Businesses in today’s globalized market are always looking for methods to cut expenses and increase efficiency. Outsourcing has evolved into a strategic instrument for US businesses to accomplish these objectives, especially in the accounting sector. India has become a popular location if you are looking to outsource your accounting service due to its large pool of qualified workers and reasonably priced services. This article examines the advantages of outsourcing accounting services to India as well as the reasons why American businesses should do so.

Access to Expertise

If you are thinking of Outsource your accounting service, having an expert service provider is very vital. There is a sizable pool of highly skilled accountants in India who are knowledgeable about international accounting standards, such as International Financial Reporting Standards (IFRS) and Generally Accepted Accounting Principles (GAAP). The Institute of Chartered Accountants of India (ICAI) states that the nation produces more than 100,000 chartered accountants (CAs) each year. This guarantees that American businesses outsourcing to India will have access to experts who can manage intricate accounting duties.

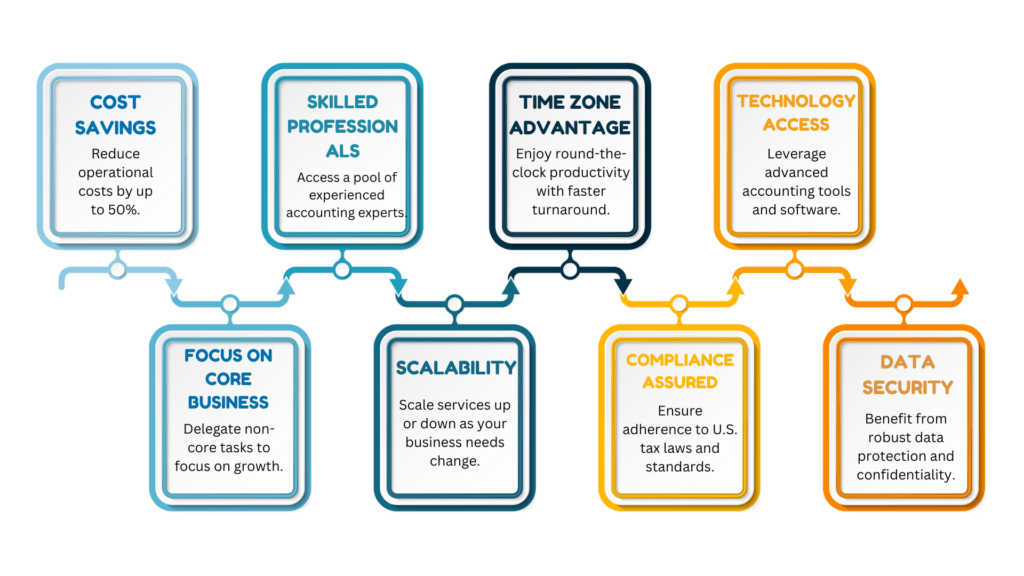

Focus on Core Business Activities

United States businesses are able to concentrate on their main company operations by outsourcing accounting services. Outsource accounting work to professionals in India allows businesses to focus more of their resources on marketing, customer support, and product development. This not only promotes innovation and growth but also improves overall business performance.

Scalability and Flexibility

The flexibility and scalability that outsourced accounting services provide are among their main benefits. Businesses’ accounting requirements change as they expand. Indian service providers give businesses the freedom to scale their services up or down in accordance with their needs. This is especially helpful for newly established and expanding companies that deal with varying demands.

Time Zone Advantage

For enterprises, the time zone difference between the United States and India can be rather advantageous. Indian accountants are able to work on assignments at night in the United States and finish them before the next business day. This “round-the-clock” service capacity increases overall production by enabling quicker turnaround times.

The Cost Advantage

One of the primary motivations driving U.S. firms to outsource accounting services to India is the significant cost advantage. India has labor costs that are far lower than those in the US, which helps businesses save a lot of money. According to a Deloitte analysis, outsourcing to India can help businesses reduce their accounting expenses by 40% to 60%. The savings are extremely beneficial for small and medium-sized firms (SMEs) that must adhere to stringent budgets.

Advanced Technology and Infrastructure

Modern infrastructure and technology are used by Indian accounting businesses to deliver top-notch services. To guarantee accuracy and efficiency, many Indian service providers make use of the newest cloud-based platforms, data analytics tools, and accounting software. American businesses can make use of state-of-the-art technology without having to make large expenditures in infrastructure and software by outsourcing to India.

Risk Management and Compliance

It can be difficult to navigate the complicated regulatory landscape in the United States, particularly for companies without internal regulatory experience. Indian accounting firms are familiar with the rules and specifications for compliance in the United States. They support American businesses in managing the risks connected to financial reporting, tax compliance, and audits. By doing this, companies may stay in compliance with regulations and lower their risk of fines and legal problems.

High-Quality Service

Indian accounting companies are renowned for their dedication to excellence. Several companies adhere to stringent quality control procedures to guarantee accuracy and dependability in their services. 85% of businesses who outsourced to India expressed excellent satisfaction with the caliber of services they received, according to a study conducted by the National Association of Software and Service Companies (NASSCOM). This superior caliber of service is essential.

Case Studies: Successful U.S. Companies Outsourcing to India

Many American businesses, big and small, have successfully contracted with India to handle their accounting needs. For instance, by working with an Indian accounting service provider, a well-known technology company in the United States was able to cut its accounting expenses by half and increase productivity. In a similar vein, an American e-commerce company was able to concentrate on growing its business and improving customer service by outsourcing its whole accounting department to India.

Challenges and How to Overcome Them

Although Outsource accounting services to India has many advantages, American businesses should be aware of possible drawbacks and how to handle them.

1. Communication Barriers

- Even though English is a common language in India, miscommunication can occasionally result from variations in accents and communication methods. In order to get around this, American businesses should set up clear communication channels, use collaboration tools, and plan frequent meetings to guarantee alignment.

2. Data Security Concerns

- Data security is crucial for any business, especially when handling sensitive financial data. US businesses should select service providers with strong data protection policies and adhere to international data security standards like ISO 27001.

3. Cultural Differences

- Disparities in culture can affect how business is done. American businesses need to take the time to learn about the subtle cultural differences when doing business with Indian partners in order to build cooperative relationships.

Conclusion

American businesses can reap a number of advantages from Outsource their accounting needs to India, such as reduced costs, more focus on core operations, scalability, and access to specialized knowledge. U.S. businesses can get a competitive advantage in the market and manage their accounting demands more efficiently by collaborating with seasoned Indian service providers.

The choice to outsource your accounting services to India is a wise one that can greatly impact American businesses trying to streamline their financial operations and cut expenses. With the appropriate strategy and collaboration, Indian outsourced accounting services can play a significant role in your company’s success.