CBIC clarifies on taxability of goods sent/ taken out of India for exhibition or on consignment basis for export promotion

Indian exporters engage in several business promotion activities outside India in order to expand their outreach globally and increase volumes. Certain activities may require physically showcasing the goods to the potential buyers in order to strike deals and finalise sale orders.

In this connection, the goods would have to be taken outside India for demonstration to the potential buyers either directly in exhibitions, trade fairs, business congregations, industry meets etc. or indirectly through distributors/ agents on consignment basis.

The goods would crystallise into exports either wholly or partly, only after a certain period from the physical movement outside India.

In this context, Central Board of Indirect Taxes and Customs has received several representations from trade and industry regarding procedure to be followed in respect of such goods taken out of India. Vide Circular No. 108/27/2019-GST dated 18 July 2019, the CBIC has provided clarifications on the same.

In this context, the CBIC has clarified that the time of supply would be the date of actual sale or expiry of six months from removal. Further, such goods would not be eligible for refund under the IGST route, but eligible for refund under the ITC route.

The summary of the Circular is given below:

1. Test for the activities to be supply

As per section 7 of the Central Goods and Service Act, 2017 (‘CGST Act’), for any activity or transaction to be considered a supply, the following twin tests should be satisfied:

- it should be for a consideration by a person; and

- it should be in the course or furtherance of business.

2. Exceptions to Section 7

The exceptions to Section 7 of CGST Act are enumerated in Schedule I of the CGST Act, wherein the CGST Act presumes certain transactions to be supplies even if made without consideration. Similar provisions also exist in Section 2(21) of the Integrated Goods and Services Tax Act, 2017 (‘IGST Act’) as well.

3. Zero rated supplies

As perSection 16 of the IGST Act, ‘Zero rated supply’ means supplies of the goods or services or both by way of exports or to Special Economic Zone (‘SEZ’) developer or a SEZ unit.

Based on the above analysis, the activity of sending / taking the goods out of India for exhibition or on consignment basis for export promotion does not constitute supply and hence cannot be considered as a zero-rated supply as per the provisions of the IGST Act. The critical factor for this determination is that there is no consideration arising at the point of taking the goods out of India.

4. Procedural clarifications by CBIC

In view of the above position taken by the CBIC, the following procedural clarifications have been issued on issues relating to maintenance of records, issuance of delivery challan / tax invoice etc.

4.1 Maintenance of records by registered person for sending/ taking specified goods out of India

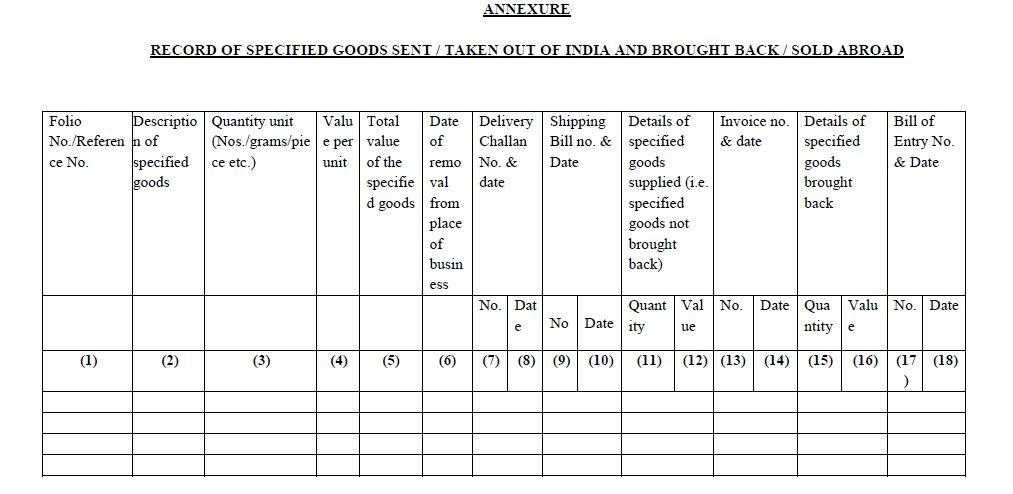

The registered person shall be required to maintain a record of as per the format as Annexure to the Circular as under:

4.2 Documentation required for sending/ taking the specified goods out of India

- The activity of sending/ taking specified goods out of India is not a supply. The same is in the nature of “sale on approval basis” wherein the goods are sent/ taken outside India for the approval of the person located abroad (potential buyers). The actual supply from the Indian exporter takes place only when the goods are approved by the importer.

- This activity of sending/ taking specified goods is covered under the provisions Section 31(7) of the CGST Act read with Rule 55 of Central Goods & Services Tax Rules, 2017 (‘CGST Rules’).

- A delivery challan (issued as per Rule 55 of the CGST Rules) shall accompany the goods.

- As this activity is not a zero-rated supply, execution of a bond or a Letter of Undertaking (‘LUT’) under section 16 of the IGST Act, is not required.

4.3 Time of supply of the goods

- As per Section 31(7) of the CGST Act, the goods sent/ taken out of India are required to be either sold or brought back within the stipulated period of six months from the date of removal.

- Where goods are sold abroad, the time of supply would be the date of sale.

- Where goods are not sold abroad or not brought back to India, the time of supply would be expiry of six months form the date of removal.

4.4 Issue of invoice

Invoice has to be issued at the time of supply of goods as explained above in accordance with Section 12 and Section 31 of the CGST Act read with Rule 46 of the CGST Rules.

4.5 Eligibility of refund claims for goods not brought back into India

- As clarified in above, the activity of sending/ taking specified goods out of India is not a zero-rated supply and hence the same is not eligible for refund claim.

- As also clarified above, supply would be deemed to have taken place on the date of sale or date of expiry of six months from the date of removal, if the goods are neither sold nor brought back into India.

- However, the Indian exporter sender may be eligible for a refund claim even when the goods were sent/ taken out of India without execution of a bond or LUT, if he is eligible for refund of unutilised Input Tax Credit (‘ITC’) on zero rated supplies under Section 54(3) of the CGST Act read Rule 89(4) of the CGST Rules

- The Indian exporter would not be eligible for a refund of IGST paid on exports under Rule 96 of the CGST Rules as supply of goods takes place after the goods are sent/ taken out of India.

5. Conclusion

These clarifications by the CBIC are much appreciated and would clear the administrative and documentation hurdles involved in taking goods physically outside India without having a sale. Further, the option for refund of accumulated ITC by the Indian exporters has been kept open, even if the IGST route for refund claim is not available. The documentation requirements recommended by CBIC are also not cumbersome and indeed a step in the right direction.

Read more on CLARIFICATION ON ISSUES RELATING TO REFUND.