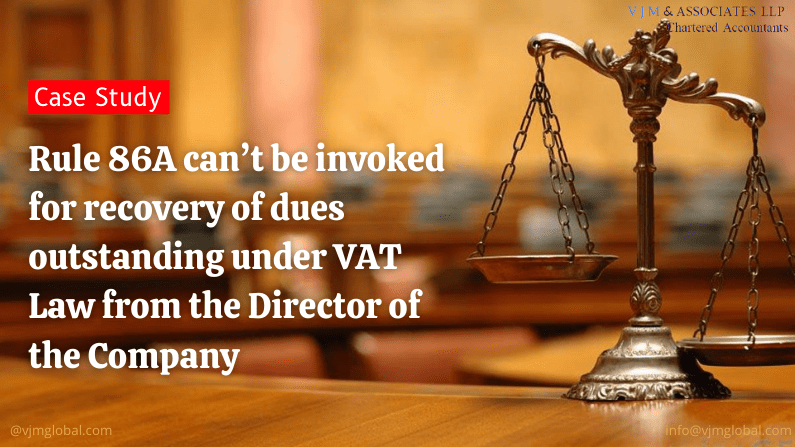

Rule 86A can’t be invoked for recovery of dues outstanding under VAT Law from the Director of the Company

In the matter of NIPUN A BHAGAT, PROPRIETOR OF STEEL KRAFT INDUSTRIES VERSUS STATE OF GUJARAT, (R/Special Civil Application No. 14931 of 2020), ITC of the writ applicant was blocked under Rule 86A of the CGST Act for recovery of dues outstanding under GVAT Act from the company in which writ applicant was a director.