Businesses want to outsource accounting services because it is cost-effective. However, choosing the correct accounting outsourcing services can be vital to avoid the following pitfalls, which can affect the business. Since more and more companies, such as US accounting firms, are outsourcing to India, outsourcing is good for business, but care must be taken when choosing where to outsource.

Outsourcing accounting services has become a strategic move for many businesses in the USA. However, choosing the right provider for accounts outsourcing services is crucial to avoid mistakes that could disrupt operations. With many US accounting firms outsourcing their processes to countries like India, it’s essential to understand the risks and benefits of outsourcing. This guide outlines the most common pitfalls businesses face and provides actionable tips to help you choose the right outsourcing partner.

What Are Accounting Outsourcing Services?

Accounts outsourcing services involve hiring external specialists to handle financial tasks such as bookkeeping, payroll, tax preparation, and financial reporting. This allows businesses to focus on their core functions while ensuring professional management of their financial records.

For years, US accounting firms have been outsourcing their operations to India due to the significant cost savings and access to highly skilled professionals. This trend highlights the growing trust in Indian firms for providing reliable and efficient accounts outsourcing services.

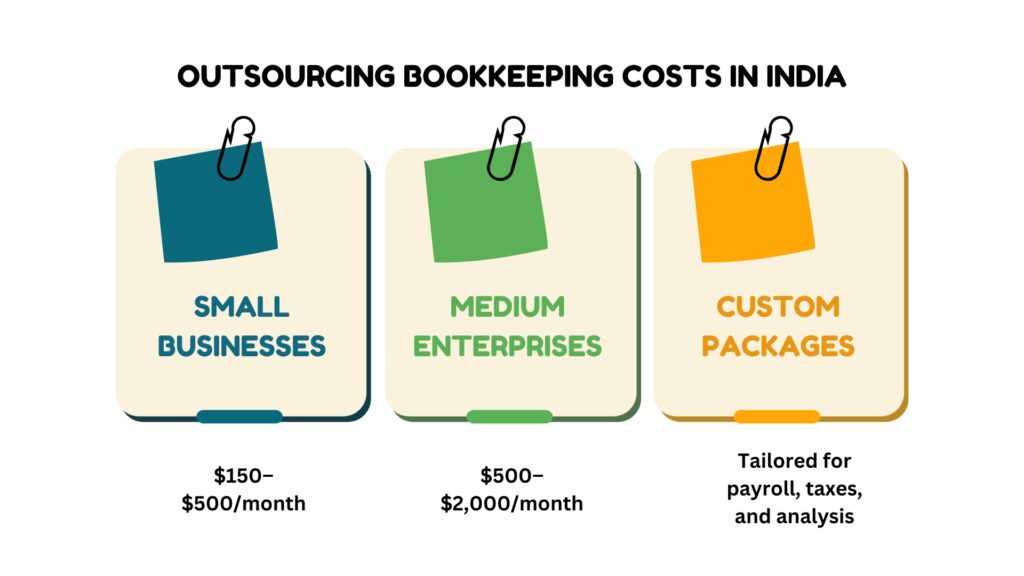

How Much Do Small Businesses Pay for Accounting Services?

The cost of outsourcing depends on your business’s financial needs. Small businesses typically spend between $500 and $2,500 per month. By outsourcing to India, US accounting firms and businesses can achieve substantial savings compared to hiring in-house accountants.

How Much Does It Cost to Outsource an Accountant?

Outsourcing costs vary depending on the complexity of tasks and the accountant’s qualifications:

- Basic Tasks (e.g., bookkeeping): $20–$50 per hour

- Advanced Tasks (e.g., auditing, tax consulting): $50–$150 per hour

Many US accounting firms choose Indian outsourcing firms for their competitive pricing and excellent service quality. While considering outsourcing costs, businesses must also factor in additional expenses like software tools and data security measures to ensure smooth operations in accounts outsourcing services.

Top 5 Mistakes to Avoid When Choosing Accounting Outsourcing Services

1. Ignoring Credentials and Experience

Inexperienced providers may lead to non-compliant financial reporting. US accounting firms and businesses must prioritize providers with a proven track record in accounts outsourcing services, particularly those experienced in working with international clients.

2. Poor Communication and Reporting Standards

Clear communication is key when outsourcing financial tasks. Avoid providers that fail to offer timely updates or detailed reports. Look for firms that use advanced software, ensuring transparency and accountability in accounts outsourcing services.

3. Focusing Solely on Cost

While cost savings are a major benefit of outsourcing to India, focusing only on affordability can compromise service quality. Many US accounting firms evaluate both cost and service quality when selecting providers for accounts outsourcing services to maintain high standards.

4. Overlooking Data Security

Outsourcing involves sharing sensitive financial information. It’s critical to choose providers that adhere to strict data security protocols. Many US accounting firms ensure their chosen providers comply with international privacy regulations to protect client data during accounts outsourcing services.

5. Failing to Assess Scalability

Your accounting needs may grow as your business expands. Selecting a provider incapable of scaling services can hinder growth. Firms offering flexible accounts outsourcing services are better suited to meet evolving business demands.

How Much Should You Be Paying for Outsourced Accounting Services?

The average monthly cost of accounts outsourcing services varies depending on the size of the business:

- Small Businesses: $500–$2,500

- Medium Businesses: $2,500–$5,000

- Large Enterprises: $5,000–$15,000

By outsourcing to India, US accounting firms and businesses can reduce costs by 30–50%, making Indian firms a top choice for affordable, high-quality accounts outsourcing services.

How to Choose the Right Outsourcing Firm

- Define Your Needs: Decide whether you require basic bookkeeping, tax preparation, or comprehensive financial management.

- Research Potential Firms: Focus on firms experienced in serving international clients, particularly US accounting firms.

- Check Reviews and References: Seek testimonials from past clients to assess reliability and expertise.

- Evaluate Technology: Choose providers using modern accounting software for efficient and transparent accounts outsourcing services.

- Discuss Pricing and Contracts: Ensure the pricing aligns with your budget and check for any hidden costs.

Benefits of Accounting Outsourcing Services

- Cost Efficiency: Outsourcing to India helps US accounting firms and businesses reduce expenses without compromising quality.

- Expertise: Access to skilled professionals with expertise in various financial operations.

- Scalability: Flexible solutions that grow with your business.

- Focus on Core Activities: Free up time to concentrate on business strategies and growth.

Conclusion

Selecting the right provider for accounts outsourcing services is vital to your business’s financial health. Avoid common mistakes like overlooking credentials, focusing solely on cost, and neglecting data security. With the cost savings and expertise offered by Indian firms, many US accounting firms and businesses have successfully improved their financial management through outsourcing.