India is considered an investor-friendly country with enormous potential for budding entrepreneurs. Registration of a company in India requires funding, vision, and passion to ensure all legal formalities are covered and companies can be set up effectively. While business setup in India offers many opportunities, foreigners must understand Indian consumers better.

This article is a foreign entrepreneur’s guide for the registration of a company in India. Businesses can explore market demands, consumer needs, and how to scale their business. Entrepreneurs can tap into this country’s untapped potential with the proper business setup in India.

Registration of a Company in India

Company registration requires following certain legal formalities and adapting the business per Indian laws. The proper company structure, name, and collection of all essential documents is the first step to establishing your business. A business setup in India requires a Digital Signature Certificate, MOAs, AOAs, Certificate of Incorporation, and the reserve of a company name.

Companies also need to follow all registration of a company formalities and legal requirements. They must ensure all documents are to streamline company registration. After DIN registration and name approval, companies can enter registration formalities to select the business structure that aligns with their business goals.

How much does it cost to register a company in India?

Various factors determine the cost of establishing a company in India. The business structure, number of employees, type of shareholder distribution, and authorized capital. The registration fee also changes with changes in this parameter. Most foreign companies hire an outsourcing company to handle the registration of a company process and accounting or hire an entire department for in-house operations.

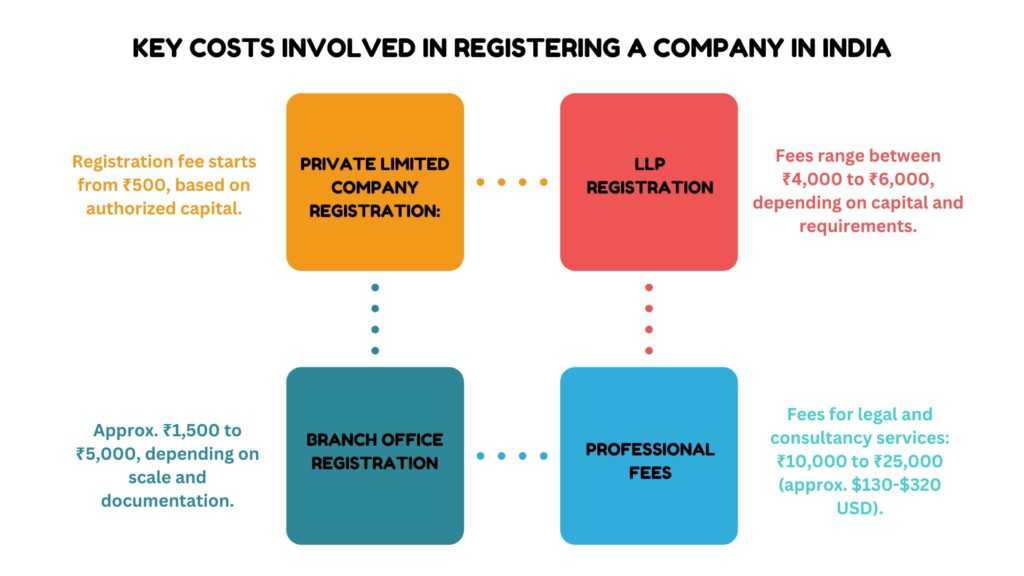

The government fees for registration of a company in India depend on the type of company, authorized capital, and state where the company is being incorporated. Below are the approximate fees:

A. Private Limited Company Registration

Registration Fees: The registration fees for a private limited company depend on the company’s authorized capital. The more capital you propose, the higher the fee. Generally, fees are calculated as follows:

- Up to ₹1,00,000 capital: ₹500 to ₹1,000 (for filing the MoA and AoA)

- For capital above ₹1,00,000: The fee increases incrementally based on the capital.

B. Limited Liability Partnership (LLP) Registration

The government fees for registering an LLP typically range between ₹4,000 to ₹6,000, depending on the capital and registration requirements.

C. Branch Office or Liaison Office Registration

Branch Office: The fee for registering a branch office is approximately ₹1,500 to ₹5,000, depending on the scale of the operation and the documentation required by the Reserve Bank of India (RBI).

Professional Fees for Legal and Consultancy Services

If you engage a company secretary, chartered accountant, or law firm to help you with the registration of a company process and other compliances, you will need to pay their professional fees. These can vary significantly based on the complexity of the company formation and the service provider.

Legal/Consultant Fees: Generally, the professional fees range between ₹10,000 and ₹25,000 (approx. $130 to $320 USD) for the basic incorporation process of a private limited company. Additional services, like legal advice, drafting the Memorandum of Association (MoA), Articles of Association (AoA), or handling specific compliance requirements, can cost more.

Cost of Documentation and Miscellaneous Charges

There are other documentation costs involved in registering a company in India, which include:

A. Digital Signature Certificate (DSC): Cost: ₹1,000 to ₹2,500 per DSC (typically required for directors).

B. Director Identification Number (DIN): Cost: ₹500 for each DIN application.

C. Notarization and Attestation: Cost: If any documents ( passport copies) need to be notarized or attested by the Indian embassy, it could cost anywhere from ₹1,000 to ₹5,000 or more, depending on the embassy and requirements.

PAN and TAN Registration

- Permanent Account Number (PAN): The cost of obtaining a PAN is typically included in the company registration package (if handled by professionals). The government fee for a PAN card is approximately ₹110.

- Tax Deduction and Collection Account Number (TAN): Registration for TAN usually costs ₹65.

Do I need a CA to register a company in India?

There is no legal requirement to hire a CA for registration of a company in India. However, most foreign entrepreneurs hire Chartered Accountants to streamline their registration of a company process. Businesses want their financial and accounting records to be accurate and precise. By outsourcing their financial expertise services, they can achieve their goal and ensure compliance with all relevant laws and regulations.

Business setup in India comes with a long list of financial challenges. As an entrepreneur, it is essential to adapt to new situations. Companies can simplify their bookkeeping needs and registration of a company process with CA and accounting experts. They offer legal expertise and financial guidance and help resolve initial disputes based on financials or bookkeeping.

How can a foreigner register a company in India?

The first step is deciding on the type of company you want to register in India. The most common types of foreign investors are:

- Private Limited Company: India’s most popular and preferred structure for small to medium businesses. It has limited liability and can have foreign direct investment (FDI) subject to sector-specific guidelines.

- Limited Liability Partnership (LLP): Suitable for professional services and small businesses, offering the benefit of limited liability with flexibility in governance.

- Branch Office: A foreign company can set up a branch office in India to conduct business activities in sectors allowed by Indian law.

- Wholly Owned Subsidiary: A subsidiary with 100% foreign ownership registered as a private limited company in India.

Registration of a company in India from the USA

Yes, you can register a company in India from the USA. However, there are specific guidelines every foreign investor should follow during the registration of a company in India. These guidelines help investors and entrepreneurs follow all legal formalities and avoid compliance risks. Here are some of the requirements you must keep in mind as a foreign entrepreneur:

- Resident Director Requirement: At least one director must be a resident of India (someone who has been in India for at least 182 days in the previous year).

- No Minimum Capital Requirement: Private limited companies have no minimum capital requirement, although some capital may be required to meet operational needs.

- FEMA Compliance: Foreign nationals must comply with FEMA investment regulations in India.

- Communication and Legal Support: You may need a legal advisor or company secretary in India to help you navigate through legal, compliance, and documentation procedures.

- Online Process: Much of the company registration process can be done online, and you do not need to be physically present in India.

- FDI Policy: Foreigners must comply with the FDI policy, which has certain restrictions in specific sectors (defense, media, real estate, etc.).

Conclusion

India is an attractive destination to invest in or scale your business. With a vast market size, a variety of consumers, and hundreds of new opportunities for every industry every day, the country offers unmatchable potential. Foreign investors and entrepreneurs seeking business setup in India to achieve success need a better understanding of Indian markets.

Business expansion in another country requires new challenges to adapt to its legal and regulatory environment. Foreign investors enjoy benefits such as a trained workforce, fluency in English, and lower labor costs, making India a one-stop destination that provides better ROI. By outsourcing a few services and adapting to compliance and legal requirements, foreign brands can enormously impact Indian markets.

With VJM Global, you can consult expert accountants, CAs, and bookkeeping experts to simplify your registration of a company process. You can learn more about Indian legal requirements, compliance needs, and how to tap into limitless resources in Indian markets. Registration of a company in India is simplified and streamlined with proper guidance by VJM Global.