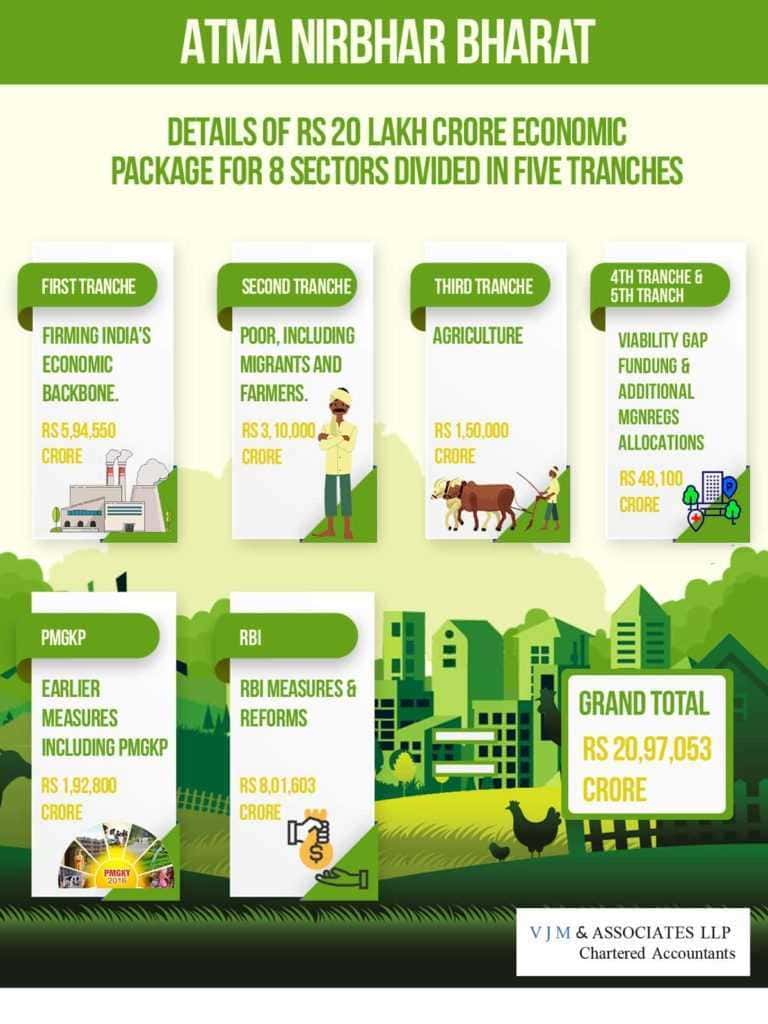

To fight against the covid-19 pandemic, our Prime Minister Narendra Modi has addressed the nation on lockdown situations with new sets of rules & economic relief packages. Under Atma Nirbhar Bharat Abhiyan a stimulus economic package of Rs 20 Lakh Crore has been allotted for different sectors to restrain the adverse effects of this pandemic in India.

As per the data, the package is equivalent to 10% of India’s GDP. PM Narendra Modi said that to deal with the current economic imbalance condition for covid-19, we need to focus on the Self-reliant India Mission. He has also stated that in coming days more information about the economic package will be delivered by the government.

Finance Minister Nirmala Sitharaman has announced the five tranches of economic package under Atma Nirbhar Bharat Abhiyan. She has provided the detailed break-up of 20,97,053 crore package via press conferences.

This overall package includes Rs 1.92 lakh crore measure announced earlier by the government as Pradhan Mantri Garib Kalyan scheme. The monetary and fiscal measures by RBI were announced earlier in addition to this package.

The Finance Minister has unveiled the tranches one after another accordingly for every important sector. She has added in her announcement how the stimulus package of Rs 20 Lakh Crore will boost up the Indian economic condition with proper classification.

Overall Stimulus Under Atma Nirbhar Bharat

| Sl.No | Items | Amount(Crore) |

| 1 | First Tranche (Rs 5,94,550 crore) – Focused on firming India’s economic backbone | 5,94,550 |

| 2 | Second Tranche (Rs 3,10,000 crore) – Poor, including migrants and farmers | 3,10,000 |

| 3 | Third Tranche (Rs 1,50,000 crore) – Agriculture | 1,50,000 |

| 4 | Fourth Tranche & Fifth Tranche (Rs 48,100 crore) | 48,100 |

| Sub-Total | 11,02,650 | |

| 5 | Earlier Measures including PMGKP | 1,92,800 |

| 6 | RBI Measures & Reforms | 8,01,603 |

| Sub-Total | 9,94,403 | |

| Grand Total | 20,97,053 |

1. First Tranche (Rs 5,94,550 crore) – Focused on firming India’s economic backbone

The first installment of Atma Nirbhar Bharat package announced by the Finance Minister focused on firming India’s economic backbone. To build a self reliant India, growth in the MSME sectors is highly required at this stage. Thus, the central bank and government together have taken these measures to uplift the growth of small scale businesses in our country.

A complete set of 17 measures taken to emphasize on the concept of Prime Minister’s Atma Nirbhar Bharat Abhiyan. 7 out of them are dedicated to MSME sectors. This package focuses on other sections such as land, labour, liquidity, discoms, real estates and other factors.

1.1 Measures To Uplift The Micro, small and medium scale industries

1.1.1 Rs 3 lakh crore collateral-free MSMEs emergency loan-

The installment of Rs 3 lakh crore collateral-free automatic loans for business and credit guarantees to the lender. It also includes a credit line for micro and macro small scale businesses.

The time period granted for the loan is 4 years and after a 12 months moratorium the repayment of the principal will be started and the scheme can be availed till 31st Oct 2020 with no guarantee and no fresh collateral.

1.1.2 Rs 20,000 cr subordinate debt for stressed MSMEs

Rs 20,000 crore debt will be facilitated by the government. For this 20,000 crore subordinate debt at least 2 lakh MSMEs will be benefited.

Functioning MSMEs which are NPA or are stressed will be eligible for subordinated debt funds.

1.1.3 Rs. 50,000 crore equity infusion by MSME Fund of Funds for small scale businesses

As MSMEs face severe economic crises thus the funds of funds with a corpus of Rs.10,000 crore shall be provided. This equity fund has been allotted for all the small scale businesses. It will encourage them to list their business on the main board of stock exchange.

FoF will be operated through a Mother Fund and few daughter funds will help leverage Rs 50,000 cr of funds at daughter funds level

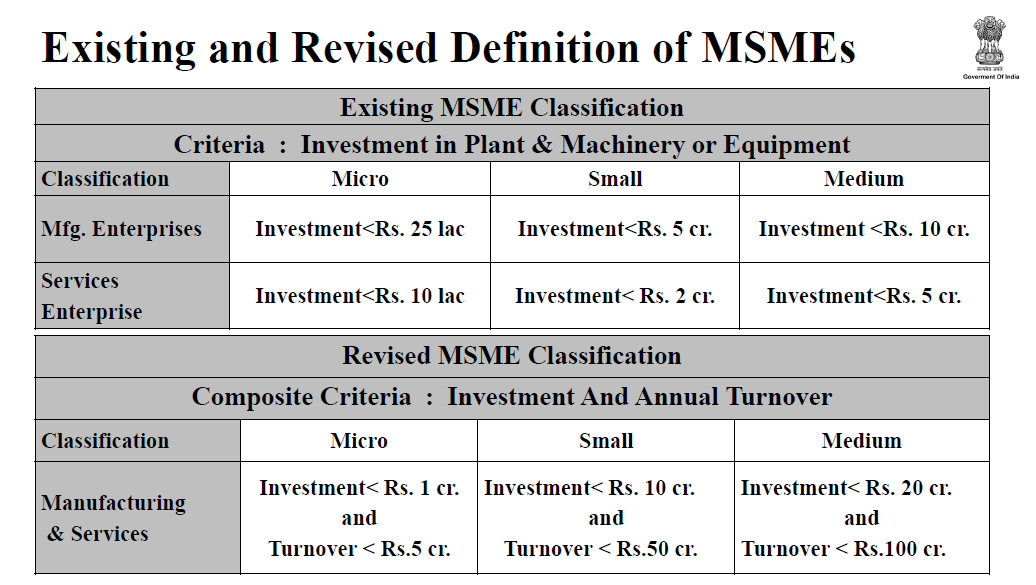

1.1.4 There’s a change in the definition of MSME sectors

The investment limit needs to be revised where new MSMEs have revised upwards. An additional criteria of turnover is added which will help the MSMEs to increase their production capacity without losing the advantages of being a small unit.

Read more about MSME here

1.1.5 Global tenders Rs. 200 cr will be restricted

Global tenders will be disallowed in government procurement tenders up to Rs.200 crore as Indian business sectors get an unfair competition with foreign companies. To make a self reliant India the growth of local business sectors are quite essential and to eliminate competition from foreign companies.

1.1.6 Other initiative for MSMEs

The Union government and state ministry will clear every due to MSME in 45 days. E-market linkage will be acted as a replacement of trade fairs and exhibitions.

Rs 4000 crore partial credit guarantee to the banks allotted by the government for stressed MSMEs.

1.2 Extended EPF Support for Business & Workers

1.2.1 Rs. 2500 crore EPF ( Employment Provident Fund) facility for businesses and workers

The government will extend contribution to 24% EPF for the month of June, July and August. Under Pradhan Mantri Garib Kalyan Package ( payment of 12 of employer and 12 employee contributions was made into EPF accounts of eligible establishments.

A liquidity relief of Rs.2500 crore will be provided to 367,000 organisations and to 72.22 lakh employees of eligible firms.

1.2.2 Statutory PF contribution reduced for 3 months

A relaxation of statutory PF for both employers and employees shall be reduced to 10% each from the existing 12% each for every sector for 3 months covered under EPF. This implementation provides liquidity of Rs.6750 crore to employees and employers. Which will increase their take home salary for the next 3 months.

This scheme will be applicable for workers who are not eligible for 24% EPF support under PM Garib Kalyan Package and its extension

1.3 Direct Tax Measures

1.3.1 Refund to Income Tax

All pending refunds to charitable trusts and non corporate businesses professions including proprietorship, partnership, LLP and Co operatives would be issued on an immediate basis.

1.3.2 Rs 50,000 crores liquidity through TDS/TCS rate reduction

In order to provide more funds at the disposal of the taxpayers, the rates of Tax Deduction at Source ( for non salaried specified payments made to residents and rates of Tax Collection at Source ( for the specified receipts shall be reduced by 25 of the existing rates with effect from1st April 2020 till 31st March 2021.

Press Release: Reduction in rate of Tax Deduction at Source (TDS) & Tax Collection at Source (TCS)

1.3.3 Extension in income tax Return

Due date of all income tax return for FY 2019 20 will be extended from 31 st July, 2020 and 31 st October, 2020 to 30 th November, 2020 and Tax audit from 30 th September, 2020 to 31 st October, 2020.

1.3.4 Other Relief

- Date of assessments getting barred on 30 th September, 2020 extended to 31 st December, 2020 and those getting barred on 31 st March, 2021 will be extended to 30 th September, 2021

- Period of Vivad se Vishwas Scheme for making payment without additional amount will be extended to 31st December, 2020

1.4 Liquidity Relief Measures For Shadow Banks i.e. NBFCs/HFCs/MFIs

1.4.1 Rs.30,000 crore liquidity schemes for Non Banking Financial Companies

The Centre will provide Rs.30,000 crore for a special liquidity scheme to support NBFC/MFIs/HFCs and mutual funds. To reduce their debts in the market the government has launched these schemes for mid size and small size non banking financial companies in the market.

Under this scheme investment will be assigned for both the primary and secondary market transactions according to the investment grade debt paper of NBFCs/MFIs/HFCs

Cabinet approves Special Liquidity Scheme for NBFCs/HFCs to address their Liquidity Stress

1.4.2 Rs. 45000 cr additional credit guarantee scheme 2.0 for NBFCs

Already existing PCGS scheme will be extended by the government of India to cover the borrowings of NBFCs. In case of a default, the government will bear 20% of the loss.

Cabinet approves modifications in the existing “Partial Credit Guarantee Scheme (PCGS)”

1.5 Rs. 90000 cr Liquidity Injection For Distribution Companies

- Rs.90,000 crore liquidity to lightning up DISCOMs– PFC/RFC will infuse Rs90,000 crore to the DISCOMs receivables and this loan will be granted under state government’s guarantee for exclusive purpose of discharging liabilities of Discoms to Gencos.

- As DISCOMs payable to the power houses and transmission companies. And this will create liquidity flow in the power sectors.

1.6 6 months extension of registration & completion deadlines under RERA

- 6 months extension of registration & completion deadlines under RERA- The ministry has announced a relaxation and extension of real estate projects under RERA by 6 months. This will relieve the stress of real estate agents to complete the projects. And it ensures that the buyers will get their booked houses on time. If it requires the time period can be extended for more 3 months.

- Under RERA, timelines of other statutory compliances will be extended if it’s required. Further COVID 19 would be treat as an event of Force Majeure under RERA

1.7 Relaxation For Contractors

- There’s a deadline extension upto six months, without any costs for the contractors declared by the central government bodies.

- This relaxation for contractors includes the Ministry of Road Transport, Railways, and Highways shall extend, service contracts construction work, etc.

| Sl.No | Schemes | Amount(Crores) |

| 1 | Emergency fund for businesses,MSMEs | 3,00,000 |

| 2 | Subordinate debts for stressed MSMEs | 20,000 |

| 3 | Funds for Funds scheme | 50,000 |

| 4 | EPF for business & workers | 2,800 |

| 5 | EPF Rates Reduction | 6,750 |

| 6 | Special liquidity Scheme for NBFC/HFC/MFIs | 30,000 |

| 7 | Partial Credit Guarantee | 45,000 |

| 8 | Liquidity Injection for DISCOMs | 90,000 |

| 9 | TDS/TCS rates reduction | 50,000 |

| Total | 5,94,550 |

2. Second Tranche (Rs 3,10,000 crore) – Poor, including migrants and farmers

After the announcement of the first installment package, Finance Minister Nirmala Sitharaman introduced the second tranche specially for Migrant laborers and street vendors.

Here’s the detailed elaboration of measures taken by the government:

2.1 Arrangements For Migrant Workers

2.1.1 One Nation One Ration Card

- Due to the adverse effects of covid-19, the government has announced a new scheme for every migrant worker. One nation one ration card will be implemented from the month of August 2020. Any labour can get a ration for free at any corner of our country for the next 3 months.

- Technology Systems to be used enabling Migrants to access Public Distribution System (Ration) from any Fair Price Shop in India by March 2021

2.1.2 Free Food grain Supply to Migrants for 2 months

- For 3 months there will be free supply of food and grains for the migrant workers. This will benefit at least 800 million people in our country. 5 KG Rice or Wheat along with 1KG pulses for each household for 3 months. Even non ration card holder migrant workers will get the same amount of food and grains.

- Rs 3500 Crore will be spent on this intervention for 2 months.

- Under PM Awas Yojna a rental housing scheme will be initiated for urban poor and migrant workers. Government housing will be converted into affordable rental houses for migrant labourers.

- Around Rs11,000 crore would cost the centre while providing food and shelter to migrant workers. The government allowed states to use disaster management funds to operate this function.

2.2 Facility To Street Vendors

- A special credit facility of Rs 5000 crore was announced by the government for street vendors. This will benefit nearly 50 lakhs street vendors to develop their business with an initial capital of Rs 10,000 within a month.

2.3 Emergency Fund For Farmers

- The Finance Minister has announced Rs 2 lakh crore emergency fund for farmers which will be given through Kisan Credit Cards. Nearly 2.5 crores farmers including fishermen, animal husbandry farmers and others will be benefited from this credit at a concessional rate.

- Allotment of Rs30,000 crore emergency working capital fund via NABARD for farmers. More Rs30,000 crore will be added into this.

2.4 Shishu Loans under MUDRA rate reduction

- Rs 1,500 crore interest subvention for Sishu loans under MUDRA. There’s a 2% interest subsidy for promot payee for a period of employees. SBI has granted the loan moratorium.

2.5 Relief for Housing Sectors

- There will be an extension Credit Linked Subsidy Scheme (CLSS) till March 2021. The government has announced the amount of Rs 70,000 crore fund to the housing sector and middle income group. This scheme has already benefited middle income groups in India.

2.6 Funds For Tribals

Under CAMPA funds allotment of Rs 6000 crore to secure the employment of tribals. This fund will increase more job opportunities to tribals in urban, semi-urban areas for afforestation and plantation works.

In addition to these measures Finance Minister has also added other reforming labour laws. The bill is in standing committee and it will be introduced soon in the parliament. These are the future steps that will be taken by the government for the migrant workers:

- Appointment letters for migrant workers

- Annual medical check-ups

- Social security funds

- Occupational safety and hazard code

- Timely wages and universalisation of minimum wages.

| Sl.No | Schemes | Amount(Crores) |

| 1 | Free Food & Grains for migrant workers | 3,500 |

| 2 | Reduction for Mudra Shishu Loans interest | 1,500 |

| 3 | Credit facility to street vendors | 5,000 |

| 4 | Housing CLSS-MIG | 70,000 |

| 5 | Working capital fund via NABARD | 30,000 |

| 6 | Additional fund through Kishan Credit Cards | 2,00,000 |

| Total | 3,10,000 |

3. Third Tranche (Rs 1,50,000 crore) – Agriculture

The government has placed the third tranche out of its economic measure for agricultural sectors. To strengthen the infrastructure of agricultural sectors, the animal husbandry and dairy government announced an overall amount of Rs 1.5 lakh crore agricultural infrastructure fund.

The Finance Minister Nirmala Sitharaman announced important economic measures solely focused on developing better infrastructure, capacities in agricultural areas. Along with these funds other measures such as governance and administrative reforms, are also included in the list.

3.1 Agriculture Infrastructure Fund – Measures to strengthen Infrastructure Logistics and Capacity Building

- A financial package of Rs 1 lakh crore for farm-gate infrastructure including the post harvest management infrastructure and agricultural proprietors. The government is immediately looking after the core agricultural sectors to strengthen the farm industry.

- The government is also taking initiative towards other sectors like micro food enterprises to promote our local value added products in the global business market. A fund of Rs 10,000 crore issued by the government in favour of these MFEs. This scheme will help nearly 2 lakh MFEs to build their own industries, technological developments and global marketing.

- Through Pradhan Mantri Matsya Sampada Yojana Rs20,000 crore will be provided to the Fishermen. As per the scheme Rs 11,000 crore allotted for the marine and rest Rs 9000 crore for the upliftment of fishing harbours and cold chains etc.

- A special program has been launched to control animal diseases. National Animal Disease Control Programme 100% vaccination will be provided to cattle animals. The government has provided around Rs13,343 crores for this scheme. Till now 1.5 crore cows, buffaloes and other cattles are vaccinated.

- For animal husbandry the government will provide a fund of Rs15,000 crore. To develop the cattle farming and dairy industries the government will set up this fund. It will help the dairy farming industry to gain a better exposure in the privatised market.

- Rs4000 crore fund will cover an area of 10,00,000 hectare for the promotion of Herbal cultivation under the surveillance of National Medicinal Plants Board (NMPB).

- To increase the Bee-keeping initiatives for honey and wax production the government has announced a fund of Rs500 crore. This scheme is enacted for quality production of honey, marketing and storage purposes.

- Under Top to Total initiative Rs 500 crore has been allotted to extend the Operation green from tomatoes, onions to other fruits and vegetables. 50% subsidy for transportation and cold storages.

3.2 Other Agricultural Reforms

The government of India is focusing on the legal framework in the agricultural sectors including making relevant amendments in the Essential Commodities Act, 1955.

The government will bring the agricultural marketing reforms to enhance the marketing choices of farmers through central law.

This will help the farmers to expand their business, in open markets, large retailers and exporters in a transparent way.

| Sl.No | Schemes | Amount(Crores) |

| 1 | Fund for Micro Food Enterprises | 10,000 |

| 2 | Pradhan Mantri Matsya Sampada Yojana | 20,000 |

| 3 | Animal Husbandry Infrastructure Development Fund | 15,000 |

| 4 | Promotion of Herbal Cultivation | 4,000 |

| 5 | TOP to TOTAL Initiative- Operation Greens | 500 |

| 6 | Agricultural Infrastructure | 1,00,000 |

| 7 | Beekeeping Initiative | 500 |

| Total | 1,50,000 |

4. Fourth Tranche (Rs8,100 crore) Schemes For 8 Sectors

Following the earlier schemes the government has announced the fourth tranche of it’s 20 lakh crore economic package in favour of 8 important sectors. Finance Minister Nirmala Sitharaman has added on her announcement about these 8 sectors and the complete break-up of the economic package.

The fourth and fifth tranches have an equivalent value of Rs 48,100 crore including the additional figure of Rs 40,000 crore for MNREGA to create job facilities amid the nationwide lockdown. And Rs 8100 crore for viability gap funding.

The names of these important sectors and the respective schemes are listed below:

4.1 Coal and mining Commercialisation

- Investment of Rs 50,000 crore in the coal and mining sector. The government will introduce an open market for coal industries. Privatisation in the coal industry will increase the competition amongst the private companies.

- There’s a liberalisation in the coal bidding and selling market. Any party can bid for coal blocks without any norms.

4.2 Defense Production

- Enhancing the defence productions to make India a self reliant country- Atma Nirbhar Bharat.

- To make India self reliant in defence, the production of weapons and ammunition should be increased. Thus, the government is stopping the import of foreign defense weapons. A separate budget has been declared for domestic capital procurement.

- The government has settled a Project Management Unit (PMU) to support the contract management. The FDI limit in defence productions is raised to 79% from 49%.

4.3 Minerals Sectors

- Introduction of private companies in the mineral sectors. This will boost up the employment structure and bring state of the art-technology.

- Transparent auction process, around 500 mining blocks would be offered in this process. Joint auction of bauxite, mineral blocks will increase competitiveness.

4.4. Air space management (Civil aviation, Airports and MRO)

- For the betterment of the civil aviation sectors restrictions on the utilisation of the Indian Air Space will be reduced. There will be a profit margin of Rs1000 crore estimated from the aviation sectors. The ease of air space utilisation will reduce the air travel costs.

- Increase the privatisation in aviation industry, new airports and optimal utilisation of airspace is required to develop the aviation sectors in India.

- Reforming the Maintenance ,Repair and Overhaul (MRO) to make India a global hub of aircraft maintenance. The budget has been increased from Rs800 crore to Rs2000 crore for the maintenance and aircraft components repairs. For repairing facilities, the world’s major manufacturers are being appointed to set up the engine repair in India.

4.5 Distribution Companies In UTs (Power Distribution)

- Distribution Companies to ensure the adequate power supply and reduced the load shedding issues.

- Changes in the tariff policy reforms. Consumers won’t face any problems due to the inefficiency of DISCOMs.

- Privatisation in power distribution groups in union territories. This will help the consumer to get better services and financial efficiency in distribution.

4.6 Social Infrastructure Development via Viability Gap Funding

- Growth in private sectors is required to uplift the economic development in our country. Through viability gap funding scheme a total outlay of Rs 8100 crore is projected.

- Social infrastructure projects need to be proposed by state ministry, central and statutory entities.

4.7 Space Sectors

- The government will provide regulatory compliance to private associations. There will be access to private industries in the field of space activities.

- New space projects, outer space travel and research will be open for private parties.

- To improve the standard of space programs and activities private parties can work with ISRO.

4.8 Atomic Energy Reforms

- For the welfare of humanity through affordable health treatment against cancer and other major diseases, the government is likely to establish the research reactor in PPP mode for the production of medical isotopes.

- To develop the atomic power sectors, the technology cum incubation center will be set up with a collaboration of research facilities and tech entrepreneurs.

5. Fifth & Final Tranche (Rs40,000 Crore) For MGNREGA Fund

In the last and fifth tranche Finance Minister has announced an additional package of Rs 40,000 crore in seven steps namely for MGNREGA, health and education, decriminalization of Companies Act, Ease of Doing Business, state government funds and others.

5.1 MGNREGA Fund

- The fund aims to help mainly the migrant workers those who have faced the financial and health problems for Covid-19 pandemic. Under Mahatma Gandhi National Rural Employment Guarantee Act the government will allocate a fund of Rs40,000 crore to provide employment boost for economically poor people.

- Around 300 crore people will be benefited under this scheme. It will enhance the rural economy through higher production.

5.2 Special Package For Health & Educational Departments

- The government of India has announced a special package of Rs 15,000 crore solely for the development of the Health and Educational sectors. To avoid the critical situation from future pandemic or inadequate supply of medical resources, the government will increase medical research. More public labs, infectious diseases blocks need to be settled in every district to counter the adverse effects of Covid-19. The government will be focusing on the National Digital Institutional platform to upgrade the health insurance sectors.

- The government has taken a new initiative named as Manodarpan to provide mental support and encourage the emotional comfort of the students, their family members and teachers. With the help of 100 best academic institutions the government has arranged the online classes.

- Under e-Vidya program of the government, digital online classes will be launched with the help of online education sectors. And there will be live classes for the students 1standard to 12th through DTH and cable operator’s channels for those students who are not technically savvy.

5.3 Insolvency Resolution For MSMEs

- As per the insolvency code section 240A the government will draft an insolvency resolution for the MSME sectors. No new insolvency proceedings will be drafted for a year. Minimum threshold raised in this insolvency process is Rs 1crore from Rs1 lakh.

5.4 Violation Of Companies Act Decriminalisation

- The government is planning to pass an ordinance for violating the regulations of the Companies Act.

- The Union Cabinet Minister has passed 72 amendments related to the decriminalisation of several administrative offences and any minor technical defaults such as CSR shortcoming reports, inappropriate board reports etc under the companies act.

- This will probably nurture the ease of doing business for private sector companies.

5.5 Ease Of Doing Business

- Any private company that lists NCDs will not be granted as a listed company on the stock exchange board.

- Minimum penalties for all technical defaults for every small, sole proprietor and start up companies.

- The centre has allowed the public companies for direct listing in foreign countries under the permissible jurisdiction.

5.6 Public Sector Policies

- A new policy will be applicable for private sectors to participate in any business sectors along with the public organisation (PSE). The public sector will work on their respective areas. As per the strategy, the private companies will be allowed in respect to one public organisation.

5.7 Funds For State Government

- This Covid-19 pandemic has badly affected both the central and state government’s revenue structures.

- To overcome the economic crisis of the state governments the Central Ministry has allocated Rs 46,038 crore for the State governments respectively.

- The government has increased the advance limit by 60% for every state government for emergency purposes. Rs 4,113 crore fund released from the Health Ministry in favour of state government for Covid-19 activities.

| Sl.No | Schemes | Amount(Crores) |

| 1 | Viability Gap Funding | 8100 |

| 2 | Additional MGNREGA Fund | 40,000 |

| Total | 48,100 |

6. Others Measurements

6.1 RBI Monetary Fund & Policies

- The Reserve Bank Of India has previously announced a monetary policy to combat against the poor economic condition of the country. Rs 8,01,063 crore fund is allocated as a liquidity measure to deal with the downfall of economic situation for Covid-19 pandemic since March.

6.2 Pradhan Mantri Garib Kalyan Package (PMGKP)- Measures For Unprivileged Citizens

- Before the covid-19 pandemic situation the Central government has already announced a relief fund for the socio-economic poor and unprivileged citizens of the country. A fund of Rs 1,92,800 crore as a part of the Pradhan Mantri Garib Kalyan Yojana has been approved by the government to provide sufficient food and grains to these poor people.

- As per the analysis, the financial support of Rs 52,608 crore has been provided to the Gramin people around 41crore people successfully received the package under PMGKY.

End Note

The covid-19 pandemic has changed the economic and social infrastructure of India and other countries. The world is now standing at the verge of a heavy economical breakdown. Where India is already going through an economic downturn at the same time announcing 10% of the GDP is a tough decision. Many sectors have already gained the relief funds and other measures will be in action soon to the respective sectors. But it depends on time, how these measures and schemes of Atma Nirbhar Bharat will draw a rising curve in India’s economic growth line.

Sources: