In India’s varied business scene, entrepreneurs have lots of choices for setting up their companies. There’s sole proprietorship, partnerships, and more—each has its pros. But, the Private Limited Company really stands out as a favourite for many people. Why?

A Private Limited Company in India is a type of business where the money you put in is what you risk. Another characteristic is that you can’t trade shares of a private limited company to the public. This setup works well for all sizes of businesses—from startups to bigger corporations—looking to balance control with growth.

If you’re an entrepreneur with big dreams, growing your business, or just want to keep your personal wealth safe while running a company, registering as a Private Limited Company might be just what you need. This guide will look at some big benefits of this type of company and explain the process of private company registration in India so that you can decide what’s best for your future.

Why Should You Register As a Private Limited Company in India

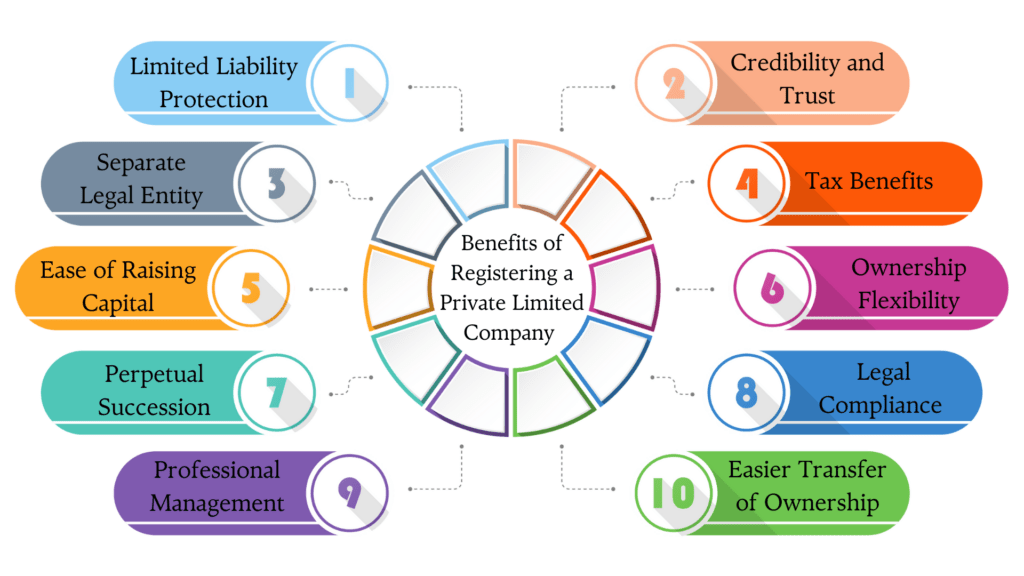

Picking the right business type can change your journey as an entrepreneur. Let’s dig into why registering as a Private Limited Company can be a game-changer:

It has Limited Liability

One huge benefit of a Private Limited Company is how well it protects your personal wealth. As a shareholder, you’re only responsible for the money you’ve invested in the company. So, if things get tough financially or there are legal troubles, your home, car, or savings are safe.

For instance, if your company takes out a loan and can’t pay it back, lenders can only go after the company’s assets—not your personal ones. This keeps personal and business finances separate and gives entrepreneurs a safety net to take smart risks and be creative.

The Existence of the Company is Uninterrupted

Unlike sole proprietorships or partnerships, a Private Limited Company sticks around even if owners change. This idea—sometimes called ‘perpetual succession’—means the company lives on if the original owners step down, retire, or pass away.

This is great because it makes:

- Selling shares easy

- Planning for family businesses smooth

- Things stable for employees, clients, and partners

So, if you want to retire someday, you can sell your shares or hand them down to your family without mucking up the company’s daily work. Having this kind of structure is great for long-term planning!

These are Preferred by Banks and Financial Institutions in India

When you’re after funding, Private Limited Companies usually have an advantage. Banks and financial institutions see these companies as more trustworthy and solid than other types. This helps with:

- Getting loan approvals easier

- Better interest rates

- Higher credit limits

Plus, having this setup opens up more funding options! Places like venture capital firms and angel investors often prefer giving money to Private Limited Companies since they have clear ownership structures and good growth chances.

A Pvt. Ltd. Company Pays a Low Income Tax in India

Tax rates can be pretty friendly for Private Limited Companies in India! For instance, as of 2021, companies that are making up to ₹400 crore get a corporate tax rate of only 25%. This could mean lower taxes than what individuals might pay!

On top of that, they can grab deductions and exemptions that other businesses can’t always access. These cover costs like rent and salaries which helps cut down on taxes even more.

It offers a High Maximum and Low Minimum Limit of Shareholders

Another unique benefit of Private Limited Companies is flexibility with shareholders. You only need two shareholders to start! This makes things simple for small businesses or family-run ventures. If your company grows big time? You can add up to 200 shareholders.

This allows for:

- Gradual ownership expansion

- Bringing in helpful partners or investors

- Offering employee stock plans (ESOPs) to keep talent happy

Think about it—a startup could kick off with two founders and later bring in employees or investors to help it grow!

These Can be a Separate Legal Entity

A Private Limited Company stands alone legally from its owners and directors. This means:

- The company can own its property and sign contracts by itself.

- Its assets belong to the company—not its shareholders.

- Who runs or owns it doesn’t change its existence.

Having this kind of legal status gives the company credibility when it does business and helps when signing contracts.

Requirements for Registration of Private Limited Company in India

While there are many benefits, going ahead with a private company registration in india takes some work too. Here’s what you should know:

The Number of Directors Needed

You need at least two directors on board—one must be an Indian resident who handles management tasks and decisions—plus they carry legal responsibilities too. There isn’t any upper limit on how many directors you can have!

The Number of Members Needed

To start a Private Limited Company you need two members (which are shareholders). They can be people or other companies too. One person can be both director and member if needed. Members have voting rights based on their share stakes too.

Get a DSC (Digital Signature Certificate)

At least one director needs a Digital Signature Certificate (DSC) which helps sign documents online securely so they can get things like brand name registration in India in a jiffy. You get these from authorized services. Normally they last 1-3 years before needing renewal.

What Certification is Needed?

After you have successfully registered, you get a Certificate of Incorporation that proves your company exists legally. This is important as it shows your unique Corporate Identity Number (CIN) too. You’ll need this certificate to open bank accounts or apply for loans.

Easily Register Your Private Limited Company with VJM Global

Registering as a Private Limited Company has tons of perks—from shielding assets and easier funding to tax breaks and stability. Sure there are some extra compliance steps compared to other setups but often those advantages make them worth it!

If you’re all set to level up and get started with the private company registration in India then we have a way to make the process even easier. You can simply seek help from experts at VJM Global. They know the best way to guide entrepreneurs through brand name registration India while handling all those pesky papers plus ensuring everything meets legal standards. Reach out to VJM Global today so you can build a strong foundation for your growth-ready business in India!