.webp)

For U.S. business owners looking to enter or expand into India, it’s important to understand the factors to consider when starting a business. This will help you manage the nuances of India's regulatory environment, its economic dynamics, and its diverse consumer base.

The right strategy can set you up for long-term growth, while a poor strategy can lead to costly mistakes. If you're considering a startup or looking to expand your existing business to India, knowing these key elements will be instrumental to your success.

This blog will walk you through the most important aspects of revamping your business strategy in India, from choosing the right business structure to understanding the necessary steps for legal compliance and market fit.

One of the most important factors to consider when starting a business from the US to India is selecting the right business structure. Your decision on whether to establish a private limited company, branch office, joint venture, or liaison office in India will affect everything from taxation to liability and operations.

Here are some of the common business structures for foreign companies entering the Indian market:

This is the most common business structure for U.S. businesses entering India. It offers limited liability protection and is considered an independent legal entity. Foreign investment is allowed in private limited companies under the Foreign Direct Investment (FDI) policy.

A branch office allows you to conduct business in India while being an extension of your U.S.-based company. This structure is ideal if you want to perform limited operations, like marketing or services, without setting up a full legal entity. Branch offices are governed by the Reserve Bank of India (RBI) and require specific approval.

A joint venture involves partnering with an Indian company. This is especially useful for U.S. businesses wanting to use local knowledge, networks, and resources. However, the JV agreement needs to comply with the FDI regulations and should be structured to meet both parties’ expectations.

A liaison office acts as a communication channel between the foreign company and its clients in India. It cannot conduct revenue-generating activities, making it a less involved structure for U.S. businesses aiming to establish a presence in India without committing fully to local operations.

VJM Global understands the importance of choosing the right business structure for your US operations in India. If you're considering a Private Limited Company or LLP, we provide expert assistance to ensure your business complies with Indian corporate laws and aligns with your goals.

Also read: How to Register a Holding Company in India

Choosing the right structure is critical, as it directly impacts the business type you’ll select for expanding into India.

For U.S. business owners seeking to establish or expand operations in India, understanding the legal and regulatory environment is key to ensuring both compliance and long-term success.

Each business structure in India has distinct tax benefits. For instance, a Private Limited Company (PLC) is subject to corporate tax rates under Section 115BAA of the Income Tax Act, 1961, with potential tax holidays under FDI policies or the Startup India Scheme.

A Private Limited Company shields owners from personal liability under the Companies Act, 2013, unlike sole proprietorships or partnerships. This structure ensures limited liability, protecting personal assets from business debts.

A Private Limited Company facilitates equity investment and is often the preferred choice for foreign investors under the Foreign Exchange Management Act (FEMA) and FDI policy. It’s an ideal structure for scaling with external funding.

Foreign businesses must navigate India’s Companies Act, 2013, GST Act, 2017, and Reserve Bank of India (RBI) guidelines. A branch office or joint venture (JV) may require additional approvals from the Department for Promotion of Industry and Internal Trade (DPIIT) or the RBI.

Choosing the right structure aligns with your operational scale. For instance, JV structures are common for U.S. companies using local partnerships to gain market access in India, whereas a subsidiary (PLC) offers more control and better integration with your global operations.

Also Read: From Idea to Incorporation: A Deep Dive into Company Setup in India and Different Business Types

With the right business type in mind, it's time to consider the key factors to weigh before starting your U.S. business in India.

When setting up your business in India, certain key considerations can make or break your strategy. These considerations are critical for any U.S. business looking to build a sustainable and profitable operation in India.

Before expanding to India, ensure your business idea aligns with local demand and preferences. Analyze the Indian market size and potential competition using data from sources like IBEF or NASSCOM for tech and service sectors.

U.S. entrepreneurs should familiarize themselves with FDI policies, sector-specific regulations, and local compliance under laws such as GST and Labor Codes.

Before setting up, research the Indian market size and growth trends. Consider how your U.S. company can position itself against local competitors and adapt to consumer behavior differences unique to India.

Craft a localized marketing strategy based on Indian consumer behavior and preferences. Utilize insights from local platforms like Google India and Facebook to target your audience while adhering to advertising standards under the ASCI guidelines.

For U.S. entrepreneurs, learning how to secure capital and finance for their India operations is crucial. You should explore foreign funding options, government incentives, and venture capital opportunities available under the FDI policy. Consider the capital investment norms and funding limits for foreign entities in India.

Choosing the right location for your US business in India is critical. If you’re setting up a manufacturing plant or an office, consider factors like logistics, local infrastructure, and proximity to suppliers or customers. Cities like Bengaluru, Delhi, and Mumbai are key hubs for U.S. businesses.

India has specific licensing and regulatory requirements for foreign businesses. Depending on the business structure, you may need approvals from the Reserve Bank of India (RBI), the Ministry of Corporate Affairs (MCA), and the Department of Industrial Policy & Promotion (DIPP). Understanding FDI regulations is key to navigating the licensing process.

As a U.S. entrepreneur entering India, you must familiarize yourself with Indian labor laws, tax regulations, and compliance standards. Additionally, ensure you have adequate liability insurance to cover legal challenges. Hiring a local legal advisor is highly recommended.

Ensure your trademarks and patents are registered under the Indian Patents Act, 1970, and Trademarks Act, 1999. Learn the Indian IP conditions to protect your U.S.-based company’s intellectual property from infringement or counterfeiting.

Hiring in India requires understanding local labor laws and employee benefits, which differ from the U.S. Ensure compliance with Indian labor codes such as the Industrial Disputes Act, 1947 and the Payment of Gratuity Act, 1972, to avoid penalties.

As you evaluate the critical factors to consider when starting a business in India, VJM Global can guide you through the complexities of tax compliance, legal requirements, and market strategy. We offer comprehensive services to ensure your US business setup aligns with both Indian regulations and your long-term objectives.

Also Read: Register a Software Company in India

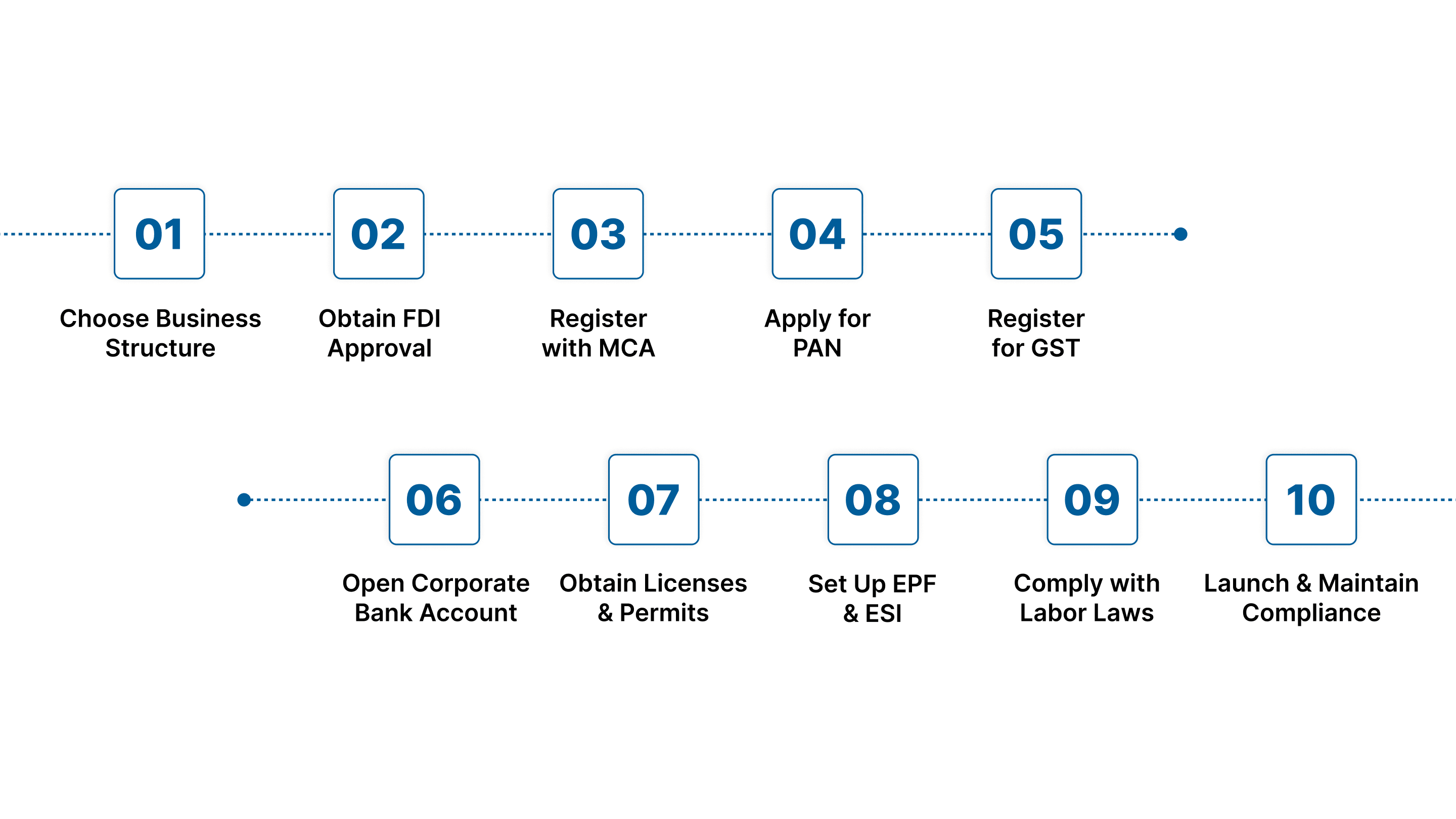

After considering the essential factors, we can break down the 10 crucial steps to take when you're ready to launch your business in India

The process of setting up a US business in India can be complex, but breaking it down into clear steps makes the process easier to manage. Below are the 10 key steps you should follow to start or expand your business in India:

You can opt for a Private Limited Company (PLC), Joint Venture (JV), or branch office based on your business needs. The structure affects your tax obligations, liability, and capital-raising options under the Companies Act, 2013 and the Foreign Exchange Management Act (FEMA).

For U.S. businesses planning to invest in India, obtaining approval for Foreign Direct Investment (FDI) is essential. You must align with India’s FDI policy, governed by the DPIIT, and ensure compliance with sector-specific caps, such as those for defense, retail, and telecom.

Once your business structure is finalized, you must register with the Ministry of Corporate Affairs (MCA), which will provide your business with a Corporate Identification Number (CIN). This registration ensures that your business complies with the Indian Companies Act and is recognized legally.

A Permanent Account Number (PAN) is essential for U.S. businesses to comply with Indian tax regulations under the Income Tax Act, 1961. This number will be used for all financial transactions, including tax filings, employee payments, and international remittances.

GST registration is mandatory for businesses in India if their turnover exceeds the prescribed threshold. This process, governed by the GST Act, 2017, ensures that your U.S. business complies with India's value-added tax system for the sale of goods and services.

To operate in India, your business will need to open a corporate bank account. This will facilitate transactional activities in Indian Rupees (INR) and help with repatriating profits back to the U.S. Ensure your account complies with RBI regulations and foreign exchange laws.

Depending on the nature of your business, securing licenses and permits is essential. These could include sector-specific licenses under the Factories Act, Trade Marks Act, or Food Safety and Standards Authority of India (FSSAI). Ensure compliance with local state regulations for operational permits.

For U.S. businesses hiring employees in India, setting up EPF and ESI is mandatory. These schemes, regulated by the Employees' Provident Fund Organisation (EPFO) and the Employee State Insurance Corporation (ESIC), ensure that your employees receive social security benefits and are protected under Indian labor law.

India has extensive labor laws that U.S. entrepreneurs must understand, including regulations around minimum wages, working hours, and employee benefits. Key acts like the Industrial Disputes Act, 1947, and the Factories Act, 1948, govern employment standards. Ensure your workforce practices comply with these standards to avoid legal issues.

Once your company is registered and all compliance requirements are met, you can officially launch your operations in India. Continuous compliance with Indian tax, labor laws, and corporate governance regulations under the MCA and CBDT will help you operate smoothly. It's essential to have a team of local professionals or outsourcing partners to maintain your accounting, audit, and legal compliance in India.

Now that you have the steps, VJM Global’s expert accounting services are here to help ensure your U.S. to India expansion runs smoothly and efficiently.

When planning to start, expand, or revamp your US business strategy in India, it’s crucial to consider key factors like legal structures, compliance, market entry, and financial structuring. At VJM Global, we offer expert services to U.S. business owners, entrepreneurs, and companies looking to establish a strong foothold in India.

Here’s how VJM Global can help you strategically plan and execute your US-India expansion:

VJM Global provides expert guidance in business formation, tax planning, compliance, and auditing to ensure your U.S. business succeeds in India’s market. Contact us today for a strategic consultation tailored to your business needs.

For U.S. business owners, companies, and entrepreneurs, it’s essential to have the right strategy, a clear understanding of the Indian market, and the legal framework to drive success. If you're starting from scratch or expanding your business, aligning your US business strategy with India's regulations and market realities is key to ensuring sustainable growth and profitability.

As you move forward, VJM Global is here to support you with end-to-end services tailored for U.S. businesses entering India, from company registration to tax filing and compliance. We help you navigate Indian corporate laws, ensuring your operations align with both U.S. and Indian regulations for a smooth and successful market entry.

Partner with VJM Global and let us help you establish a strong foundation for your US business in India.

U.S. companies must navigate FDI regulations, obtain necessary business licenses, and ensure GST compliance, while also adhering to Indian labor laws and foreign exchange policies.

The chosen structure, Private Limited Company vs Branch Office, impacts tax rates under the Indian Income Tax Act and eligibility for tax holidays under Startup India.

FEMA regulates foreign investment flows into India, requiring compliance for capital remittances and profit repatriation. U.S. companies must ensure compliance for smooth operations.

GST registration is mandatory for small companies with a turnover of over INR 40 lakhs, impacting invoicing, tax reporting, and claiming GST refunds on imports and exports.

Indian labor laws mandate EPF, ESI, and benefits such as gratuity. U.S. companies must adapt to Indian employment contracts, leave policies, and termination regulations.