal will provide option to search two typesof dealers viz. “Opted In for Composition Scheme” or “Opted Out for compositionScheme”. Through “Opted in for composition Scheme”, details of those dealerscan be searched who have opted for composition scheme and through “Opted Outfor Composition Scheme”, details of those dealers will appear who have optedout of composition scheme.

Upon selection of either of theoption, further search will be based on either “GSTIN/UIN” or “State”.

In case of search through“GSTIN/UIN”, upon entering correct GSTIN of dealer who has opted In/Out ofcomposition scheme and Captche, details of such dealer will appear.

Further, if GSTIN/UIN is not available,search may be carried out through state. In case of search through state, nameof state, financial year (In which Composition scheme is opted in or opted out)and legal name (Optional) are required to be entered to search details ofdealer. If correct details are entered then GST portal will display details ofdealer.

However, in case of incorrectinformation, GST portal will display message of “No Records”.

Further, if Legal name is also notavailable, then GST portal will display information of all dealers “OptedIn/Opted Out” of composition scheme during such financial year.

Information available related to GSTIN

After entering correct GSTIN, GSTportal will display following information:

* Either of state or center jurisdictions is marked as Red which is jurisdiction of Assessee for all proceedings purpose under GST Law.