Central Board of Indirect Taxes & Customs (“CBIC”) implemented a new functionality of “Aadhaar Authentication” for new GST registrations with effect from 21st August, 2020. Objective of Aadhaar Authentication was interlinking of information avail at different domains through Aadhar Number. Later on, standard operating procedure was issued to take strict actions against the taxpayers who failed to carry out Aadhar Authentication.

With effect from 6th January, 2021, functionality of “Aadhaar Authentication” and “e-KYC”, where Aadhar Number is not available, has been implemented for existing taxpayers. Therefore, all existing taxpayers are required to complete “Aadhaar Authentication” or “e-KYC”.

In this article, we have discussed in detail about “Aadhar Authentication” for existing taxpayers.

1. Who is required to carry out “Aadhaar Authentication”?

All following registered taxpayers can do their Aadhaar Authentication or e-KYC on GST Portal:

- Regular Taxpayers (including Casual Taxable person, SEZ Units/Developers),

- Input Service Distributor (“ISD”) and

- Composition taxpayers.

However, this is not applicable for Government Departments, Public Sector Undertakings, Local Authorities and Statutory Bodies.

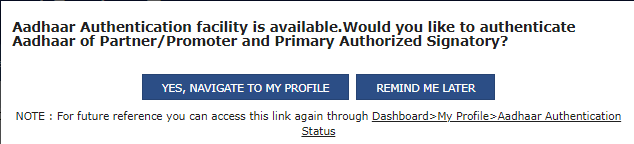

While login at GST portal, following message will pop-up:

Therefore, a person can either complete the authentication process by clicking on “Yes, Navigate to my Profile” or can postpone it by clicking on “Remind me Later”

2. Whether “Aadhaar Authentication” is required for all directors and authorised Signatories?

Authentication should be done for the primary authorised signatory and any one of the persons who is Proprietor/Partner/Director /Managing Partner/ Karta of the entity. Therefore, Aadhar Authentication is not required for all directors.

If same person is appointed as authorised signatory and Director/partner/proprietor then aadhar Authentication should be done only once for such person.

3. Option to complete Authentication process

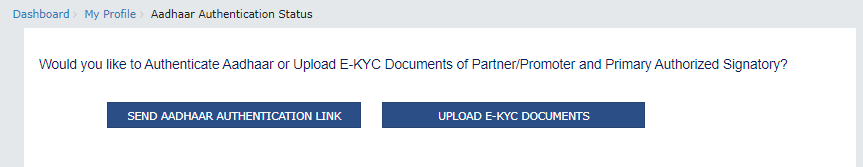

Once a registered person click on “Yes, Navigate to my Profile” then the system will navigate him and following 2 options will display:

- Send Aadhaar Authentication Link

- Upload e-KYC documents

In case of non-availability of Aadhar Number, a person may opt to upload KYC documents to complete the authentication process.

4. Process of Authentication through Aadhar Number

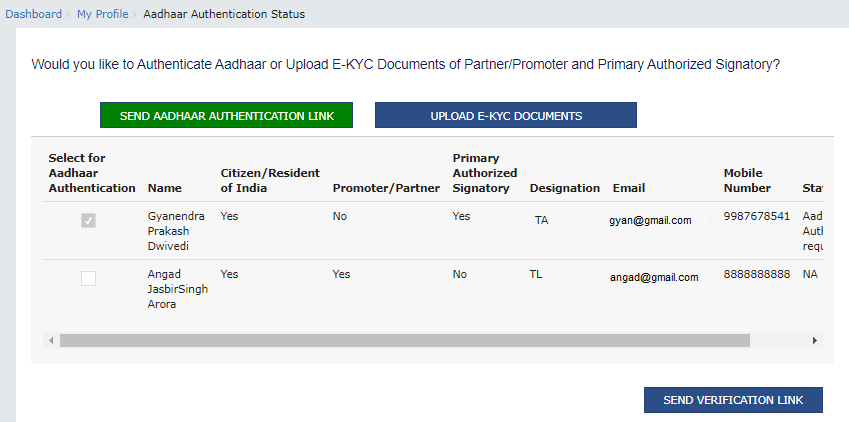

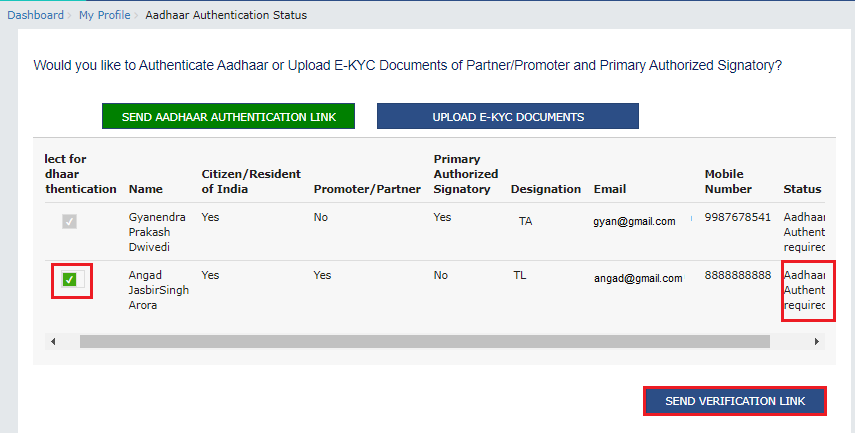

- If a person selects the option of authentication through “Aadhaar Number” then the system will display a list of all persons (i.e., directors/partners/proprietor) and concerned person can be selected to complete the process.

- Person should select the Promoter/ Partner for Aadhaar authentication by selecting the check box corresponding to such person.

Note:

- Selecting the check box changes the status as Aadhaar Authentication required.

- In case, the column of Promoter/ Partner displays more than one name, the taxpayer can select only one name out of them.

- If the Promoter/ Partner is the same as the Primary Authorized Signatory, in that case the check box against the name would be auto selected and the taxpayer is required to directly click the SEND VERIFICATION LINK.

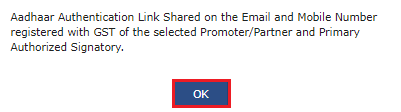

- Upon clicking on “Send Veriffication link”, system will pop up a message that link has been sent to registered email Id and Phone number.

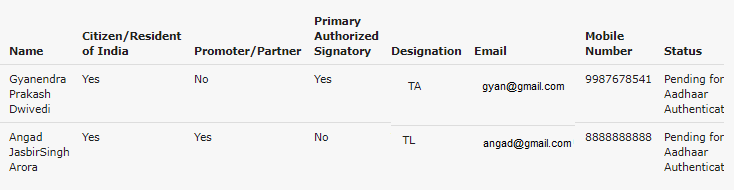

- After sending verification link, system will change the status to “Pending for Aadhar Authentication”

- A common link will be received on both registered email id and phone number and such link remains valid for 15 days.

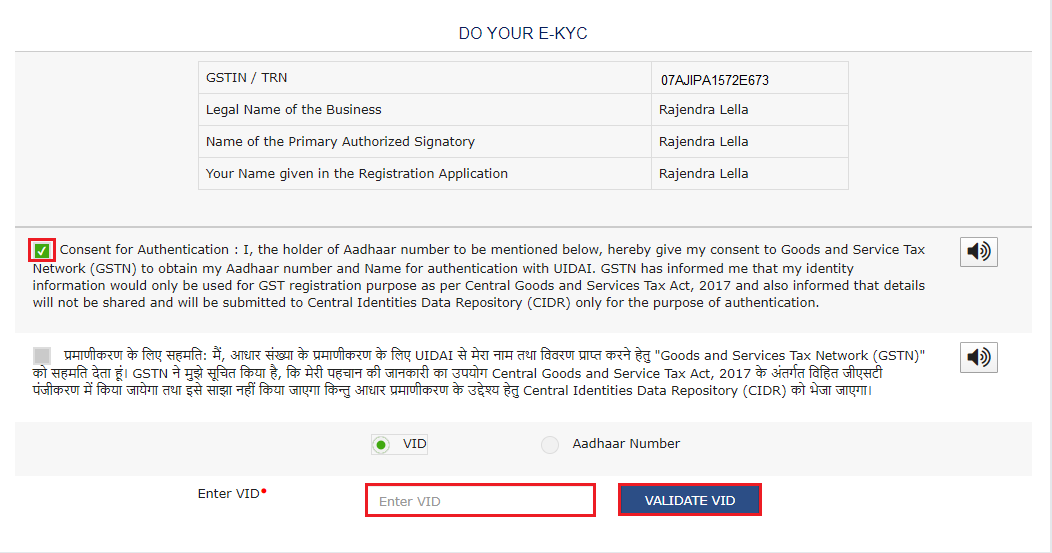

- Registered person shall click on the link received for Aadhar Verification and shall select the “Consent for Authentication”. Then the person is required to enter either an Aadhar Number or VID.

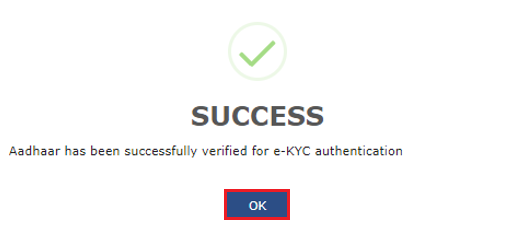

- After clicking on “Validate VID” or “Validate Aadhar ”, the system will send the OTP to the registered email id and mobile number of the Authorized Signatory registered at the UIDAI. After entering such OTP and clicking on the “VALIDATE OTP” button, Aadhar authentication process shall complete and system will show the following message:

4.1 Important points for Aadhaar Authentication for GST registration

- If an Aadhaar authentication link is used once for authentication then same authentication link cannot be accessed again.

- The pop-up message window for pending Aadhaar authentication will not appear again when the taxpayer logs in to the GST Portal. However, until the authentication is completed, the taxpayer will receive three Email reminders for Aadhaar authentication on 5th, 10th and 15th day.

- In case the link expires before Aadhaar authentication is completed, the taxpayer will again receive the pop-up message window on log in to GST Portal.

- If out of 2 required person, Aadhaar Authenication is completed only for one person and another one is pending then system pop up message will be shown whenever taxpayer will login into the GST Portal. Taxpayer is required to complete authentication of another person by the same means.

- If both of the persons tried to authenticate Aadhaar and both of them have failed or both of them have not tried till 15 days, then pop up will come every time whenever a taxpayer will login to the GST Portal. And again taxpayer will have two options either to upload e-KYC documents or send verification link.

5. Process of Authentication through e-KYC

- If a taxpayer is not available with Aadhar Number or his Mobile number and email id is not linked with Aadhar Number then he may choose to complete verification through e-KYC.

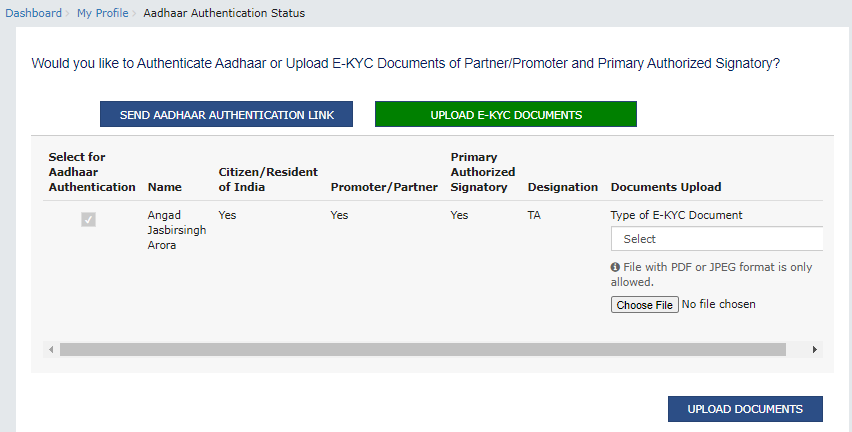

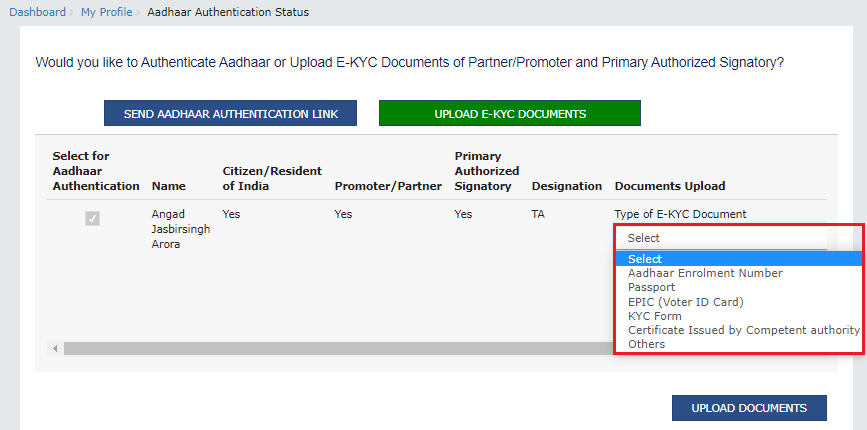

- Upon selection of “UPLOAD E-KYC DOCUMENTS”, list of all persons will start appearing.

- System will provide a drop-down list of type of documents that can be uploaded for e-KYC. Taxpayer can select either of following documents:

- Aadhaar Enrollment Number

- Passport

- EPIC (Voter ID Card)

- KYC Form

- Certificate issued by competent authority

- Others

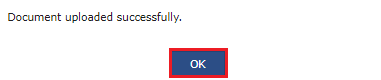

- Upon successful uploading selected document, system will display following message:

- Upon uploading documents, an ARN will be generated for this and it will go to Tax Official queue and the Tax Official can either approve or reject the documents.

- If Tax Official approves the document, then taxpayer will be considered E-KYC Authenticated and not Aadhaar Authenticated. No Pop up message will appear after approval by jurisdictional tax officer.

- However, if taxpayer wishes to authenticate Aadhaar then the taxpayer can do so by navigating to MY PROFILE > AADHAAR AUTHENTICATION STATUS > SEND AADHAAR AUTHENTICATION LINK. Taxpayers won’t be able to upload documents again if once approved by the Tax Official. However, taxpayers can view the document uploaded in the Upload E-KYC Document column.

- Till the time the Tax Official doesn’t take any action on the ARN, taxpayer won’t be able to upload documents again.

- If the Tax Official rejects the documents, then the taxpayer will again get the same pop up whenever the taxpayer will login into the GST Portal and the same procedure will follow.

- If the taxpayer has not done the Aadhaar Authentication through link, in that case the taxpayer will again get the pop-up for Aadhaar authentication.

6. Time limit to complete Authentication process

As of now no time limit is provided by CBIC to complete the authentication process. However, it is suggested to complete the same at earliest.