The laws governing foreign exchange in India, as provided by FEMA, are dynamic and sometimes confusing for corporate bodies and investors. Compliance with IFRS and sound fiscal management requires an appreciation of these issues. This is where FEMA consulting firms come to light in facilitating the client’s way through the legal quagmire. By doing so, such firms help meet and implement compliance mandates while enhancing efficiency in operations related to foreign exchange trading.

In this blog, we will discuss the profile of FEMA consulting, their work for other agencies, and why foreign investors require FEMA consultants in India.

What Does a FEMA Consultant Do?

FEMA consultants have in-depth knowledge of FEMA and Foreign Exchange Regulations, helping companies and persons involved in dealing with foreign exchange under the FEMA Act. They not only provide compliance services as required by the laws on foreign exchange in India, but they also help make compliance a natural process. Here’s what their role entails:

1. Compliance Management

FEMA consulting firms ensure that all the transactions concerning foreign exchange are within the framework of law governing the Indian economy. This comprises assisting firms to follow the rules of RBI (Reserve Bank of India), documenting and submitting relevant papers, and guaranteeing that reporting is done on time. They closely supervise transaction activities so that all processes do not violate regulatory standards.

2. Advisory Services

FEMA consultants offer advisory services on various aspects, such as:

- The beginning of subsidiaries or joint ventures overseas has to be incongruent with Indian laws.

- Engaging in transactions consisting of buying foreign assets, selling domestic ones, and organizing the flows of immigrants and emigrants in the country.

- Transaction optimization involves shaping the flow of business processes to cut risks while ensuring maximum compliance.

For example, their consulting for foreign investors often advises them on India’s complex Foreign Direct Investment (FDI) policies. It, therefore, allows businesses to set their first foot forward in the Indian market without having to face delays or legal complications.

3. Transaction Structuring

Many rules govern cross-border transactions; hence, they should be planned properly to avoid incurring penalties while affecting the transactions. Transaction consultants at FEMA take great care in assessing and categorizing all aspects of a transaction and structuring it, thereby concerning its financial effect and the rules it is subjected to. It does so by yet again being a proactive measure that helps protect businesses from inadvertently breaching such rules or laws and also minimizing their financial decisions.

4. Consistency in Non-Compliance

It emerges that FEMA consultants are essential tools where there is unintentional non-compliance, which leads to the regularisation of violations. They help companies navigate compounding processes, amnesty programs, and other remedial activities as offered by the Reserve Bank of India or any other regulatory body.

Their experience helps businesses avoid significant fines and legal problems and makes them the best FDI consultants in India for those investors who do not wish to encounter legal problems in their financial operations. Thus, due to the comprehension of their services, FEMA consulting firms not only reduce exposure but also build sustainable confidence between business entities and regulatory authorities.

How do FEMA Consulting Firms Collaborate with Foreign Investors?

Understanding the forex laws of India could be a challenge for foreign investors, particularly because the laws can be complex and change frequently. FEMA consulting firms help investors navigate this rat race by working as intermediaries between Indian regulations and Indian regulatory structures. Thus, with their specialized knowledge and practical experience, foreign investors can easily deal with these complexities.

Key Services for Foreign Investors

- Drafting Investment Agreements: FEMA consultants pay a lot of attention to ensure that the agreements developed meet FEMA guidelines in terms of comprehensiveness and legal requirements. These agreements serve as the basis for exercising a safe and permitted manner of investing.

- Insights into Tax Implications: Through understanding the applicable tax regime of foreign investment, consultants aid investors in developing implementable fiscal strategies that enhance operational profitability without violating the law.

- Facilitating Government Approvals: In cases where specific permission is needed, FEMA consultants are responsible for overall approval. This is mainly done through coordination with the concerned authorities.

Their excellent consulting for foreign investors ensures additional insightful strategies besides compliance for stress-free entry and operation in the Indian market.

Real-Time Tracking and Updates

For businesses in India, foreign exchange rules are rather dynamic, and you always have to ensure that you do not violate these regulations. FEMA consulting firms are informed of the changes in regulations and let their investors know what adjustments are needed. This triggers long-term compliance with laws and regulations so that foreign investors do not suffer penalties or potential losses in business.

Other Agencies that FEMA Consulting Firms Work with

FEMA consultants generally cooperate with other governmental and financial departments. Here’s how their collaboration benefits businesses:

1. RBI (Reserve Bank of India)

The RBI is the most important government institution for the regulation of foreign exchange in India. FEMA consultants interact with the RBI to seek approvals and requisites, submit reports and clearances, and determine the specified FEMA compliance.

2. Income Tax Authorities

The FEMA regulation overlaps with the tax regulation. FEMA consultants work in conjunction with tax authorities in order to optimize FEMA compliance and eliminate legal issues involving transactions in accordance with both FEMA and the Income Tax Act.

3. Custom and Import-Export Agencies

In the import and export business, FEMA consultants assist the customs in handling all the documents and business compliance with FEMA concerning the trade.

4. Corporate Affairs Ministry

Other consultants have communicated with the Ministry of Corporate Affairs (MCA) to help companies submit the required documents for foreign investments and other formalities.

Integration of Efforts

FEMA consulting firms working with these agencies guarantee businesses receive complete services in their financial management. It also explains the loose working relationship between organizations because FEMA consultants help unravel what could otherwise be very convoluted processes.

Why Opt for FEMA Consulting Firms?

1. Expertise in Diverse Sectors

FEMA consultants understand industries and regulations governing each sector—from Manufacturing to IT Services- making them the best FDI consultants in India.

2. Proactive Compliance

Their compliance helps avoid penalties, hence making business operations run effectively.

3. Tailored Solutions

FEMA consulting firms ensure their compliance strategies suit a company’s needs so that the company operates efficiently and effectively.

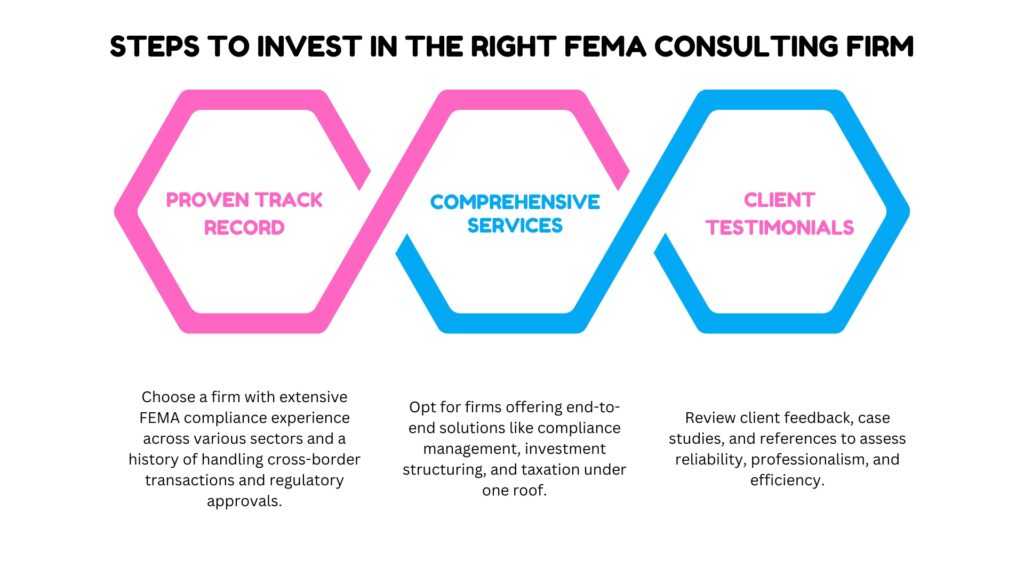

Steps to Invest in the Right FEMA Consulting Firm

Opting for the appropriate FEMA consulting firm is important for the seamless operation of the law concerning foreign exchange in India. The perfect firm not only has special know-how but will also take the time to understand your needs. Here are key factors to consider:

1. Proven Track Record

Experience, as a rule, is a guarantee of reliability. Choose those firms that have substantial experience in FEMA compliance cases across diverse sectors. This proven track record shows the firm’s wide experience in dealing with complicated regulatory matters and offering efficient solutions. Firms that have time and again assisted clients on how to carry out cross-border transactions and deal with cases of non-compliance, as well as where to obtain regulatory approval, are the most satisfactory ones.

2. Comprehensive Services

Some of the prominent FEMA consulting firms offer compliance management, investment structuring, advisory services, and non-compliance regularization services all under one roof. They also need to specialize in commercial and investment drafting, government approval processes, and taxation. Selecting a firm with extensive service means you do not have to deal with several providers, which is time-consuming and complicated.

3. Client Testimonials

Feedback from the clients indicates how reliable the firm is and the level of professionalism it holds. Research firms with recommendations and complaints from past clients. These testimonials may focus on the positive aspects of the firm, such as quick service delivery, emphasis on professional detail, and efficiency in working on client complaints. Don’t pull back from asking for case studies or references to know the strategies and practices that the chosen FEMA consulting firm employs.

Conclusion

India’s foreign exchange policies can be complex to navigate, understand, and manage on your own as a foreign investor. FEMA consulting firms specializing in legalities help reduce compliance problems and guarantee smooth operations of your company’s finances. Their services range from compliance management to working with regulatory agencies, and their knowledge is invaluable for both businesses and shareholders.

Whether you are an international investor planning to invest in India or an Indian business wanting to go international, FEMA consultants at VJM Global are your best bet for success. These consultants provide sector-specific and customized solutions for policy compliance and business development that close the gap between the rules and revenue.