It has been a while since the GST was launched and its technical issues are not yet closed. One of the oldest and ligitaed issues was the filing of GST TRAN-1 and TRAN-2. These forms were the way of transferring ITC remaining in the pre-GST regime like under VAT or in the CENVAT Credit register to the GST regime. However, since this window was open for a very limited period of time and multiple technical glitches were persisting on the GST portal, many taxpayers could not file the GST TRAN-1 and TRAN-2 forms.

High Courts have continued to face petitions from taxpayers requesting to direct GST Authorities to reopen TRAN-1 and TRAN-2 filing portals so that taxpayers who have missed filing it or filed it incorrectly can have another chance to file it. In many verdicts, High Courts have directed GST authorities to reopen the portal.

1. Supreme Court Precedence

Now to put an end to this continuous topic of litigation, the Hon’ble Supreme Court has passed a judgment in the matter of Union of India vs. Filco Trade Centre Pvt. Ltd., SLP(C) No. 32709-32710/2018 wherein Hon’ble Apex Court held:

- The Apex Court directed the GST Network to reopen the common portal for filing of TRAN-1 and TRAN-1 for the period of 2 months, i.e., 01.09.2022 to 31.10.2022. The time for opening the portal was further extended by 4 weeks vide Miscellaneous Application No.1545-1546/2022 in SLP(C) No. 32709-32710/2018.

- Any aggrieved taxpayer was directed to file the relevant form or revise the already filed form irrespective of whether the taxpayer has filed a writ petition before the High Court or not or whether the case of the taxpayer has been decided by the Information Technology Grievance Redressal Committee (ITGRC).

- GSTN has to ensure that no technical glitches arise during this period.

- The concerned GST officers shall verify the veracity of credit transitions within 90 days and shall pass the appropriate orders on merits after granting the appropriate reasonable opportunity to the taxpayer.

- Thereafter, the credit will start reflected in the Electronic Credit Ledger of the taxpayer.

- GST Council may also issue appropriate guidelines to the field formations in scrutinizing the claims if required.

2. GSTN portal reopens for filing of TRAN-1 & TRAN-2

- In accordance with directions of the Hon’ble Supreme Court, GSTN reopened the window of filing GST TRAN-1 and TRAN-2.

- The Applicant will have the option to file fresh forms or revise already field forms.

- A window will open for the period of 01.10.2022 to 30.11.2022. Accordingly, GSTN would open the common portal for filing transitional credit through Tran 1 and Tran 2 w.e.f 01/10/2022.

3. Guidelines for filing TRAN-1 & TRAN-2

In order to ensure uniformity in the implementation of the directions of the Hon’ble Supreme Court, the Board issued guidelines for filing or revising forms vide CBEC-20010/3/2022-GST dated 9th September 2022 as follows:

3.1 Points to be taken care of while filing TRAN-1 & TRAN-2

- In the case of revising TRAN-1/TRAN-2, taxpayers will have the option to download earlier filed forms so that they can check what data they have filed with GST authority and where modifications are required.

- At the time of filing/revising TRAN-1/TRAN-2, The applicant shall also upload a declaration on the common portal given in Annexure-2.

- Further, The applicant claiming credit in table 7A of FORM GST TRAN-1 on the basis of Credit Transfer Document (CTD) shall also upload on the common portal the pdf copy of TRANS-3 notified earlier.

- No claim for transitional credit shall be filed in table 5(b) & 5(c) of FORM GST TRAN-1 in respect of such C-Forms, F-Forms, and H/I-Forms which have been issued after the due date prescribed for submitting the declaration in FORM GST TRAN-1 i.e. after 27.12.2017.

- Where the applicant files a claim in FORM GST TRAN-2, he shall file the entire claim in one consolidated FORM GST TRAN-2, instead of filing period-wise forms. Where GST TRAN-2 is filed for more than one tax period, then in the column ‘Tax Period’, the applicant shall mention the last month of the consolidated period for which the claim is being made.

3.2 Document Verification after submitting the form

- The applicant shall submit the hard copy of filed GST TRAN-1/TRAN-2 (Self-certified) along with declaration in Annexure ‘A’ and a copy of TRANS-3 to the jurisdictional officer within 7 days of filing FORM TRAN-1/TRAN-2 on the common portal.

- Applicants are advised to keep all the requisite documents/records/returns/invoices, in support of their claim of transitional credit, ready for making the same available to the concerned tax officers for verification.

- The declaration in FORM GST TRAN-1/TRAN-2 filed/revised by the applicant will be subjected to necessary verification by the concerned tax officers. The applicant may be required to produce the requisite documents in support of their claim of transitional credit before the concerned tax officers for verification of their claim.

- After the verification of the claim, the jurisdictional tax officer will pass an appropriate order on merits after granting a reasonable opportunity of being heard by the applicant.

- The transitional credit allowed as per the order passed by the jurisdictional tax officer will be reflected in the Electronic Credit Ledger of the applicant on the common portal.

3.3 Last opportunity to file forms

- The GST Department has clearly mentioned that this is the last one-time opportunity for the applicant to either file the said forms, if not filed earlier, or to revise the forms earlier filed. Therefore, The applicant is required to take utmost care and precaution while filing or revising TRAN-1/TRAN-2 and thoroughly check the details before filing his claim on the common portal.

- It is further clarified that pursuant to the order of the Hon’ble Apex Court, once the applicant files TRAN1/TRAN-2 or revises the said forms filed earlier on the common portal, no further opportunity to again file or revise TRAN-1/TRAN-2, either during this period or subsequently, will be available to him

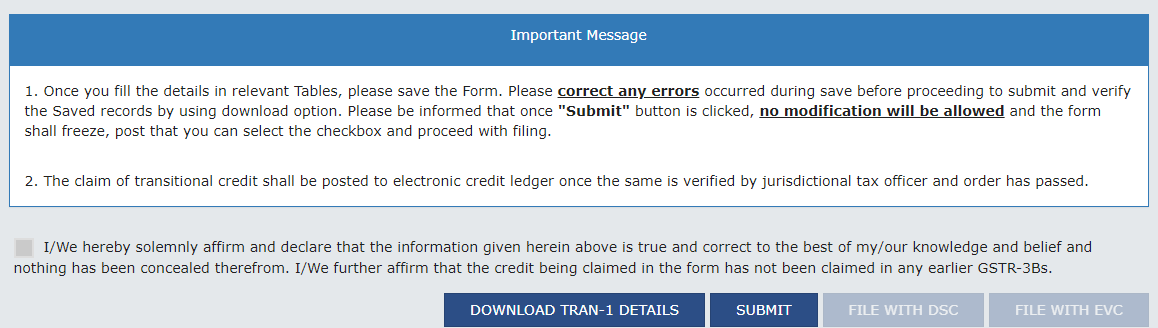

3.4 No edit allowed post submitting the form

- GSTN further clarified that Form GST TRAN-1/ TRAN-2 can be edited only before clicking the “Submit” button on the portal. Once the “Submit” button is clicked, the form gets frozen, and no further editing of details is allowed.

- Post submitting the form, the same can be filed using a Digital signature certificate (DSC) or an EVC.

- Therefore, The applicant shall ensure the correctness of all the details in FORM TRAN-1/ TRAN-2 before clicking the “Submit” button.

3.5 Forms Filed correct earlier

- GSTN has also clarified that those registered persons, who had successfully filed TRAN-1/TRAN-2 earlier are not required to file/ revise TRAN-1/TRAN-2 during this period from 01.10.2022 to 30.11.2022.

- In such cases where the credit availed by the registered person on the basis of FORM GST TRAN-1/TRAN-2 filed earlier, has either wholly or partly been rejected by the proper officer, the appropriate remedy in such cases is to prefer an appeal against the said order or to pursue alternative remedies available as per law.

- Where the adjudication/ appeal proceeding in such cases is pending, the appropriate course would be to pursue the said adjudication/ appeal.

- Therefore, such taxpayers are not suggested to file fresh declarations in FORM GST TRAN-1/TRAN-2.

4. Procedure of filing GST TRAN-1 and TRAN-2

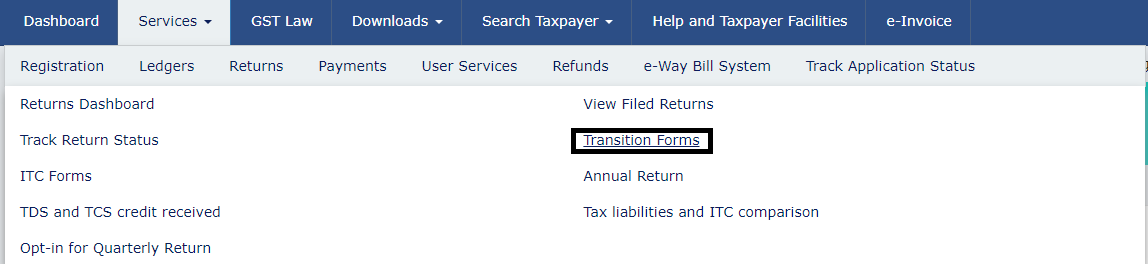

Option of filing TRAN-1 and TRAN-2 is not live on the GST portal w.e.f 01.10.2022 and an aggrieved taxpayer can file these forms by the following procedure:

- Option of filing TRAN-1 and TRAN-2 is appearing at the following path post-login:

Services>Returns>Transition Forms

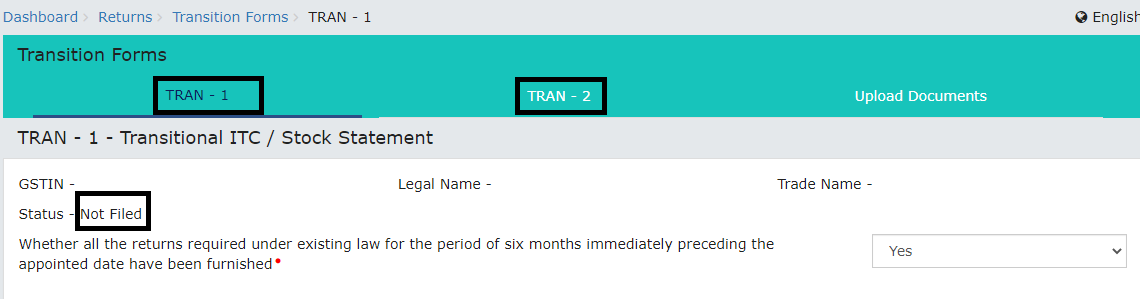

- On the landing page, taxpayers will have the have 3 tabs on the top namely TRAN-1, TRAN-2, and Upload Documents.

- Please note that the TRAN forms are enabled and the default filing status of TRAN forms for all taxpayers is now visible as “Not Filed”. The status “Not Filed” only implies that TRAN forms are not filed in the new window.

4.1 GST TRAN-1

- While filing TRAN-1, the very first option a taxpayer has to answer is “Whether all the returns required under existing law for the period of six months immediately preceding the appointed date have been furnished”

- The taxpayer has to answer it as “Yes/No”.

- GSTN has advised taxpayers to be very careful while selecting options. If ‘Yes’ is selected then all tables of TRAN-1 shall open.

- However, if the taxpayers select ‘No’, then the system would not allow the taxpayers to fill in details in the following tables:

- Table 5: Amount of tax credit carried forward in returns filed under existing laws.

- Table 8: Details of transfer of CENVAT credit for registered person having centralized registration under existing law (section 140(8))

- The taxpayers should ensure that there are no saved records in Table 5 & Table 8 of TRAN-1 forms before selecting the “No” option. Selecting an option of Yes / No contradicting the data filed / not filed in Tables 5 and 8 of TRAN-1 respectively may result in denial of credit by the officer examining the details of the form filled.

- TRAN-1 can be filed directly or through a JSON file or CSV File. Once the complete form is filed, the taxpayer can download the complete TRAN-1 details added by them by clicking on the button „DOWNLOAD TRAN-1 DETAILS’.

- Taxpayers are advised to download the filled TRAN form in an Excel file and verify the details before finally submitting Form TRAN-1 as this is the last option available.

- In the case of revised TRAN-1, taxpayers are required to file the complete form with all the required details and not the differential values (i.e. the difference between originally claimed credit and credit being claimed now).

- It is pertinent to note that if the submitted forms are not filed with DSC or EVC then the submitted forms would be considered as Not Filed as it would be unsigned forms.

- Functionality to \DOWNLOAD EARLIER FILED TRAN-1 forms will be made available shortly.

4.2 GST TRAN-2

- The taxpayer can file the entire claim in one consolidated FORM GST TRAN-2, instead of filing the claim tax period-wise.

- TRAN-2 form shall be made available only if the taxpayer has filed TRAN-1 and has made a declaration in table 7 of TRAN-1.

- In case of revising Form TRAN-2, The taxpayers are required to fill in the complete details afresh.

- Data can be entered in the form either directly on the portal or in case of substantial data, data can be entered in “Excel Template” and uploaded on the portal through JSON File.

- Filed TRAN-2 can be downloaded for review by clicking on “Download TRAN-2 Details” and taxpayers are advised to download the Excel file to verify the details before finally submitting the same.

- The taxpayers, who have filed TRAN-2 earlier, can download the earlier filed TRAN-2 form by clicking on DOWNLOAD EARLIER FILED TRAN-2 button.

4.3 Upload documents

- After filing TRAN-1 and TRAN-2, supporting documents can be uploaded under the “Upload Documents” tab.

So, If you have not yet migrated your pre-GST regime ITC then this is the last option available.