Got your business registered under the GST regime? Then, you must be already aware of the GSTR-1, GSTR-2, and GSTR-3 forms. Similar to other GST return forms, GSTR-3B is another essential form you need to file monthly. More precisely speaking, the GSTR-3B is nothing but a self-declaration form that acts as a consolidated summary of all the inward and outward supplies your business has gone through in a month.

1. What is GSTR 3B?

As said earlier, GSTR 3B is the form that summaries all your monthly returns. Through GSTR 3B, you need to accumulate the total values of purchases and sales your business has gone through.

Once you file your GST return through GSTR-1 and GSTR-3B for a particular month, You might have to encounter trouble if the preliminary information you have submitted does not match with the sales and purchase data you submit through GSTR-3B.

2. Facts About GSTR 3B

Here are some of the must-know facts about the GSTR-3B,

- GSTR 3B is a self-declaration form that you need to furnish monthly

- You need to file GSTR-3B separately for each GSTIN you have

- While filing GSTR 3B for a particular month, you will have to pay the tax liability within the due date

- Once you file GSTR-3B for your business, it can not be revised. In case you made mistake in GSTR 3B of any month, Read How to rectify any error in GSTR 3B

- You have to reconcile GSTR-2A and GSTR 1 with GSTR 3B. This will help you to improve your GST Compliance rating and avoid penalties due to short paying of tax

- You can file GSTR-3B online through the GSTN portal. Online payment and payment through bank challans is possible for the tax payable

- To verify your return using an electronic verification code, you need an OTP from your registered phone.

You may refer our guide on Important Points to be considered for GSTR-3B return under GST

3. Who Should File GSTR-3B?

All the taxpayer with a GSTIN needs to file GSTR 3B. No matter if on a certain month the transaction of your business is nil or its not significant, you still need to file the GSTR 3B. Businesses need to file GSTR-3B for a particular month within the 20th of the following month. For example, you need to file the GSTR 3B for the month of December on 20th January.

However, in the following cases, you don’t need to file the GSTR 3B,

- If you are a composition dealer

- You are an input service distributor

- If you supply online information and database access or retrieval service

- You are a non-resident taxable Indian citizen

Read the new guideline on Taxpayers Are Allowed to File GSTR-3B Returns in a Staggered Manner from Now On!

4. Late Fees and Penalties Associated with GSTR-3B

As we have already said, filing the GSTR 3B even if your business has absolutely zero transactions on a particular month is necessary. There are late fees in case of non-filling even for nil returns. You will have to pay rupees 50 per day of delay once the deadline gets passed. In case of a zero tax liability, the late fine is rupees 20 per day of delay. Alongside that, you will have to pay an interest of 18% per annum on the total amount of outstanding tax.

Further, read more on Action against taxpayers fails to furnish GSTR-3B within Due Date

5. Details You Need to Furnish While Filing GSTR-3B

While filing return through the GSTR 3B form, you need to put the following details,

- GSTIN number

- The registered name of your business

- Details of your sales and purchases

- Information on inter-state sales made to buyers under the composition scheme, unregistered buyers and UIN holders

- Eligible Input Tax Credit

- Value of nil-rated, inward and non-GST supplies

- Payment of tax

- TCS or TDS credit

6. How to File GSTR-3B?

Here we have explained the whole format of the GSTR 3B form.

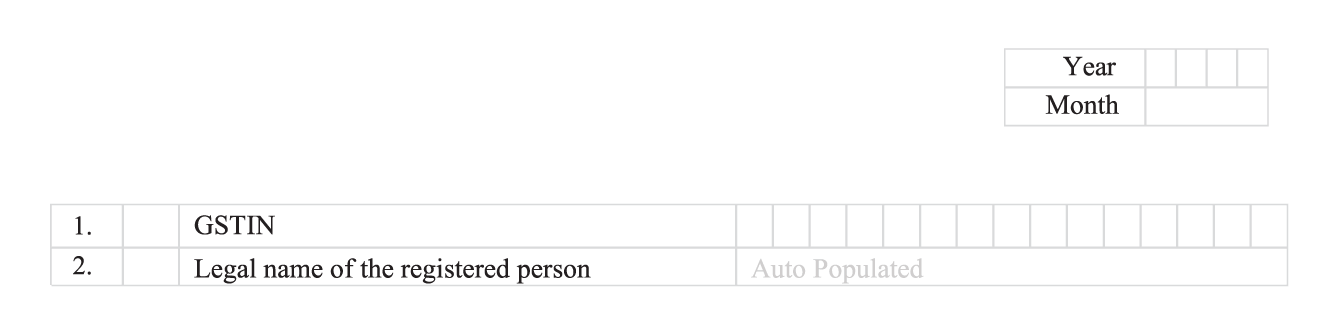

6.1 Section 1

1. GSTIN:

Put your GSTIN in this column

2. The legal name of the registered person:

This will be filled automatically as you put your GSTIN.

6.2 Section 2

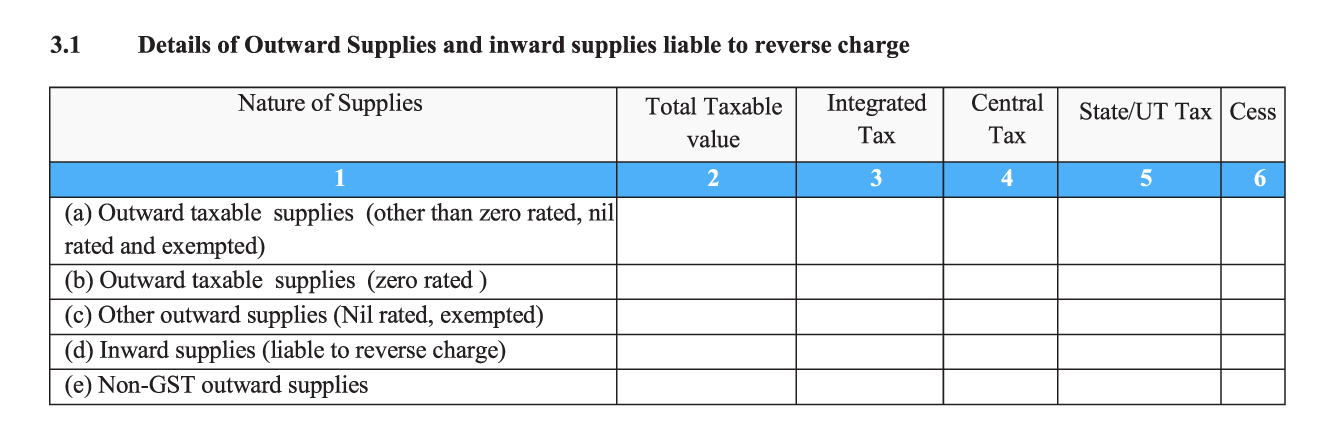

3.1 Details of Inward Supplies and Outward Supplies liable to reverse charge

You need to put the complete taxable value, and tax collected under various tax heads such as IGST, CGST, SGST/UTGST, and Cess for the following:

- Outward supplies(Include Zero-rated supplies)

- Outward supplies(Other than zero-rated supplies includes exempt supplies)

- Other Outward supplies(Nil rated supplies)

Here, you need to understand that nil rated supplies and the exempted supplies come under two different schemes.

For Nil rated supplies you don’t need to pay any tax at the time of sale, but you can still claim ITC for them.

Whereas, for exempted products, neither you pay any tax at the point of sale nor you can claim an input tax credit for those.

- In the Inward Supplies row, you need to submit the details related to the inwards supplies liable for reverse charge. These are the purchase transactions where you have paid tax directly to the government on behalf of your supplier.

- The next row is for entering Non-GST outward supplies

- The cess column is for the automobile and tobacco industry. If your business is not involved in the selling of such goods, you don’t need to enter in cess-related detail.

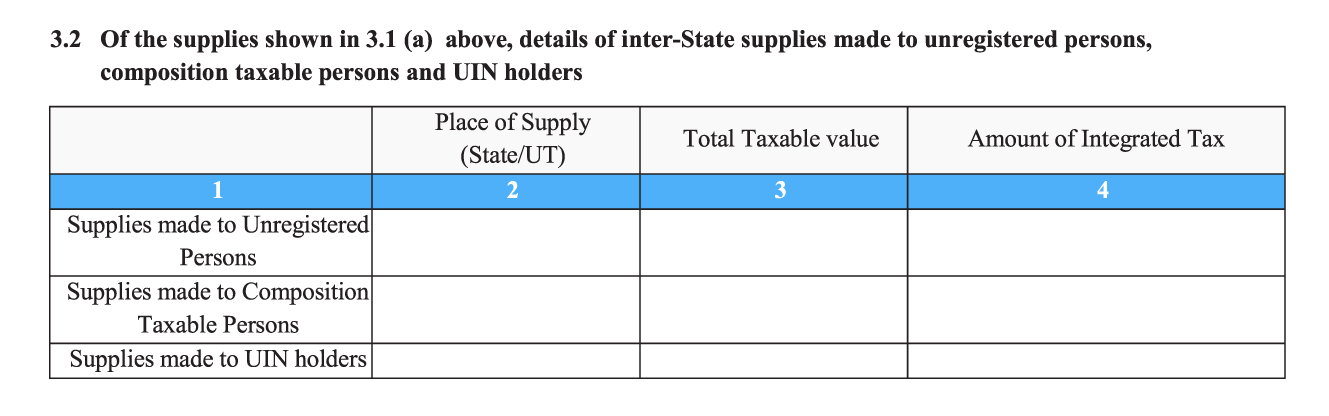

3.2 Of the supplies shown in 3.1 (a) above, details of inter-State supplies made to taxable composition persons, unregistered persons, and UIN holders

In this part, you need to furnish all the details related to the following types of interstate sales you have made:

- Supplies you have made to unregistered persons. Read more for How to report Interstate supply to an unregistered person in GSTR-3B

- All the supplies you have made to Composition Taxable People

- Supplies made to UIN holders

Here you need to mention the location of the customer or the location where you have delivered the product or service, total taxable amount, and the IGST collected.

Section 3:

4. Eligible ITC

You need to furnish the amount of tax you need to pay which is based on your input tax credit while filing GSTR-3. You need to furnish the following details here,

A. ITC Available: Here you require to put all the tax amount related to the import of goods, inward supplies from Input service distributors, import of services, and other details mentioned in the column

B. ITC Reversed: Mention the details of ITC on goods or services that you have to utilize for non-business purposes.

C. Net ITC available: Subtract the reversed ITC(Amount in column B) from the available ITC(Amount in column A) and put the value here.

D. Ineligible ITC: Here, you have to put details related to blocked credits. You can’t claim ITC for transportation of goods, food, health, cab services, and employees by default.

Section 4:

5. Values of nil-rated, exempt, and non-GST inward supplies: Here, you need to mention the inward supplies from composition dealer, exempt supplies and NIL rated supplies.

5.1. Interest and late fee payable: This section applies only for businesses with additional tax liabilities imposed because of failure to compile with one or more GST regulations

Section 5:

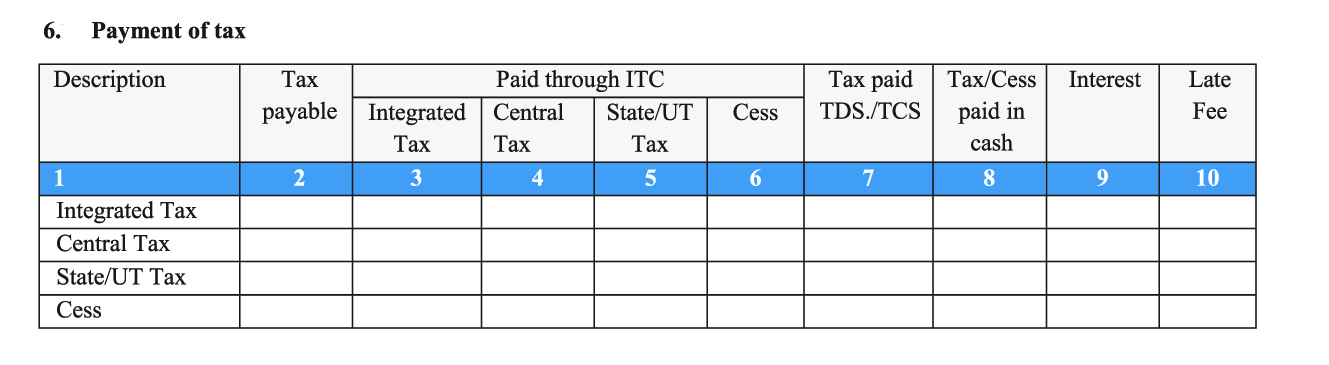

6. Payment of tax: You need to fill this section once you pay the tax amount you owe to the government.

7. TDS/TCS credit: If your business deducts or collect tax at source, then, you must have received credit against it. You need to furnish those details in this part.

Once you fill all the details we have mentioned here; you need to get the form signed by an authorized taxpayer and then file GSTR-3B return.