Partnering Businesses

Globally

We are full service firm focuses in domain of Business Setup in India, FEMA, Expatriates Taxation, Accounting Outsource, International Taxation, Auditing, Transaction advisory and so on.

Underpinned by our values and with our global presence, we serve on FDI advisory, cross-border accounting, International tax planning and Management consulting needs of our overseas clients all over the world.

Welcome to VJM &

Associates LLP

We are a firm of Chartered Accountants offering wide range of professional services under one roof. The firm was established by team of experienced professionals, geographically located in the National Capital of India – New Delhi. Our presence extends to the financial capital of India – Mumbai and several other cities in India in association with our affiliates.

With our ability to decode and resolve complex issues and proactively engage with clientele, we have positioned ourselves as a one stop shop with several professional service offerings under one roof.

Our Services

Corporate Tax Advisory

Risk and Assurance Advisory

Cross Border Transaction Advisory

Transactions Advisory Services

Industries We Serve

Automotive & Transportation

Hospitality

Healthcare

Retail & Wholesale

Manufacturing

Banking & Finance

Insurance

Law

Countries We Serve

India

Germany

Argentina

United States

Italy

Ukraine

United Kingdom

Algeria

Singapore

South Africa

UAE

Malaysia

Switzerland

Japan

France

Nigeria

China

Ethiopia

Our strength lies in the ability to combine in-depth knowledge of cross sections of the industry with the specialized skills of our professionals, spreads across our widespread network.

Our Associations

The EAI International is a globally recognized group of qualified and independent accounting and tax firms, serving clients internationally. Most importantly, an EAI member can be entrusted with transparency, ethics and professionalism in the delivery of work.

.webp)

.webp)

Testimonials

What our clients say about us

Our Publications

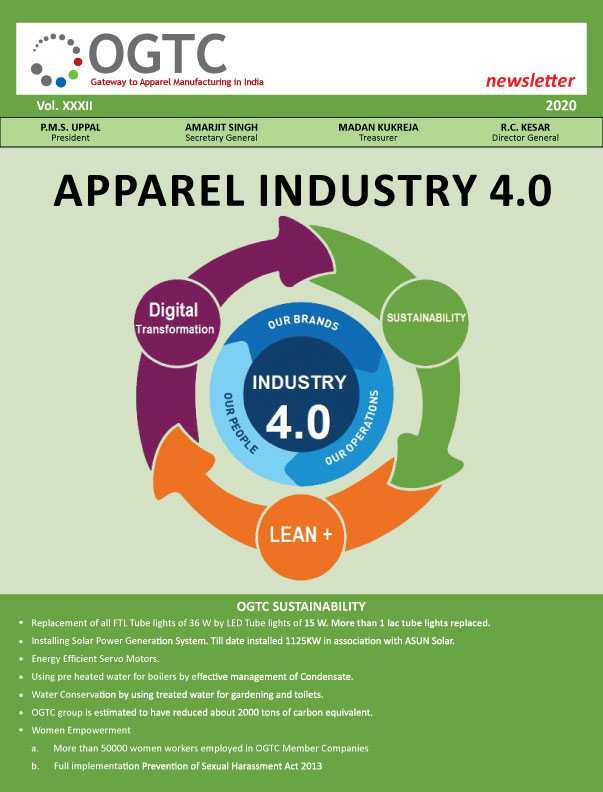

.jpg)

.webp)

.webp)

.webp)

.png)