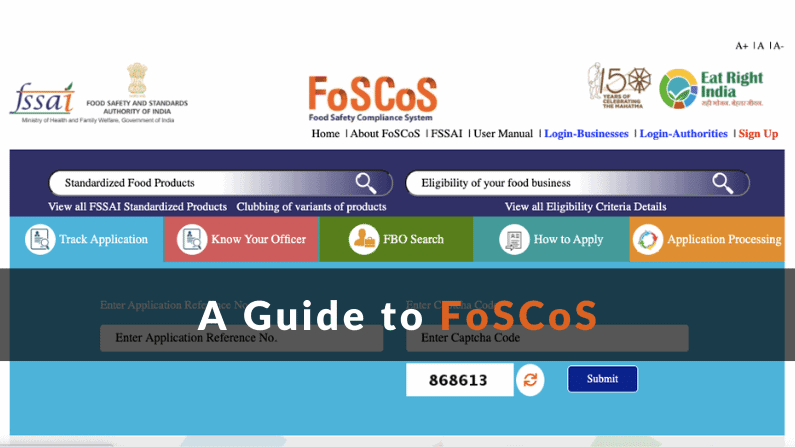

A Guide to FoSCoS- An Upgrade to FLRS by FSSAI

FoSCoS is an online platform launched by the government to ease out the application filing process by the FBOs. This is a one-stop digital center for document filing, registration, and licensing; It also provides compliance services. The FoSCoS replaced the FLRS system by FSSAI, the primary registration, and licensing system for the past 11 years.