In the pre-GST regime, there was no option available to check the authenticity of Input Tax Credit taken by any taxpayer. Whether the corresponding supplier has paid his taxes or has filed his return or has disclosed the corresponding sales was not traceable unless the Assessing Officer cross checks returns of all the suppliers during assessment proceedings. Under VAT, in a few states, the option to verify details of local purchases was available online but it was not fulfilling the purpose.

Under Goods and Service Tax (“GST”), transparency of Input Tax Credit was kept on priority. Details of sales made by a registered person were provided to the recipient on their online portal so that ITC availed in GST return can be checked with ITC appearing on portal and no person can take fake or bogus or incorrect ITC. Details of supplies made by the supplier are available to the recipient in Form GSTR-2A and GSTR-2B.

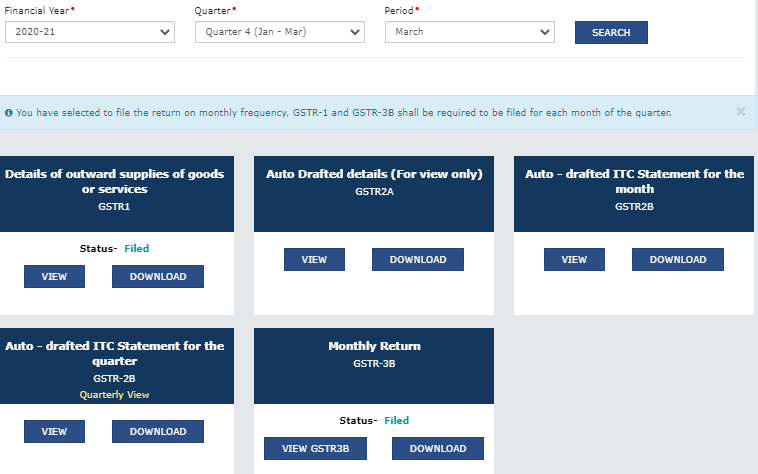

Since the introduction of GST, GSTR-2A has been available on the GST portal. However, GSTR-2B is a newly introduced form made available from August, 2020. Option to download GSTR-2A and GSTR-2B is available in following way:

In this article, we have made a detailed discussion on GSTR-2A and GSTR-2B.

1. GSTR-2A

- GSTR-2A is an auto-populated purchase return available on GST portal of a taxpayer. GSTR-2A contains details of all sales disclosed by the supplier against GSTIN of a taxpayer.

- It is a purchase related summary that reflects when the supplier files his GSTR-1 (Details of Outward Supplies).

- GSTR-2A is a real time document and it keeps on getting updated as and when suppliers file their GSTR-1 or other forms. In simple words, when a supplier files its return of outward supplies, the information furnished by the supplier in its GSTR-1 starts reflecting in GSTR-2A of the buyer as and when the supplier saves the data on his GST portal.

- Therefore, before availing Input Tax Credit in GSTR-3B, buyers may refer to GSTR-2A for clear understanding of Input Tax Credit to be taken for the month.

- If ITC availed by a registered person in his GSTR-3B is far different from ITC auto-populating in GSTR-2A then GST authorities may take appropriate action.

- Data in GSTR-2A auto-populates on the basis of following returns filed by the counter party:

- Form GSTR-1: – Details of outward supplies filed by a normal registered person.

- Form GSTR-5: – Returned filed by Non-Resident.

- Form GSTR-6: – Return filed by an Input Service Distributor.

- Form GSTR-7: – Return to be filed by tax deductor.

- Form GSTR-8: – Return filed by an E-commerce operator liable to collect the tax.

Therefore, GSTR-2A contains details of purchase made from a registered person, Credit distributed by Input Service Distributor, TDS deducted, TCS collected, IGST paid on Import of Goods and IGST paid on purchase of goods from Special Economic Zones.

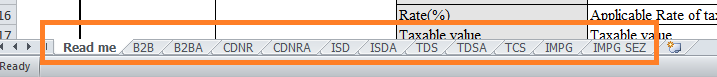

Data of GSTR-2A can be downloaded in Excel and downloaded document contains following data:

2. GSTR-2B

- GSTR-2B is a newly introduced form available on the GST portal from August, 2020.

- GSTR-2B is auto-generated purchase return which contains details of eligible Input Tax Credit, i.e., ITC available for availment during a tax period.

- Though it sounds the same as GSTR-2A but it contains a separate set of information.

2.1. Reason of Introduction of GSTR-2B when GSTR-2A was already available

- Section 16(2) of CGST Act, 2017 provides conditions for availing ITC. One of the conditions for claiming ITC is that the supplier must have filed his GST return.

- A new rule 36(4) was inserted by N/No. 49/2019-Central Tax dated 09.10.2019. As per Rule 36(4) of CGST Rules, 2017, a taxable person shall be entitled to avail ITC upto 105% of ITC which is uploaded by supplier on GST portal.

- E.g:-

- ITC as per books of Accounts-INR 500

- ITC uploaded by corresponding supplier on GST Portal through GSTR-1 -INR 400

- Supplier shall be entitled to claim ITC upto 105% of INR 400, i.e., 420.

- Therefore, If an invoice is pertaining to the month of April, and supplier delays in filing his GSTR-1 for the same month and files the same in September, 2020. Then, as per Rule, 36(4) of CGST Rules, 2017, the recipient shall be entitled to claim such ITC in the month of September, 2020 itself.

- GSTR-2A is prepared on the basis of date of invoice and not on the date of filing of return basis, i.e., in the above mentioned example invoice of April, 2020 will appear in GSTR-2A of April, 2020 and not september, 2020. Therefore, such statements could not be used to calculate eligible ITC under Rule 36(4) of CGST Rules.

- GSTR-2B is a static statement and it contains details of all purchases uploaded by the supplier upto due date of filing of GSTR-1. E.g., GSTR-2B of April, 2021 shall contain all purchases uploaded by suppliers during the period of 14th April, 2021 to 13th April, 2021 irrespective of the month of return and date of Invoice.

2.2 Features of GSTR-2B

The GSTR-2B is made available to every taxpayer with advance features which were not available in GSTR-2A. The GST department has kept both in usage as GSTR-2A and GSTR-2B have different features which can be used separately. Apart from similar features in both the statements the following are the features which made GSTR-2B distinct and more advanced from GSTR-2A :

- Separate column of Eligible ITC and Ineligible ITC available.

- ITC can be Viewed in 1000 rows without downloading it in Excel.

- It has included the feature of advisory which suggests the action to be taken on different ITC whether eligible, Ineligible or reversible. With help of same, taxpayer can take relevant action in GSTR-3B.

- Unlike GSTR-2A, it includes the data of SEZ (Special Economic Zone) unit and also Import.

- GSTR-2B is systematic in nature, i.e., GSTR-2B once generated don’t change with filing of GSTR-1 by supplier.

- GSTR-2B is the detailed format of the Input Tax Credit eligible as well as ineligible ITC at one place.

2.3 Corresponding returns on the basis of which GSTR-2B is auto-populated

Data in GSTR-2B auto-populates on the basis of following returns filed by corresponding party:

- From GSTR-1: – Return filed by normal registered person.

- Form GSTR-5: – Returned filed by Non-Resident.

- Form GSTR-6: – Return filed by an Input Service Distributor.

- Data of Import available on ICEGATE (Auto populated Import data)

3. Difference between GSTR-2A and GSTR-2

| Basis of Difference | GSTR-2A | GSTR-2B |

| Difference in Nature | GSTR-2A is dynamic in nature, i.e., it changes as and when the supplier files his return for the corresponding month irrespective of date of filing of return. Therefore, GSTR-2A keeps on changing. | GSTR-2B is static in nature, i.e., it contains all purchases uploaded between 14th of the month till 13th of the following month irrespective of month of return and date of invoice. |

| Use for the purpose of availing ITC | GSTR-2A can’t be utilised for the purpose of claiming ITC | Data auto-populated in GSTR-2B is to be used for claiming ITC in GSTR-3B. ITC appeared in GSTR-2B auto-populates in GSTR-3B while filing. |

| Availability of DATA | Details for ITC shall be available as soon as the supplier files the returns for its supply | GSTR-2B shall only be available from 14th of the following month. |

| Inclusion of SEZ units data | The data for SEZ units will not be included in this return | SEZ unit data will be included in GSTR-2B. |

| Bifurcation | GSTR-2A does not bifurcate the ITC between eligible ITC and Ineligible ITC. | GSTR-2B bifurcates the ITC into eligible and ineligible ITC |

| Example | GSTR-2A can be amended by making changes in GSTR-1For Example ITC of Z as per GSTR-2A for Jan, 2021 is INR 10,000 as on 28th Feb, 2021.Supplier files GSTR-1 of January on 15th March, 2021 wherein ITC pertaining to Z is INR 2,000.GSTR-2A of January, 2021 will update and will reflect ITC of INR 12,000. | GSTR-2B cannot be amended, it remains constant for the tax period.For Example ITC of Z as per GSTR-2B for Jan, 2021 is INR 10,000 as on 28th Feb, 2021.Supplier files GSTR-1 of January on 15th March, 2021 wherein ITC pertaining to Z is INR 2,000.GSTR-2B of January, 2021 will remain same and such ITC of INR 2,000 will get incorporated in GSTR-2B of March, 2021.Therefore, as per Rule 36(4), Z is entiled to claim ITC of INR 2,000 in the month of March, 2020 itself. |

4. Basis for taking ITC: GSTR-2A or GSTR-2B

Both the statements are valid and acceptable in the eye of law. However, for the purpose of availing ITC, GSTR-3B pulls data in table 4 (Input Tax Credit) from GSTR-2B of the corresponding month

Therefore, for the purpose of checking the maximum eligible amount of ITC, reference must be given to the GSTR-2B itself.

5. Reconciliation of ITC claimed in Books of Accounts

Reconciliation of ITC claimed in Books of Accounts with ITC uploaded by supplier is of atmost important because of the following reasons:

- As per Rule 36(4), the taxpayer can only claim ITC only if details of such invoice is uploaded by supplier in his GST return.

- If any supplier misses to file his return or upload incorrect information then he can be asked to revise his return within due time. Reconciliation helps taxpayers to find out the error. Therefore reconciliation should be made on regular intervals.

Now, generally taxable persons get confused that whether ITC claimed in books of accounts should be reconciled with GSTR-2A or GSTR-2B.

GSTR-2B contains invoices uploaded by suppliers during the month and it may contain invoices pertaining to earlier months or years. Therefore, reconciliation with GSTR-2B may not provide desired results. Since, GSTR-2A is prepared on the basis of date of invoice therefore, GSTR-2A should be used to reconcile ITC uploaded on GST portal with ITC claimed in books of Accounts.

6. Frequently Asked Questions

6.1 How to View & Download GSTR-2B Data from the GST Portal?

The process of View and Download GSTR-2B Data is as under:

- Unlike GSTR-2A, option is available to download the GSTR-2B immediately.

- Post login at GST portal, GSTR-2B can be downloaded from following path:

Dashboard> Services> Return> Select month and year> Click on view/Download tav of GSTR-2B.

6.2 How is GSTR-2B Generated on GST Portal?

GSTR-2B is auto populated by the GST system. When a supplier submitted the return for supply of goods and services then the GSTR-2B fetched the data and auto populated with respect to such furnishing of return.