The Income Tax department is sending email notifications to the taxpayers with more than Rs. 50 crore turnover about the applicability of section 269SU. Taxpayers need to furnish an online report on the e-filing website from their own account. The due date to file the report is 31st January 2020.

The Finance Act 2019 has come up with a new section, namely, section 269SU. A person with businesses having a turn over of more than Rs 50 Crore mandatorily need to offer facilities for payments through electronic transactions. Section 269SU actually became effective from the 1st November, 2019.

As per section 269SU, business entities with more than Rs 50 crores turnover need to offer the facility to its customers to pay using the suggested electronic modes. The provision is a mandatory one for such entities to offer the digital payment facility.

If a business entity has already opted for the electronic payment mode, then they need to provide the facility prescribed under the scheme.

1. Rule 119A Notified Accepted Modes For Payment Acceptance

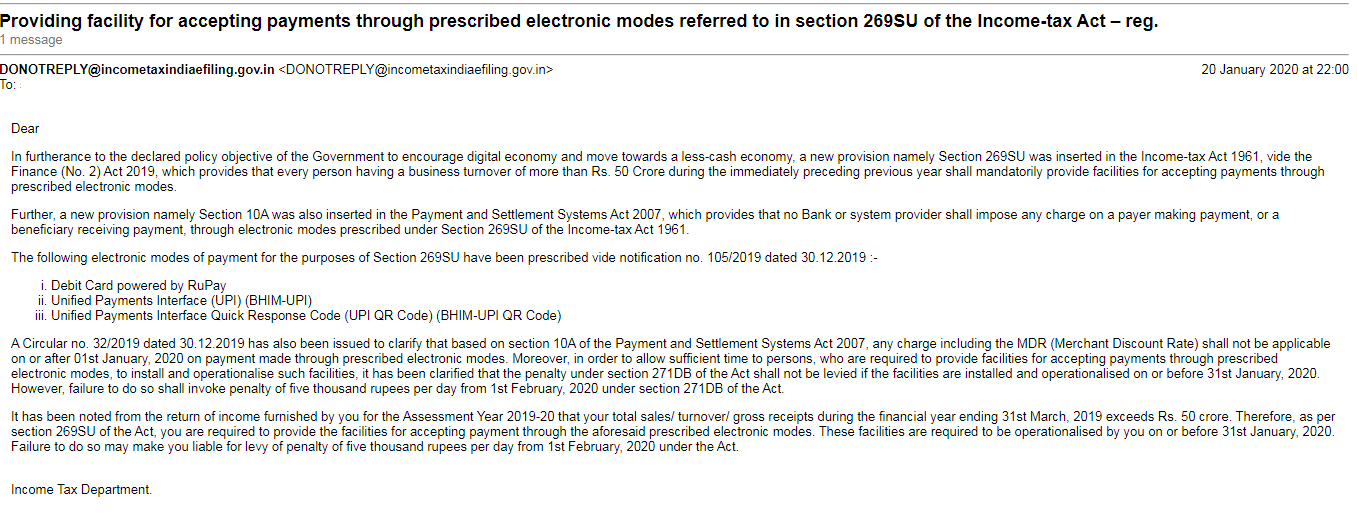

Central Board of Direct Tax released a notification, Notification No. 105/2019, dated 30.12.2019 to prescribe the mode of payments under section 269SU. They have prescribed specific modes of payment under the Rule 119AA for payment purposes under section 269SU. Followings are the mode of payment that CBDT has prescribed:

- A RuPay Debit Card

- UPI, or BHIM-UPI

- UPI QR Code, or BHIM-UPI QR Code

The rule is applicable from the 1st of January 2020.

2. Section 269SU- Scope & Purpose

Section 269SU is a part of the Government of India’s initiative towards growing as a cashless economy. Through the introduction of digital payment, the government has tried to promote digital payment mediums such as BHIM UPI, Aadhaar Pay, UPI-QR Code, Rupay Debit cards.

It was further mandated that the bank or payment system provider must not levy any charges or a merchant discount rate either on the customers or the merchants for the use of the mode of payments prescribed. The Reserve Bank of India, along with other banks, need to bear with the costs associated with these payment methods.

3. Steps Require on e-filing Portal

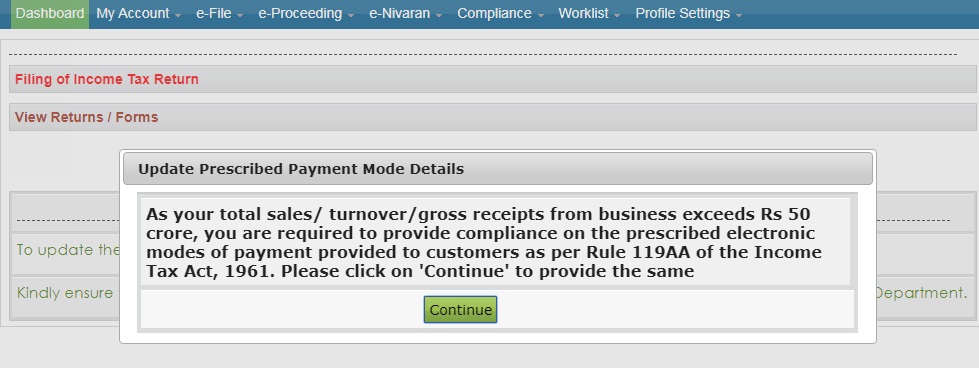

Businesses with sales or turnover of more than Rs. 50 crores will receive a pop-up when they login to the e-filing portal. The pop-up is written as,

- Hence, you need to click the green Continue button under the Pop-up notification.

- As you come to the next page, click on the Select button, and choose Yes or No.

- If you click No, you will be further asked for ‘Expected Date of Implementation’

- If you select Yes, you will be asked for the three modes of payment which you in-corporated with your payment system

- Check the box beside the appropriate payment methods and Select the Submit button

- Once done, you will see a pop-up notification along with a Transaction ID.

4. Due Date and Penalties In Case of Non-Compliance Under Section 269SU

If a person with business covered under the provisions of section 269SU can’t manage to offer the facility of payment under the prescribed modes would be liable to pay a penalty of Rs. 5000 per day during the failure or non-availability of the facility.

The last date to incorporate these payment methods is 31st January 2020. The penalty of Rs. 5000 per day will be levied from 1st February 2020.

The Income Tax department has notified through emails to all the eligible entities with turnover more than Rs. 50 crore as per the return filed by the taxpayer for the AY 2019-20. The email says,

Going cashless is a sign of a growing economy, and if the government is making all its efforts to achieve its objective of “Cashless Economy,” then as an ideal citizen, you should give your acceptance to these prescribed electronic modes at earliest. Banking transactions are anyhow useful for business as it eases the transfer of money and also makes transaction easily traceable also.

Read More: Equalisation Levy: Features, Applicability, Penalty