A corporation may encounter serious financial problems as it expands, which call for professional guidance. However, hiring a full-time Chief Financial Officer (CFO) can be costly for companies of all sizes. This is where CFO Outsourced Services prove to be incredibly helpful, providing expert financial management solutions without the expense of a full-time hire.

Using these CFO outsourced services allows companies to obtain top-notch financial guidance without having to hire a full-time employee. This paper will explain the nature of these services, their usefulness, their cost, and the reasons for the growing number of CPA firms outsourcing their financial operations to India.

Overview of CFO Outsourced Services?

The corporation uses CFO Outsourced Services to hire a part-time or virtual CFO to oversee its finances, strategy, and planning. These professionals pay by contract or fee and provide services that meet the company’s demands.

CPA firms outsourcing to India can quickly get strategic advice and financial information. Many things outsourced CFOs in India can do for you, such as:

- Creating long-term plans to help the group reach its goals.

- Make sure that your plans for money are correct.

- Checking tax laws and other financial regulations must be adhered to.

- Ensuring that the money that is received and disbursed is utilized effectively.

- Composing emails to business associates and compiling financial data as required.

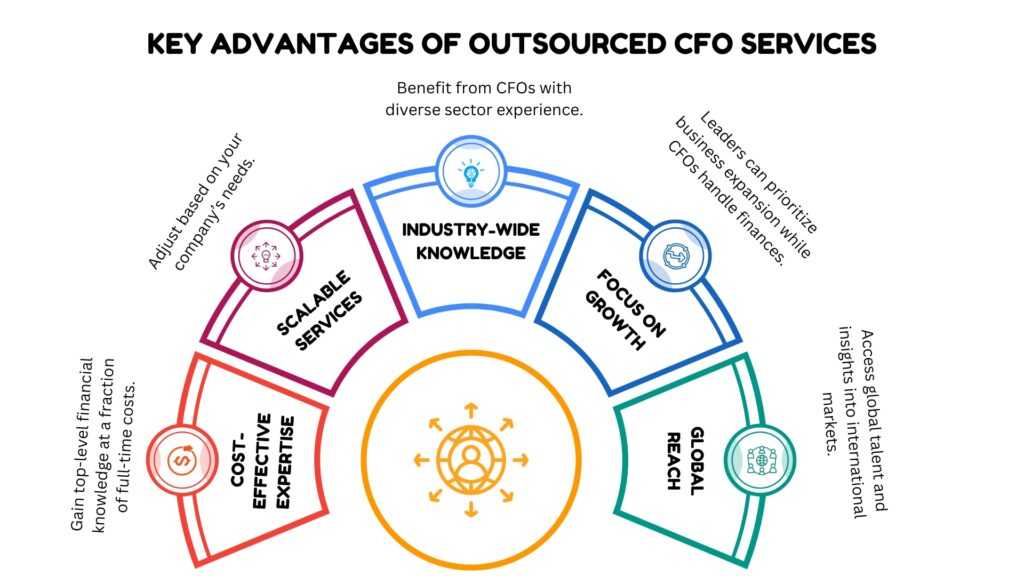

Key Advantages of CFO Outsourced Services

- Cost-Effectiveness: Hiring a full-time CFO might run more than $150,000 annually. Outsourcing, however, allows companies to get the same level of knowledge at far less cost.

- Scalable Approach: Services can be increased depending on the company’s demand.

- Access to Expertise: Outsourced chief financial officers have extensive knowledge and experience, as they are familiar with a wide range of industries.

- Focus on Growth: The organization’s owners should prioritize development if the chief financial officer manages complex financial issues.

- Worldwide Presence: Globally present companies could be able to attract workers from all around the world and learn about other markets and corporate strategies.

Why Do CPA Firms Send Their Financial Work to India?

Many CPA companies worldwide have decided that sending financial tasks to India is a smart business move. CPA firms outsourcing to India is popular because India has a lot of skilled workers and great prices. The main reasons why companies should outsource to India:

- Cost Savings: Sending work to Indian companies can cut costs by 30 to 50 percent.

- Skilled Workforce: Indian professionals know a lot about tax laws, budgeting, and analyzing finances.

- Time Difference: It means that companies can get access to CFO outsourced services 24 hours a day, seven days a week.

- Tech Skills: Indian companies are adept at leveraging the newest tools and financial software.

- More Scalability: CPA companies who outsource can provide more services without staffing more people.

Sending tasks linked to the CFO to India allows CPA companies to concentrate on dealing with clients and creating future strategies. Hence, they maintain their competitiveness in a demanding financial industry.

What Cost is Incurred by CPA Firms Outsourcing to India?

A company must know how much hiring a chief financial officer costs. Hiring a CFO outsourced services can cost differently depending on the type of company and the degree of CFO experience. Companies typically budget between $5,000 and $15,000 a month for part-time CFO services.

How Much Does an Outsourced CFO Make?

Their experience will influence their pay, job location, outsourced CFO tasks, and employment status. If they simply work part-time, an American-hired CFO averages between $80,000 and $120,000 annually.

Global Comparisons:

- United States: $100-$300 per hour or $10,000-$15,000 per month.

- India: $100-$200 per hour or $5,000-$8,000 monthly.

- Europe: $75-$200 per hour or $8,000-$12,000 monthly.

Companies can drastically cut expenses by contracting CFO services to India while maintaining high quality. This explains the growing tendency of CPA firms to outsource to India. These companies help their customers by using the knowledge of Indian financial experts.

Factors to Consider the Costs of CFO Outsourced Services

- Hourly vs. Monthly Retainer: Some chief financial officers charge $150 to $400 per hour, while others pay a fixed monthly fee.

- Required Services: Compared to a comprehensive financial plan, fundamental financial reporting reduces expenses and facilitates fundraising.

- Experience and Knowledge: Executives with extensive knowledge of a given sector could be highly sought after as top financial officers.

- Geographic Location: Because of their location, CFOs from the United States or Europe could be paid more than those from India.

If CPA firms can outsource to India without breaking the bank, hiring a CFO from an external company rather than hiring someone full-time might be a more budget-friendly option.

How to Pick the Best Outsourced CFO

CPA firms outsourcing to India need to hire the right CFO. Take a look at these things:

- Look for CFOs with a solid track record who have worked in your industry prior.

- Along with more general ones, ensure that the CFO can manage chores, including financial modeling, generating money, and following policies.

- Examining a person’s reviews or getting client references helps one to ascertain their dependability.

- Systems, including SAP, NetSuite, and QuickBooks, must be second nature to the CFO.

The Future of CFO Outsourced Services

The need for CFO outsourced services will most likely rise as companies continue to adapt to changing economic circumstances. New technologies and cost-cutting initiatives will likely drive further expansion of the $245 billion worldwide outsourcing industry.

CPA organizations still outsource financial services to India. India’s reputation for financial outsourcing is highly sought after due to its technical application expertise, minimal cost, and competent workforce.

Conclusion

Growing businesses would be smart to manage complicated finances by outsourcing their CFO instead of paying for a full-time staff member. Getting CFO outsourced services helps businesses acquire strategic insights, ensure they are following policies, and accelerate their growth.

Many CPA firms have seen that outsourcing to India has drastically changed the scene. CPA firms outsourcing to India let these companies focus on their strength and important work and save money.

If you wish to outsource CFO services, review your company’s needs and budget and determine which provider would enable you to meet your objectives. The correct outsourcing CFO might enable your company to reach unheard-of success.