For foreign companies expanding into global markets or managing international operations, outsourcing accounting functions to a reliable accounting firm can be a strategic move.

Today, financial management is an essential yet time-intensive task in the whirlwind of commercial activity of all sizes. Apart from compliance with regulations, efficient financial management forms the buttress upon which responsible decisions that ensure a business’s growth and profitability should be made. Unfortunately, managing these tasks in-house usually steals valuable time from the company while draining critical resources away from core business operations. This is a crucial point at which the decision to partner with an outsourced accounting firm can be quite a game changer.

Outsourcing underpins the business’s focus on primary activities such as product development, customer engagement, and market expansion. It allows every aspect related to the financial operations of that business to be handled with the utmost expertise and precision. These advantages extend beyond convenience-there are savings involved, access to specialized knowledge, and tremendous overall scalability. This is very important to those businesses that desire a foothold in this industry.

This article examines the top five benefits of partnering with an outsource accounting firm and how such a partnership can help a firm do better business. It also discusses the common questions regarding the cost of outsourced accounting, services, and selecting the right-fit partner tailored to your needs.

What is an Outsource Accounting Firm?

An outsource accounting firm is a third-party service provider specializing in accounting, bookkeeping, and financial reporting activities for businesses. These firms serve businesses of every size from all industries and provide various services, including payroll, tax preparation, economic analysis, and compliance management. By aligning with the best in the field, businesses can access excellent accounting practices and high-end tools without paying the high price of maintaining an in-house department, thus providing operational cost benefits and greater efficiency.

Outsourcing accounting to India has gained traction among many businesses worldwide due to its ability to furnish highly competent professionals, massive cost benefits, and the support of extensive technology infrastructure. The accounting firms of India are known for honing in on the development of comprehensive expertise in global financial standards and regulations, leading most companies worldwide to choose them as a solution for reliable and efficient services. Many tax outsourcing firms in India provide customized solutions to help business entities meet specific requirements, including custom reports, tax optimization strategies, and financial planning so that companies can effectively meet their respective financial challenges.

Top 5 Advantages of Partnering with an Outsource Accounting Firm

1. Cost Efficiency

The most significant factor in engaging in the unity of external accounting is cost-benefit. An internal bookkeeping department involves salary, rich benefits, office space, and training. On the contrary, outsourcing offers services for a fraction of the cost.

Those who provide delivery India bookkeeping services are famously affordable; However, they never have any compromises at the expense of quality. Outsourcing accounting to India also means that companies benefit from much lower costs in wages while maintaining superior levels of accuracy and efficiency.

2. Access to Expertise

Outsource accounting firms consist of highly trained specialists in numerous finance fields. Because senior officials in these industries are expected to remain constantly updated on regulations, tax laws, and best practices, the business is ensured a compliance landscape within which it can fit and compete.

Partnering with the top tax outsourcing firms in India enables a business to get professional tax advisory services like audit support and compliance assurance that are often unavailable with a mid-sized or small-sized company.

3. Scalability and Flexibility

Your company’s growth is paralleled by the development of the details in its accounting. An outsource accounting firm can offer a full array of flexible services to accommodate your expanding requirements and tax-season support to assist with complex financial reporting on an on-demand basis without building a team of specialized employees.

Outsource accounting allows businesses to exploit the time zone difference, keeping support up 24 hours a day. With that flexibility, it’s guaranteed that there is no intermission of the entire financial undertaking, especially during peak season.

4. Focus on Core Business Activities

Management of accounting functions internally may take away time and resources from core business purposes. Outsourced bookkeeping allows a competent finance team to handle the tedious work that is burdensome to you so that you can focus on developing your organization.

Most firms providing India bookkeeping services combine advanced technologies and automation tools with their processes to streamline operations further and reduce the burden of manual workloads. This enables business owners to focus more on decision-making and less on operating their businesses at a day-to-day financial level.

5. Enhanced Accuracy and Reduced Risks

Horrible mistakes caused by poor financial management would increase the risk of regulatory penalties and harm the company’s reputation. Robust processes and quality assurance measures support the need to enforce the prevention of errors and mitigation measures by outsourced accounting firms.

Firms outsourcing accounting to India tend to use automated software integrated with an intense peer review system. This proactive protection would protect the firm against financial ruin and ensure that its financial data is not negatively affected.

How Much Does It Cost to Outsource an Accountant?

Outsourcing an accountant may entail costs that range widely, depending on the nature of your financial needs, the range of specific services required, and even the outsourcing firm’s location. The average cost for outsourced accounting would be anything from $500 to $5,000 a month. The quoted cost largely depends on how extensive the assignment is. Specialized or complex tasks such as financial reporting, audits, or intricate tax strategies can entail higher costs. At the same time, more straightforward services, like general bookkeeping, tend to be at the lower end of the scale.

Businesses benefit from low and often more cost-effective rates by outsourcing tax matters to firms in competitive tax-oriented countries like India. For example, essential bookkeeping services could cost as little as $10 to $15 per hour, enabling businesses to save remarkably on hiring professionals locally. Tax preparation, financial analysis, or any other advanced accounting would take $25 to $50 per hour. In many cases, these rates are considerably less than what it costs to hire in-house accounting staff in various Western countries. This will reduce business operational expenses while keeping up with efficiency and quality.

How Much Should a Small Business Pay for Accounting Services?

In the case of small businesses, tight budgets lead to the high priority of their operations–namely, cost efficiency in managing their financial activities. With limited resources, allocating these very resources is imperative, and ensuring that any expenditure made would bring long-term success and survival for the business. The pricing for accounting services should vary based on many factors. Small Business–size of business, volume of transactions, and complexity of the Financial tasks to ensure compliance and accuracy.

For most small businesses, outsourcing accounting to India is a very economical and viable option, offering an excellent blend of low costs and quality services. Basic accounting and bookkeeping services will start at about $300 and can go up to about $1,000 monthly, depending on the firm’s scope of services and the degree of expertise required. Packages usually include bank reconciliation, financial reports, accounts payable management, etc.; with more advanced services such as tax filing, compliance management, and economic analysis costing more, it remains much less than maintaining an in-house accounting staff.

Outsourcing reduces costs associated with hiring full-time staff and eliminates the expenses associated with training, outfitting an office, and specialized software. Small businesses can have their financial processes improved by talented professionals from India and focus on their growth-oriented programs simultaneously.

Average Cost of Outsourced Accounting

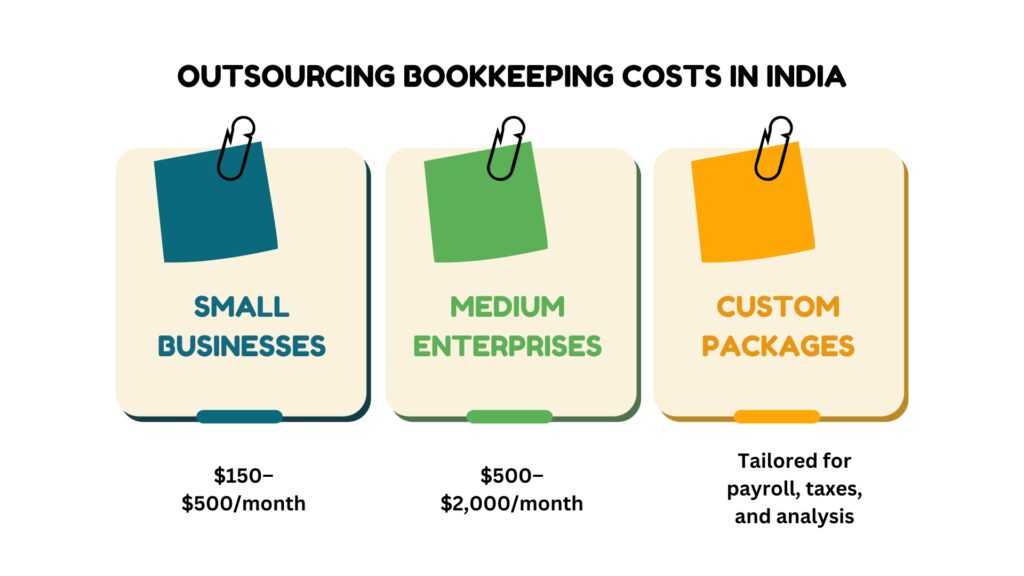

On average, the cost of outsourcing accounting to India services would fall into the following ranges:

- Basic Bookkeeping: $200-500 per month

- Payroll Processing: $100-500 per month

- Tax Preparation and Filing: $500-2,000 per annum

- Comprehensive Financial Management: $1,000-5,000 per month

The agencies offering bookkeeping and outsourced accounting services to India are the best options for getting value for money, that too at the premium services that fall within the lower end of the ranges provided. Economically, yet with top quality, India is preferred for outsourced accounting.

How to Choose an Outsourced Accounting Firm

Partnership with an accounting firm is successful only when it is the right one, and the following are to be drafted in your mind while exploring firms:

- Experience and Expertise: Companies have dipped critical toes into the industry’s experience pool. Analyze their services, such as bookkeeping, tax planning, and financial analyses.

- Technological Tools: This company has to use reliable accounting software and automation tools to streamline processes while maintaining accuracy.

- Reputation and Referrals: Take some initiative,d check for comments from another client, and speak with some references to discuss reliability and performance.

- Cost Transparency: Ensure that the firm is straightforward about its pricing. There should be no hidden fees or baseless, ambiguous billing.

- GeogrOney solutions, one can consider bookkeeping firms or tax outsourcing for cost-effective, high-quality solutions from India.

- Communication and Support: The firm should respond to customer responses quickly or provide proper communication channels to resolve issues.

Conclusion

The outsourcing plan to partner with an accounting firm benefits businesses to some extent, from cost-effective revenues to professional expertise, accurate reporting, and high scalability. All these benefits help enable operational efficiency and long-term corporate success. A business can partner with a reputed tax outsourcing firm in India and add its accounting function to the team of certain tax outsourcing firms in India that have certain advantages, such as excellent service, lower costs, and customized services according to specific business needs.

Partnering with VJM Global offers benefits such as cost—adequate revenues, professional expertise, accurate reporting, and high scalability. These benefits help enable operational efficiency and long-term corporate success. Your business can partner with our reputed outsourced accounting firm and entrust your accounting needs to one of India’s best tax outsourcing firms. Get full-fledged services, lower costs, and customized plans for your business needs!