Starting a business is definitely exciting, but before you get started with the process of registration of a company in India, you need to pick the right business structure. Why? This is because it will determine how your business runs on a day-to-day basis. It also impacts how much tax you pay, the paperwork you need to do, and even how much of your own money is at risk if things go wrong.

Some structures are simple, perfect for small operations, while others are more complex, suited for larger companies. Your choice will impact how you make decisions, raise money, and grow your business in the future. So here are the different types of business structure available in India and key points you should consider while choosing one.

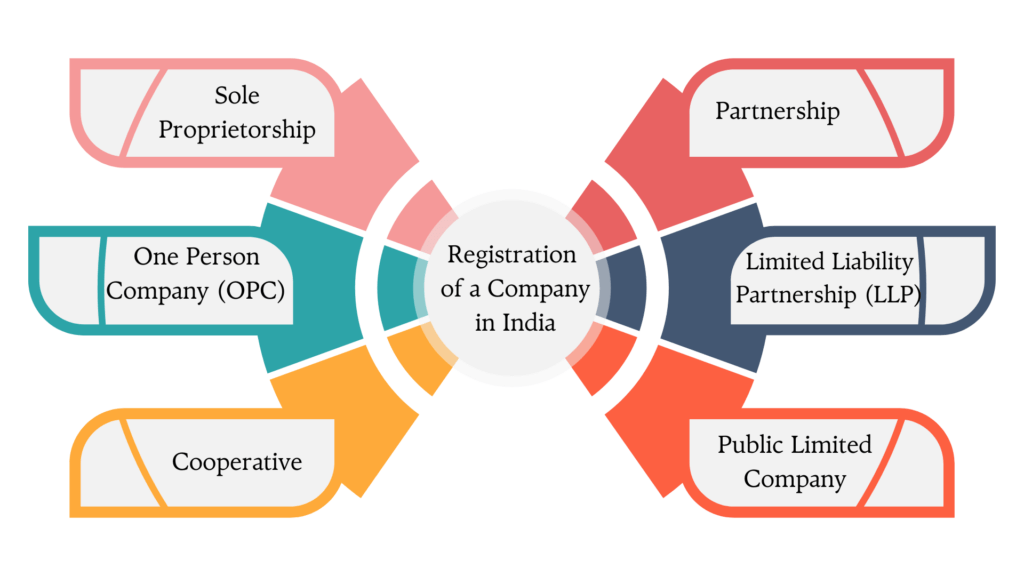

Different Types of Business Structures in India

There are plenty of business structures available in India and each of these has its own set of rules, benefits, and drawbacks. The key is finding the one that fits your business goals the best. So, here’s a brief knowledge about the top ones to help you make an informed decision:

Sole Proprietorship

A sole proprietorship is a business that is managed and controlled by one person. Here the owner has complete control over all the business decisions and also gets to keep all profits. However, they are also personally responsible for all debts and liabilities of the business.

Partnership

A partnership is a business structure in which multiple or more than two people share ownership. As per their agreement, partners split duties, earnings, and losses. This structure allows for shared expertise but can lead to conflicts if partners disagree.

One Person Company (OPC)

An OPC is a hybrid between a sole proprietorship and a private company. It provides the benefits of limited liability to a single person while retaining sole ownership. This structure offers more credibility and easier access to credit than a sole proprietorship.

Limited Liability Partnership (LLP)

An LLP combines the features of both a partnership and a single company. Partners share management and profits, but their personal assets are protected from business liabilities. This structure is popular among professional service firms due to its flexibility and liability protection.

Cooperative

A cooperative is a business where a group of individuals share the ownership, operation and mutual benefit. Members have equal voting rights regardless of their investment, and profits are distributed based on each member’s use of the cooperative’s services.

Public Limited Company

A public limited company can offer its shares to the general public. These businesses can have any number of shareholders and must be run by at least seven people. This structure allows for significant capital raising through public stock offerings but faces strict regulatory requirements.

Why Choosing the Right Business Structure in India Matters

Choosing the right business structure while you are going with the registration of a company in India is important because of the following reasons:

Legal Liability

The type of business structure you choose affects how much personal liability you have for your business’s debts and obligations. For example, in a sole proprietorship, the owner is personally responsible for all losses, whereas in a private limited company, liability is limited to the amount invested.

Taxation

Different business structures in India have different tax obligations. Sole proprietorships are taxed as individuals, while private limited companies are taxed separately. Choosing the right structure can help you manage taxes better and potentially save money.

Growth Potential

A private limited company can attract investors and raise capital more easily than a sole proprietorship. If you plan to grow and expand, the right structure can help facilitate that growth by making it easier to get loans or bring in partners.

Top Things to Consider When Choosing a Business Structure in India

Now, that you know the different types of structure and importance of choosing the right one, let’s get into the top factors you should think about when picking your business structure:

Continuity of Existence

How long a business can last depends on its structure. For example, a Sole Proprietorship usually ends when the owner passes away or retires, while a Private Limited Company can continue indefinitely, even if the original owner leaves. This is an important factor if you want to pass your business to future generations or maintain its longevity beyond your involvement.

Complex Procedures

Different business structures come with varying levels of paperwork. A Partnership is easier to set up with less paperwork, while a Corporation or Public Limited Company involves more legal formalities, ongoing compliance, and documentation. Choosing a structure that matches your capacity to handle legal procedures is essential.

Ease of Setup

If you’re looking for a structure that’s quick and cost-effective to establish, a Sole Proprietorship or Partnership can be set up in just a few days. However, setting up a Private Limited Company or LLP requires more time, money, and regulatory steps.

Control

If you want complete control over your business decisions, a One Person Company (OPC) or Sole Proprietorship might be ideal. On the other hand, a Partnership or Cooperative means you’ll need to share decision-making power with other members or partners.

Investment Needs

If your business requires significant funding, a Public Limited Company can raise money by offering shares to the public. On the other hand, raising capital in a Sole Proprietorship or LLP is more limited, as these structures don’t allow for the easy sale of equity.

Nature of Business

The type of business you’re running can influence the structure you choose. For a small, family-run business, a Sole Proprietorship or Partnership might be sufficient. However, for a rapidly growing startup or a tech company, a Private Limited Company offers more flexibility in raising capital and managing operations.

Government Regulations and Control

Some industries have specific regulatory requirements. For instance, businesses in finance or insurance sectors might be required to operate as a Corporation or Public Limited Company due to stricter government oversight. Make sure to understand the rules in your industry to select a compliant business structure.

Wrapping Up

Not choosing the right business structure can impact the growth of your business in the long run. So understand the different types of structure to make a wise decision when going ahead with your business registration in India.

And if you think it’s a complex process, then simply contact the professional advisors at VJM Global to make the process even easier. They will help you better navigate the Indian business structure scenario and get your business up and running in the most beneficial way!