Invoice Furnishing Facility (“IFF”) is a terminology introduced under GST with QRMP (“Quarterly Return and Monthly payment”) scheme. IFF facility is provided which allows dealers, who have opted for quarterly filing of return under QRMP scheme, to file their B2B transactions on a monthly basis. In this article a detailed discussion has been carried out about IFF.

1. What is QRMP?

- QRMP is a scheme introduced with effect from 1st January, 2021 to ease compliance for small taxpayers, i.e., taxpayers with aggregate turnover upto INR 5 Crores during the preceding Financial year.

- Under QRMP, an option has been provided to taxpayers to furnish his GSTR-1 and GSTR-3B on quarterly basis. However, payment of tax liability should be made on a monthly basis.

- Under this scheme, a taxpayer is available with both the options, i.e., he can either file both GSTR-1 and GSTR-3B on monthly basis or both on quarterly basis.

2. Why is IFF required under QRMP?

- Newly inserted Rule 36(4) to Central Goods and Service Tax Rules, 2017 (“CGST Rules”) has restricted Input Tax Credit to the extent of 105% of the Invoices details of which are furnished by supplier in his GSTR-1 Return.

- Taxpayers are allowed to claim ITC only with respect to invoices which are filed by suppliers in his GSTR-1 with GSTIN of recipient and the same are appearing in GSTR-2B of the recipient on the date of filing of GSTR-3B or on date of payment of GST liability.

- Under QRMP, taxpayers who opt to file their GSTR-1 and GSTR-3B on quarterly basis shall file details of their B2B transactions after the end of quarter, i.e., person opted for quarterly filing for January to March, 2021 shall furnish his details of his B2B transactions in GSTR-1 to be filed by 13th April, 2021.

- Therefore, registered dealers buying goods from such persons during January & February, 2021 will not get ITC in the month of purchase itself while fling their GSTR-3B and hence, they may be reluctant to bury goods or services from small dealers.

- To avoid this issue, IFF facility is provided which allows dealers, who have opted for quarterly filing of return under QRMP scheme, to file their B2B transactions on a monthly basis.

3. How does Invoice Furnishing Facility work?

- Under IFF, taxpayers opted for quarterly filing of GSTR-1 and GSTR-3B are allowed to furnish their B2B transactions on a monthly basis by 13th of the following month. Therefore, unlike GSTR-1, details of all outward supplies shall not be furnished under IFF.

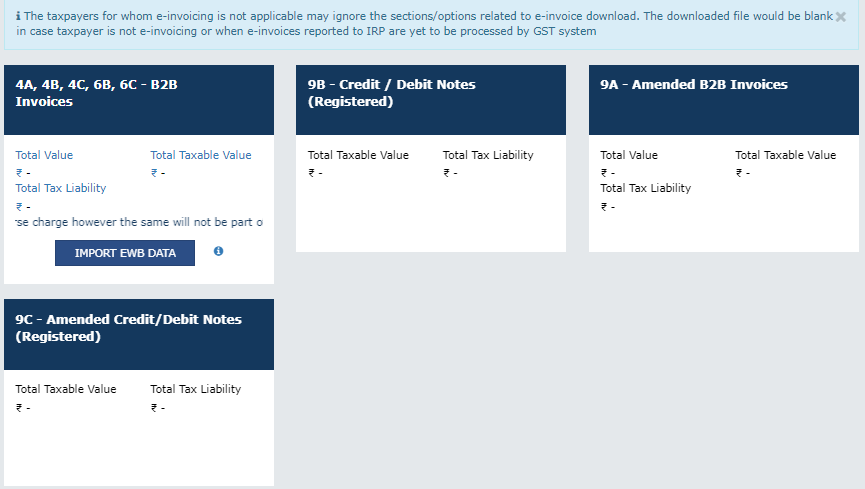

- Only following transactions are allowed to be reported under IFF:

- B2B transactions

- Credit and Debit note issued to registered persons

- Amendment to B2B invoices

- Amendment to Credit and Debit Note issued to registered person.

- Therefore, details of all other supplies, i.e., B2C transactions, Credit note or debit note issued to unregistered persons, details of exports etc. shall not be furnished under IFF. Same shall be filed while filing quarterly GSTR-1.

- Please note that IFF is an optional facility and therefore, non filing or late filing of the same shall not attract any late fee or penalty.

- Further, unlike GSTR-1, option to file IFF is available till 13th of the following month only and after 13th only “View” option is available and “File” option gets disabled.

- Therefore, if a person failed to upload details under IFF by 13th then he shall not be able to file such return and details of such invoices can be furnished in IFF of the next month or his regular GSTR-1.

- Facility to furnish details under IFF is available only for first two months of the quarter and for 3rd month option of quarterly filing of GSTR-1 shall be provided by portal.

4. What are the steps to furnish details of invoices under IFF?

- Post login at GST portal, for taxpayers, not opted for QRMP scheme, system will display four tabs namely GSTR-1, GSTR-2A, GSTR-2B and GSTR-BB.

- However, if a person opted for quarterly filing of return, the system will display only IFF, GSTR-2A and GSTR-2B tabs for the first 2 months of the quarter. For 3rd month, all 4 tabs shall be available.

- Details under IFF can be furnished any time between 1st of the following month till 13th of the following month.

- Post filing of IFF, the system will start reflecting such invoices in GSTR-2B of the recipient.

5. What points should be kept in mind while filing Invoice Furnishing Facility?

- Details of B2B transactions already entered in IFF of the month need to be furnished again while filing GSTR-1 of the corresponding quarter. For ease, invoices uploaded in IFF shall auto-populate in the relevant column of GSTR-1.

- A taxpayer is allowed to furnish transactions under IFF only to the extent of INR 50 Lacs. Therefore, if aggregate of B2B sales made during a month exceeds INR 50 lacs then details of invoices in excess of INR 50 lacs shall be furnished in IFF of the following month.

- For furnishing invoices details under IFF, taxpayers may use GST offline tool or can enter information manually on GST portal.