India is desirable for international businesses wishing to expand due to its enormous consumer base and quickly expanding economy. But, starting a business in India means negotiating a distinct and intricate regulatory landscape. A successful entry into this dynamic market requires an understanding of the many forms of business in India as well as the procedures involved in setting up a business in India. This blog post will walk international businesses through the important decisions and procedures involved in establishing a company in India.

Why Choose India to Set Up Your Business?

India’s large, young population, expanding middle-class consumption, and attractive Asian location offer foreign companies significant opportunities. The nation’s diverse economy offers opportunities in technology, manufacturing, services, and retail.

Many Indian government projects, such as Made in India and Digital India, stimulate international investment and improve business conditions. The Indian market has drawbacks despite its benefits. International companies must be prepared for complex state-level laws and regulations.

Types of Business in India

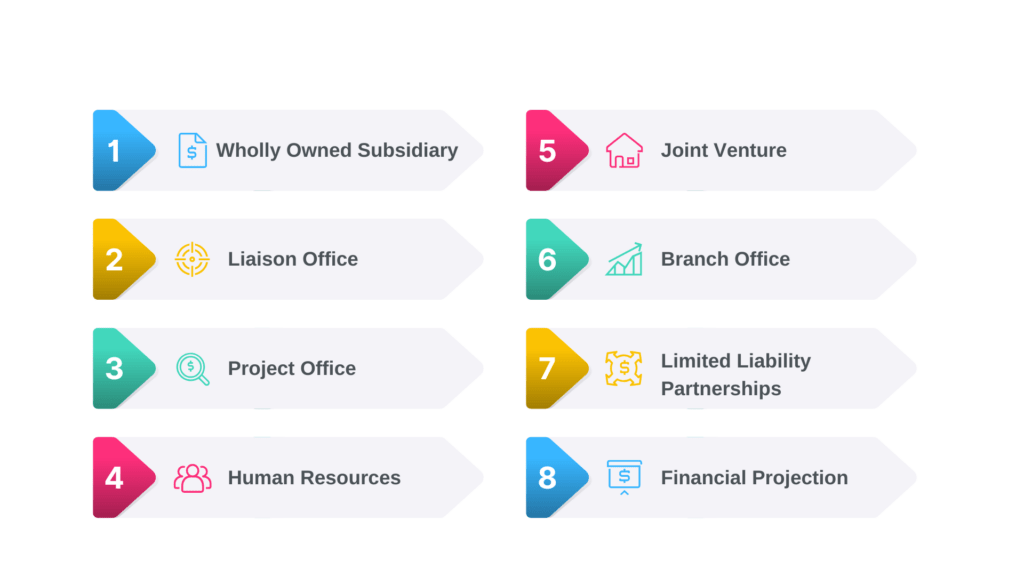

Foreign firms establishing in India might select from several kinds of business entities. Business structure affects operational flexibility, tax liabilities, and legal constraints. Types of Business in India are:

- Wholly Owned Subsidiary: This is a distinct legal company with 100% foreign ownership that was incorporated in India. A wholly-owned subsidiary is the best option for businesses that want total control over their operations in India. It can carry out any business activity that is allowed under Indian law. The Companies Act of 2013 and other rules must be followed to use this structure.

- Joint Venture (JV): A joint venture is an alliance between a foreign business and an Indian organization. Through this arrangement, international businesses can make use of the local partner’s distribution networks and market expertise. In industries where complete foreign ownership is prohibited, joint partnerships are typical. A shareholders’ agreement usually defines the parameters of the joint venture, including profit-sharing and management control.

- Liaison Office: In India, a liaison office represents a foreign business. It can facilitate communication, advertise the parent company’s operations, and look for potential business ventures. It is not, however, permitted to do business or make money in India. The Reserve Bank of India must give its clearance before establishing a liaison office (RBI).

- Branch Office: A branch office is an extension of the overseas parent firm and is responsible for certain tasks, including export/import, technical assistance, and consulting in India. It is not permitted to carry out production, processing, or retail trading. A branch office can only be established with RBI clearance and in accordance with Indian tax regulations.

- Project Office: In India, a project office is a short-term facility to carry out a particular project. It is frequently utilized in industries including infrastructure, engineering, and building. Usually, a foreign company establishes a project office only after winning a contract from an Indian enterprise. The RBI’s clearance is needed to open a project office.

- Limited Liability Partnerships (LLPs): International businesses are permitted to establish LLPs in India. With this arrangement, partners’ liability is restricted while still enjoying the advantages of a partnership. It is appropriate for companies that need managerial flexibility but still want to safeguard the partners’ personal assets. Foreign partners are permitted in an LLP, but at least one of the partners must be an Indian citizen.

Steps to Set Up a Business in India

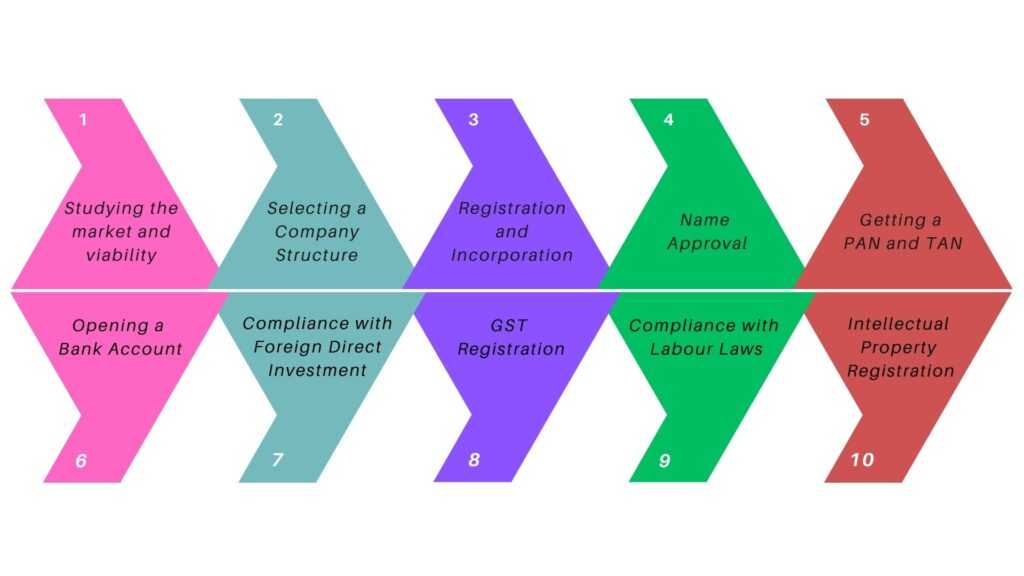

To secure a seamless introduction into the Indian market and comply with Indian rules, foreign enterprises interested in setting up a business in India must undertake these steps:

- Studying the market and viability: It is essential to carry out thorough market research and a feasibility analysis before establishing a business in India. This aids in determining competitors, evaluating the regulatory landscape, and comprehending the demand for goods and services.

- Selecting a Company Structure: The organization should choose the best business structure based on its long-term goals and type of business. There are benefits and drawbacks to each type of corporate structure, and the one you make will impact operational control, tax requirements, and legal compliance.

- Registration and Incorporation: The firm must register with the Ministry of Corporate Affairs (MCA) to incorporate a business. This entails acquiring a Director Identification Number (DIN), a Digital Signature Certificate (DSC), and submitting the necessary paperwork, such as the Articles of Association (AOA) and Memorandum of Association (MOA).

- Name Approval: The suggested name for the business must be original and adhere to the Registrar of Companies (ROC) naming standards. The business can move forward with the incorporation process as soon as the name is authorized.

- Getting a PAN and TAN: The Income Tax Department must issue the business with a Permanent Account Number (PAN) and a Tax Deduction and Collection Account Number (TAN). While TAN is necessary for withholding and collecting taxes on payments, PAN is necessary for all financial activities.

- Opening a Bank Account: To conduct financial activities for the company, an Indian bank account is required. The business must submit its PAN, incorporation documents, and other pertinent paperwork to open the account.

- Compliance with Foreign Direct Investment (FDI): In India, FDI is permitted in most sectors under the automatic route, eliminating the need for prior authorization. However, FDI is only allowed in some industries with government sanctions.

- GST Registration: A business is required to register for Goods and Services Tax (GST) if its annual revenue surpasses the designated level. Businesses that supply products or services in India are required to register for GST. The business must also abide by other GST-related obligations and periodic reporting requirements.

- Compliance with Labour Laws: India has strict labor laws governing worker rights, social security, pay, and working conditions. Businesses are required to abide by these rules and register with the appropriate authorities, such as the Employees’ State Insurance Corporation (ESIC) and the Employees’ Provident Fund Organisation (EPFO).

- Intellectual Property Registration: International businesses should consider registering their patents, trademarks, and copyrights in India to safeguard their intellectual property (IP). By doing this, the Indian market is protected from infringement and unauthorized use.

Conclusion

By setting Up a Business in India, foreign businesses can tap into one of the world’s biggest and most dynamic marketplaces. Foreign enterprises can effectively build their presence in India by comprehending the diverse business types in the country and cautiously navigating the regulatory environment. With the appropriate plan, local partnerships, and legal compliance, foreign businesses can benefit from India’s potential and help the nation’s economy thrive.