With intent to promote domestic manufacturing and to improvise security measures, The Government has imposed restriction on import of Laptop, Tablets, All-in-one Personal Computers and ultra small form factor computers and servers (Falling under HSN 8471).

So far, import of laptops, computers, tablets can be made without any restriction subject to payment of import duty. However, the government has put these products under licenses regime through Notification No. 23/2023 dated 3rd August, 2023 issued by the Directorate General of Foreign trade. Therefore, Importer is now first required to obtain licenses.

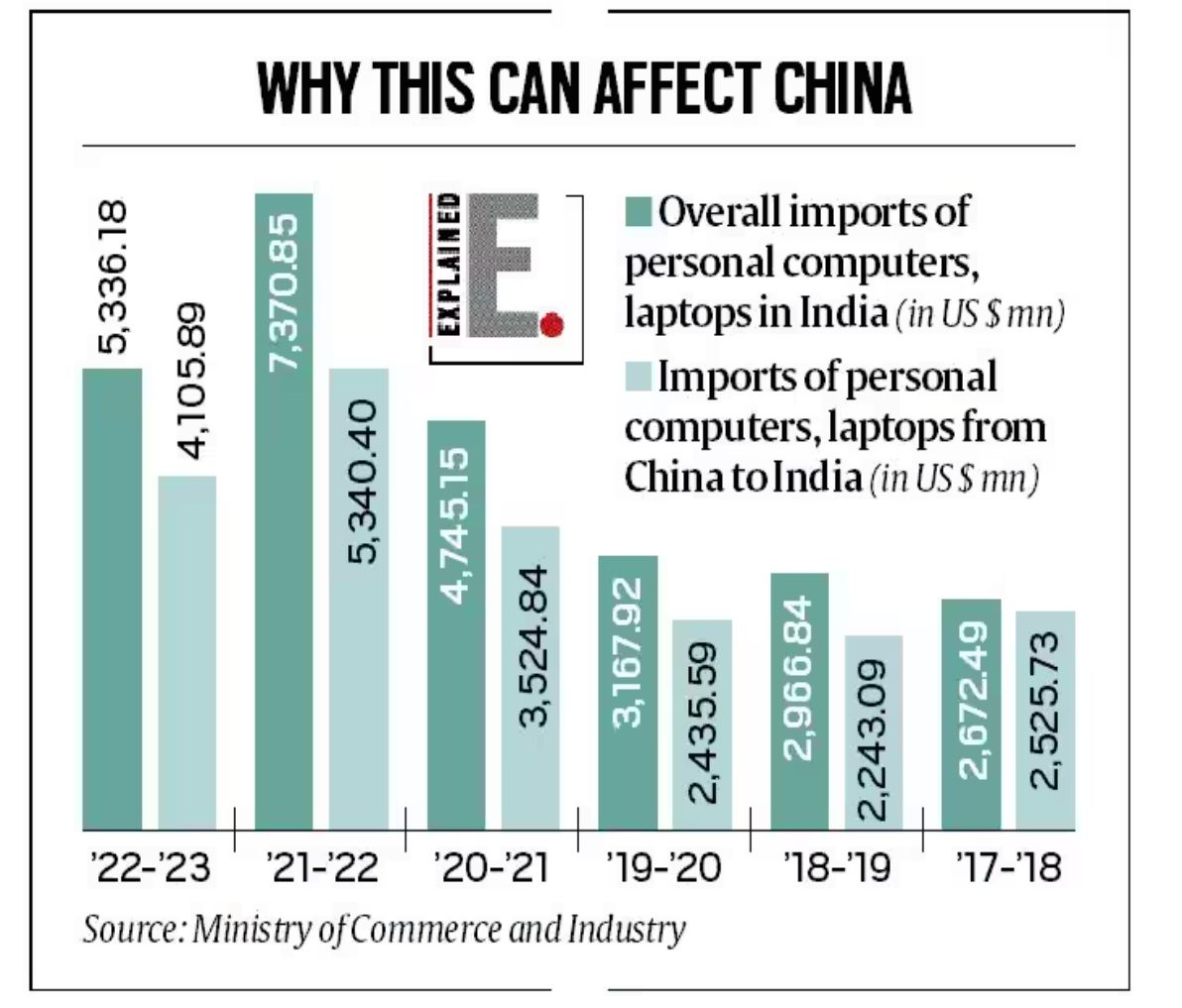

As per statistics issued by Ministry of Commerce and Industry, overall Import of personal computers, Laptops in India has increased from 2672.49 US $ Mn, in 2017-18, to 5,336.8 US $ Mn in 2022-23 wherein import from china has increased from 2525.73 US $ Mn in 2017-18 to 4,105.89 US $ Mn in 2022-23. Import from China is more than 75% of total import of such items in India. Following is the statistics issued:

Considering the increase reliance on other countries, specially china, Government has taken this move to promote in houses manufacturing and to boost its production-linked incentive (PLI) scheme for IT hardware.

Detailed discussion of such notification as follows:

a. Revised conditions for Import

Following new conditions are inserted in Condition No. 4 of Chapter 84:

- Import of Licenses, Tablets, All-in-one personal computer and Ultra small form factor computers and servers falling under Chapter 8471 shall be “Restricted” and their import will be allowed against a valid licenses

b. Exemptions from import license

Following imports can be made without any license:

- Import under baggage, subject to compliance of baggage rules;

- Import of one laptop, tablet, All-in-one personal computer, or ultra small form factor computers. Exemption shall also be available on purchase through e-commerce portal, including post or courier. However, import shall be subject to payment of duty.

- Import upto 20 units of such items per consignment are allowed for the purpose of R& D, Testing, Benchmarking and Evaluation, Repair and re-export, product development process. Import shall be allowed subject to the condition that imported goods shall be used for specified purpose only and shall not be resold. Post intended use, product would either be destroyed or re-exported.

- License is not required for goods sent abroad for repair and re-import.

- laptop, tablet, All-in-one personal computer, or ultra small form factor computers and servers, which are essential part of a capital goods shall be exempted from import licence requirement.

c. Items for which license is required

| HSN | Item Description | Existing Policy | Revised Policy |

| 84713010 | Personal Computer | Free | Restricted against license |

| 84713090 | Other | Free | Restricted against license |

| 84714110 | Micro Computer | Free | Restricted against license |

| 84714120 | Large or main frame computer | Free | Restricted against license |

| 84714190 | Others | Free | Restricted against license |

| 84714900 | Other Automatic Data Processing machiners- Others, presented in the form of system | Free | Restricted against license |

| 84715000 | Processing units other than those of sub-heading 8471.41 or 8471.49, whether or not containing in the same housing one or two of the following types of units: Storage Unit, Input Unit and Output Unit | Free | Restricted against license |

4. Effective date of Notification

Initially, Notification No. 23/2023 was given immediate effect. However, considering the practical issues in immediate effect, DGFT deferred the date of implementation till 1st November 2022 vide Notification No. 26/2023 dated 04.08.2023. Therefore, government has provided a liberalised transition arrangement and above discussed units can be imported without any licence till 31st October, 2022.