Investment outside India by a person resident in India is always monitored and governed by the regulations of RBI. Till now, overseas Investment was monitored by the Foreign Exchange Management (Transfer or Issue of Any Foreign Security) Regulations, 2004, and the Foreign Exchange Management (Acquisition and Transfer of Immovable Property Outside India) Regulations, 2015.

However, with evolving needs of businesses in India, in an increasingly integrated global market, there is a need for Indian corporations to be part of the global value chain. Therefore, liberalization and promotion of overseas investments were inevitable.

Considering the need, The Government of India undertook a comprehensive exercise of simplifying overseas investment rules in consultation with the Reserve Bank of India. The revised regulations have simplified the existing framework for overseas investment and have aligned the same with the current business and economic dynamics.

Clarity on Overseas Direct Investment and Overseas Portfolio Investment has been provided and various overseas investment-related transactions have been brought under the Automatic Route from the approval route, significantly enhancing “Ease of Doing Business”.

1. Rules and regulations related to overseas investment: Then Vs Now

Following rules and regulations have been subsumed and will no longer be applicable:

- Foreign Exchange Management (Transfer or Issue of Any Foreign Security) Regulations, 2004.

- Foreign Exchange Management (Acquisition and Transfer of Immovable Property Outside India) Regulations, 2015.

New Rules and Regulations applicable on overseas Investment:

- Foreign Exchange Management (Overseas Investment) Regulations, 2022.

- Foreign Exchange Management (Overseas Investment) Rules, 2022.

2. Investments not covered under FEM(Overseas Investment) Regulations, 2022

As per Regulation 4 of FEM(OI) Regulations, 2022, provisions of these regulations shall not apply on the following investments:

- The investment is made outside India by a financial institution in an IFSC(International Financials Service Centre).

- Acquisition or transfer of any investment outside India made:

- Out of Resident Foreign Currency Account; or

- Out of foreign currency resources held outside India and such investment is made by a person who is employed in India for a specific duration or job or assignment duration which does not exceed 3 years.

- The investment made by a person who is resident in India if such investment was acquired, held or owned by such person when he was resident outside India or inherited from a person who was resident outside India.

3. Transition Provisions

On the applicability of new overseas investment rules and regulations, any investment or financial commitment outside India held on the date of publication of new rules and such investment was made in accordance with provisions of FEMA its rules and regulations then such investment shall be considered as made under new rules and regulations.

4. Overseas Direct Investment (ODI), Overseas Portfolio Investments, Financial Commitments (FC), and Overseas Investment

4.1 Overseas Direct Investment (ODI)

- The following investments shall be considered as “Overseas Direct Investment” or “ODI”:

- Investment in Unlisted Foreign Entity

- Acquisition of equity capital; or

- Subscription as a part of the memorandum of association,

- Investment in Listed Foreign Entity

- Investment in 10% or more of the paid-up equity capital, or

- investment with control where investment is less than 10% of paid-up equity capital; or

- Subscription as a part of the memorandum of association.

- Further, where investment is classified as ODI then such investment shall continue to be treated as ODI even if the investment falls to a level below 10% or the such person loses control in the foreign entity.

4.2 Overseas Portfolio Investment (OPI)

- OPI means investment in foreign securities other than ODI.

- OPI does not include investment in any unlisted debt instruments or any security issued by a person resident in India who is not in an IFSC.

- Provided that OPI by a person resident in India in the equity capital of a listed entity, even after its delisting shall continue to be treated as OPI until any further investment is made in the entity.

4.3 Financial Commitment

- Financial Commitment shall include the aggregate amount of investment made by a person resident in India in:

- Overseas Direct Investment,

- Debt other than Overseas Portfolio Investment in a foreign entity or entities in which the Overseas Direct Investment is made; and

- Non-fund-based facilities extended by such person to or on behalf of such foreign entity or entities.

4.4 Overseas Investment (OI)

- OI means financial commitment and Overseas Portfolio Investment by a person resident in India

* Foreign Entity means an entity formed or registered or incorporated outside India, including International Financial Services Centre (IFSC) that has limited liability.

4.5 Analysis

- To put things simply, Investments made in equity shares of a foreign entity are considered ODI. In the case of listed foreign entities, equity holding should be 10% or more of paid-up share capital or a person resident in India should have control over a foreign entity where shareholding is less than 10%.

- Investments made in foreign security not covered under ODI are OPI. Therefore, the following investments shall be considered as OPI:

- Investment in Debt Security (other than unlisted debt instruments)

- Investment in equity shares of listed entities where shareholding is less than 10% of paid-up share capital and a person resident in India does not have any control over foreign entities.

5. Manner of Making ODI/OPI/OI

5.1 General Provisions related to Overseas Investment

- As per Rule 8 of new overseas Investment rules, no person resident in India shall make or transfer any investment or financial commitment outside India.

- Further, as per Rule 9 of the new rules, a person resident in India shall make an investment in a foreign entity subject to the following conditions:

- Foreign Entity is engaged in bona fide business activity,

- Investment is made directly or through a step-down subsidiary or the special-purpose vehicle,

- Investment is made subject to the limits and the conditions laid down in rules and regulations.

Note: “bonafide business activity” shall mean any business activity permissible under any law in force in India and the host country or host jurisdiction.

5.2 Rules and regulations related to investment

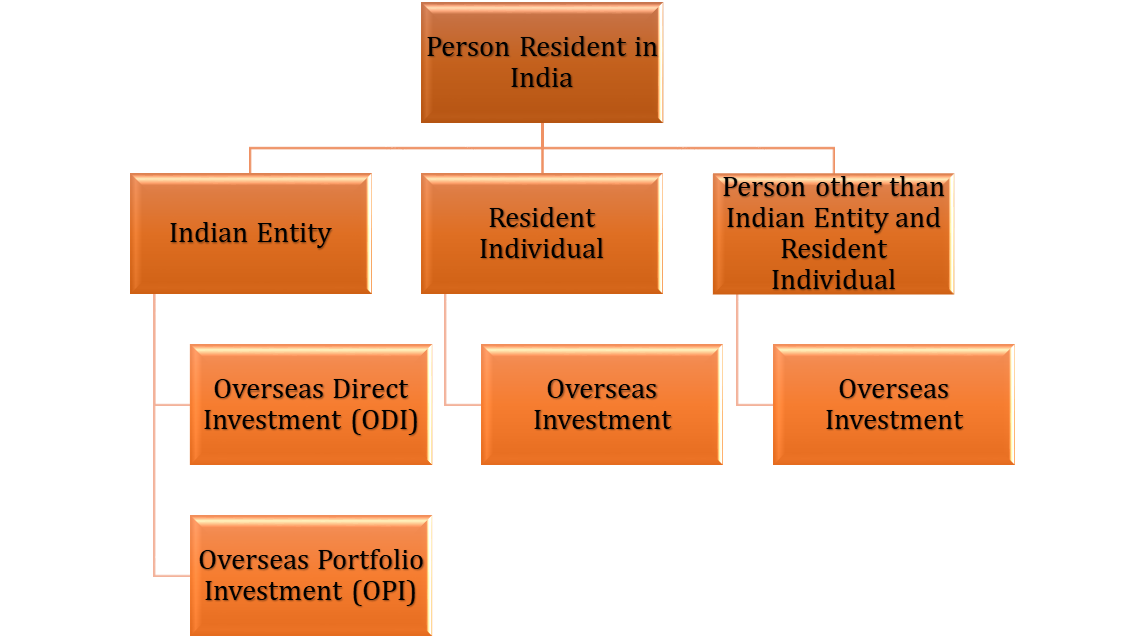

Under new overseas rules, the manner of making investments is provided based on the nature of the entity, i.e., Indian Entity, Resident Individual, etc.

5.2.1 Overseas Direct Investment by Indian Entity (Rule 11 read with Schedule I)

- Manners of making overseas Direct investments by Indian Entities are given under Rule 11 of new overseas investment rules read with Schedule.

- Indian Entity means

- Companies registered under the Companies Act, 2013.

- Body corporate incorporated by any law.

- Limited Liability Partnership Firm (LLP).

- Partnership firm registered under the Indian Partnership Act, of 1932.

- An Indian entity may make Overseas Direct Investment in equity capital for the purpose of undertaking a bonafide business activity.

- Indian entity may hold ODI by way of:

- subscription as part of a memorandum of association or purchase of equity capital, listed or unlisted;

- acquisition through bidding or tender procedure;

- acquisition of equity capital by way of rights issue or allotment of bonus shares;

- Capitalization of any amount due towards the Indian entity from the foreign entity provided that such amount is permitted under the Act or does not require prior permission of the Central Government or the Reserve Bank of India.

- the swap of securities;

- Merger, demerger, amalgamation, or any scheme of arrangement as per the applicable laws in India or the host country.

- Limit of Financial Commitment

- Total financial commitment made by an Indian entity in all the foreign entities taken together at the time of undertaking such commitment shall not exceed 400% of its net worth as on the date of the last audited balance sheet or as directed by the Reserve Bank, in consultation with the Central Government from time to time.

- Total financial commitment shall not include capitalization of retained earnings. However, it shall include:

- Utilization of the amount raised by the issue of American Depository Receipts or Global Depositary Receipts and stock-swap of such receipts; and

- utilization of the proceeds from External Commercial Borrowings to the extent the corresponding pledge or creation of charge on assets to raise such borrowings has not already been reckoned towards the above limit.

5.2.2 Overseas Portfolio Investment by an Indian entity (Rule 12 read with Schedule II)

- An Indian entity may make an OPI that shall not exceed 50% of its net worth as of the date of its last audited balance sheet.

- A listed Indian company may make an OPI by way of reinvestment.

- An unlisted Indian entity may make an OPI by the way it can make an ODI other than a Subscription to the memorandum of Association and acquisition through bidding or tender procedure.

5.2.3 Overseas Investment by a resident individual (Rule 13 read with Schedule III)

- Any resident individual may make an ODI by way of investment in equity capital or OPI in the manner provided.

- However, such investment shall be subject to the overall ceiling under the Liberalized Remittance Scheme of the Reserve Bank.

- A resident individual may make or hold Overseas Investments by any of the following ways:

- ODI in an operating foreign entity not engaged in financial services activity and which does not have a subsidiary or step-down subsidiary where the resident individual has control in the foreign entity.

- OPI, including by way of reinvestment.

- ODI or OPI, as the case may be, by way of–

- Capitalization of any amount due from the foreign entity the remittance of which is permitted under the Act or does not require prior permission of the Central Government or the Reserve Bank;

- swap of securities on account of a merger, demerger, amalgamation, or liquidation;

- acquisition of equity capital through rights issue or allotment of bonus shares;

- gift

- inheritance;

- acquisition of sweat equity shares;

- acquisition of minimum qualification shares issued for holding a management post in a foreign entity;

- acquisition of shares or interest under an Employee Stock Ownership Plan or Employee Benefits Scheme:

- However, ODI through inheritance, swear equity shares, minimum qualification shares, and ESOPs may be made whether or not the such foreign entity is engaged in financial services activity or has a subsidiary or step-down subsidiary where the resident individual has control.

- Acquisition of less than 10% of the equity capital, whether listed or unlisted, of a foreign entity without control under Sweat Equity shares, minimum qualification shares or ESOPs shall be treated as OPI.

- Acquisition of shares by way of gift or inheritance:

- A resident individual may, without any limit, acquire foreign securities by way of inheritance from a person resident in India. However, the transferor must hold such securities in accordance with the provisions of the Act or from a person resident outside India.

- A resident individual, without any limit, may acquire foreign securities by way of gift from a person resident in India who is a relative and holding such securities in accordance with the provisions of the Act.

- A resident individual may acquire foreign securities by way of gift from a person resident outside India in accordance with the provisions of the Foreign Contribution (Regulation) Act, 2010, and rules and regulations made thereunder.

- Acquisition of shares or interest under an Employee Stock Ownership Plan Employee Benefits Scheme or sweat equity shares

- If a resident individual is an employee or a director of:

- Indian office of the overseas entity; or

- Branch of an overseas entity; or

- Subsidiary of an overseas entity; or

- Of an Indian entity in which the overseas entity has direct or indirect equity holding,

- If a resident individual is an employee or a director of:

- Such resident individuals may acquire, without limit, shares or interest under ESOP or Employee Benefits Scheme or sweat equity shares offered by such overseas entity.

- However, such a scheme is offered by the issuing overseas entity globally on a uniform basis.

5.2.4 Overseas Investment by a person resident in India other than an Indian entity and resident Individual (Rule 14 read with Schedule IV)

a. ODI by registered Trust or Society: Any registered Trust or registered Society engaged in the educational sector or which has set up hospitals in India may make ODI in a foreign entity with the prior approval of the Reserve Bank.

However such investment can be made subject to the following conditions, namely:–

- The foreign entity is engaged in the same sector.

- The Trust or the Society should have been in existence for at least 3 financial years before the year in which such investment is being made;

- The trust deed in case of a Trust, and the memorandum of association or rules or bye-laws in case of a Society shall permit the proposed ODI;

- Such ODI has the approval of the trustees in the case of a Trust and the governing body or council or managing or executive committee in the case of a Society;

- Where the Trust or the Society requires a special license or permission (from the Ministry of Home Affairs, Central Government, or from the relevant local authority), the special license or permission has been obtained and submitted to the designated AD bank.

b. OI by Mutual Funds Venture Capital Funds or Alternative Investment Funds:

- A mutual fund Venture Capital Fund or Alternative Investment Fund may acquire or transfer foreign securities as stipulated by SEBI.

- Such acquisition or transfer can be made in accordance with the provisions laid down by the Reserve Bank and the SEBI from time to time.

- However, the aggregate limit for such investment shall be decided by the Reserve Bank in consultation with the Central Government.

- Also, individual limits for such investments shall be as per the instructions issued by the SEBI from time to time.

- Every transaction relating to the purchase and sale of foreign security shall be routed through the designated AD bank in India.

Note: Any investment made by mutual funds, Venture Capital Funds, and Alternative Investment Funds under this rule shall be treated as OPI.

c. Opening of Demat Accounts by clearing corporations of stock exchanges and clearing members.–

- Any SEBI-approved clearing corporation of a stock exchange and its clearing members may acquire, hold and transfer foreign securities, offered as collateral by foreign portfolio investors.

- Further, as per guidelines issued by the SEBI from time to time, such entity may

- Open and maintain Demat Account with foreign depositories;

- Remit the proceeds arising due to such action, if any; and

- Liquidate such foreign securities and repatriate the proceeds thereof to India.

d. Acquisition and transfer of foreign securities by the domestic depository.–

A domestic depository may acquire, hold and transfer foreign securities of a foreign entity, being the underlying security to issue Indian Depository Receipts as may be authorized by such foreign entity or its overseas custodian bank, and the person investing in Indian Depository Receipts may either sell or continue to hold foreign securities in accordance with the conditions provided in these rules and the Foreign Exchange Management (Overseas Investment) Regulations, 2022 upon conversion of such depository receipts.

e. Acquisition and transfer of foreign securities by AD bank.–

An AD bank including its overseas branch may acquire or transfer foreign securities in accordance with the terms of the host country or host jurisdiction, as the case may be, in the normal course of its banking business.