Goods and Service Tax Network (“GSTN”) keeps listing new features on GST portal (www.gst.gov.in) to streamline task for taxpayer and also to improvise compliance. GSTN has listed various new updates on GST portal in last 6 months such as:

- Listing of option to file annual return in GSTR-9 & GSTR-9A,

- Comparison of outward supply between GTSR-3B & GTSR-1 etc.

To complete compliance smoothly, it is important for the user to get informed about such updates so that he can use such online facility and don’t involve himself into cumbersome manual process.

Foremost new features listed on GST portal are as follows:

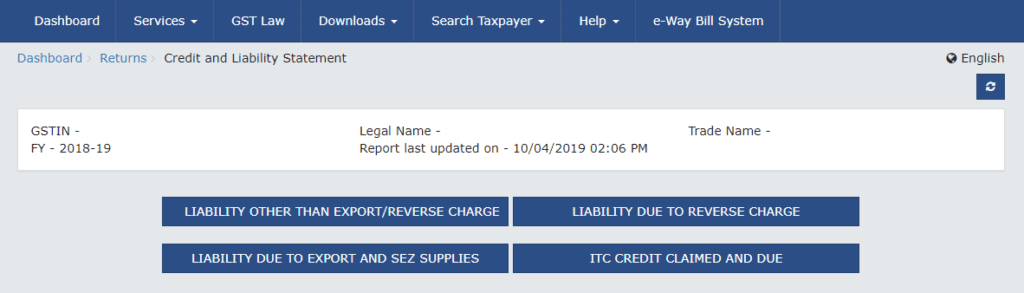

1. Comparison of Liability Declared and ITC claimed

Most of the taxpayers are facing challenge in preparation of reconciliation between liabilities reported in GSTR-3B vis-à-vis numbers filed in GSTR-1. Similarly, difference in also appearing between Input Tax Credit (“ITC”) claimed in GSTR-3B and ITC auto-populating in GSTR-2A. Both of these reconciliations are a pre-requisite for filing of annual return.

Accordingly, GSTN has simplified such task to some extent for taxpayer by providing difference online under a new tab named as “Comparison of Liability Declared and ITC Claimed”. Such tab captures following information:

- Comparison

of liability reported in GSTR-3B vis- à-vis liability reported in GSTR-1 on

monthly basis. - Comparison

of ITC claimed in GSTR-3B and ITC auto-populating in GSTR-2A on monthly basis.

Such comparison is further divided into 4 as follows:

- Liability

other than export/reverse charge - Liability

due to reverse charge - Liability

due to export and SEZ supplies - ITC credit claimed

and due

By using it, user can get a readymade comparison statement for both liability and ITC and now he is required to prepare a reconciliation statement figuring out the reason of difference. It is available for both FY 2017-18 and 2018-19.

Such difference will appear on following path (screenshot follows):

Services>Return>Returns Dashboard>Relevant Tax Period>Comparison of Liability declared and ITC Claimed

2. Option to file annual return in now live

As per Rule 80 of Central Goods and Service Tax Rule, 2017 (“CGST Rules), Annual return should be filed by every taxpayer (other than input service distributor, person responsible for deduction of tax or collection of tax, a casual taxable person and a non-resident taxable person) in form GSTR-9. Annual return should be filed for every year on or before 31st December of the following financial year.

However, for person opting for composition scheme, annual return is applicable in form GSTR-9A. Now GSTN has made option to file annual return in form GSTR-9/9A live on GST portal.

Due date to file annual return for FY 2017-18 has been extended to 30th June, 2019. However, to avoid last minute rush and technical breakdown on portal, taxpayers are suggested not to wait for last date and file their annual return at earliest.

Option to file annual return is available at following path post login to GST portal:

Services>Return>Annual Return

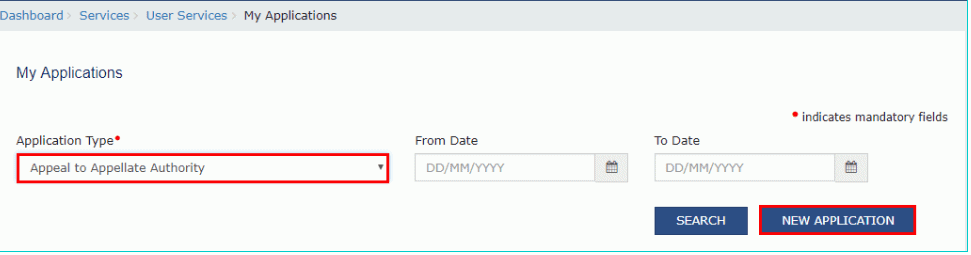

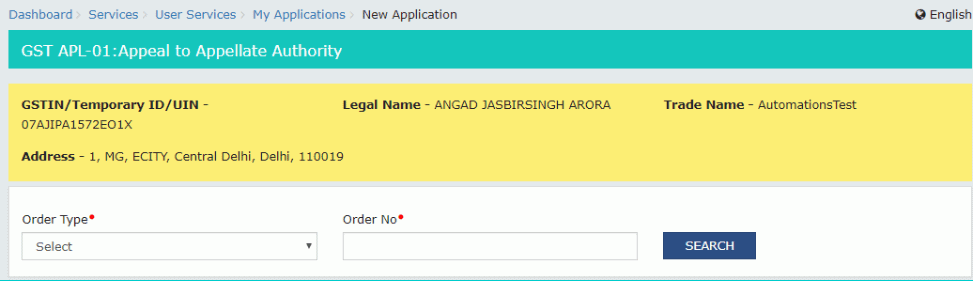

3. File an appeal to Appellate Authority

GST portal has enabled online facility to file appeal to Appellate Authority in form GST APL-01 against either of the following orders:

- Demand order

- Registration

Order - Refund order

- Other order

Option to file such appeal will appear on following path:

Services>User Services>My Applications

Post selection of “Appeal to appellate authority” under application tab, user is required to click on “New Application” tab and then option to file appeal will start appearing in following manner:

Accordingly, appeal can be filed under either of the appearing options.

4. GSTN enabled option to claim ITC on inward supplies taxable under RCM while filing refund application on account of inverted duty structure

While filing online refund application on account of inverted duty structure (where GST rate on outward supply is less than GST rate on inward supply), applicant is required to provide invoice wise details for both outward and inward supplies.

However, earlier while filing details of inward supplies, applicant was not allowed to enter his own GST number for such inward supplies which were taxable under reverse charge mechanism and therefore, applicant was not able to take credit of GST paid on such transaction.

To prevent ITC loss of such taxpayers, GSTN has resolved such technical issue and now applicant can enter his own GST number.

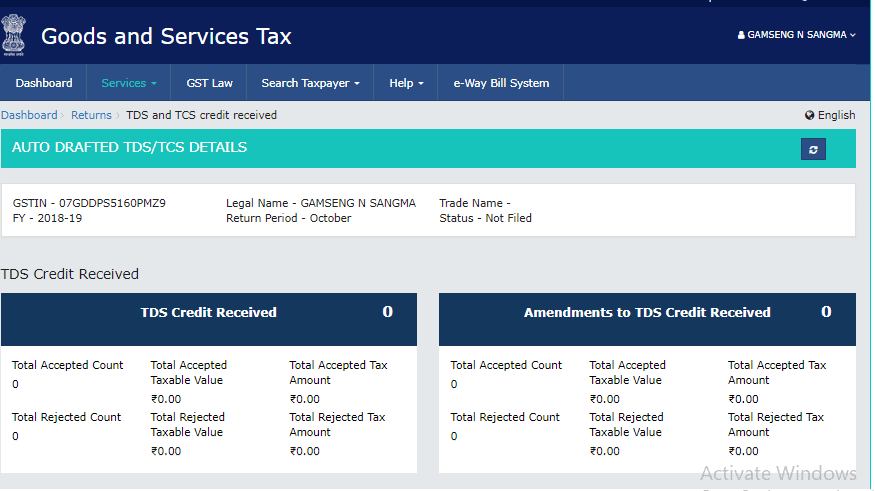

5. Option to avail TDS/TCS credit is now available

GST portal has now enable option to check TDS/TCS credit reflecting against taxpayer’s GSTIN. Such credit can be checked on following path post login:

Services>Return>Return Dashboard>TDS and TCD Credit received

Auto-drafted details of TDS/TCS will appear under this tab in following ways:

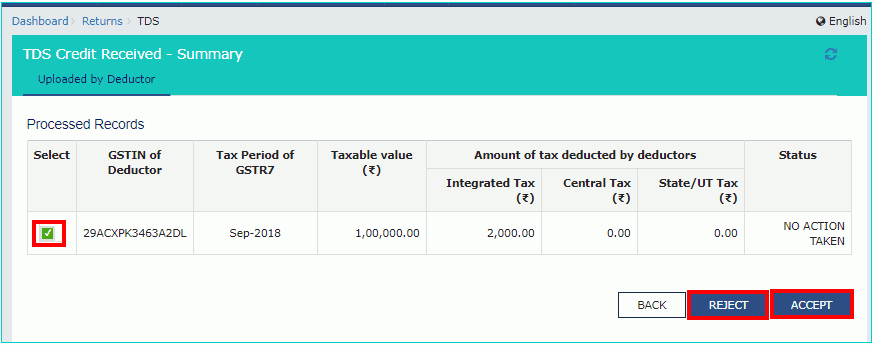

On clicking “TDS Credit Received” tab, GST portal will divert user to list of TDS credit appearing against his GSTIN. Then taxpayer will be required to take action on each entry by way of accept or reject.

Screen for TDS credit pending for action will appear in following way:

On acceptance, such credit will become part of cash ledger of taxpayer and it can be utilized for payment of GST.

6. Postpone requirement to provide bank details

Earlier, any person who was seeking registration under GST was required to provide bank account details at the time of filing application for registration in form GST REG-01.

However, while applying for bank account opening, banks were asking for GST registration certificate and it created a loop with no solution. Therefore, persons were furnishing details of their saving bank account while applying for GST registration.

Now, department has resolved this issue by removing requirement of furnishing bank account details while filing registration application. Person may enter such details when then login on GST portal for the first time.

7. Monthly refund application for taxpayers filing GSTR-1 quarterly

If any taxpayer files GSTR-1 on quarterly basis, then earlier he was able to file refund application on quarterly basis only. However, now GSTN has added new feature which will enable such taxpayer to file his refund application on monthly basis.

Taxpayer can file application only if GSTR-1 for such quarter has been filed.

8. Payments through preferred bank

While making payment of GST through internet banking, GST portal now provides option to add preferred bank. Whenever user will make payment of GST through any bank, such bank will get added in his list of preferred bank. Upto six banks can be added in such list.

Therefore, while making payment, user will not be required to enter bank details every time and he can select his bank from such list of preferred bank and remaining information will auto-populate.

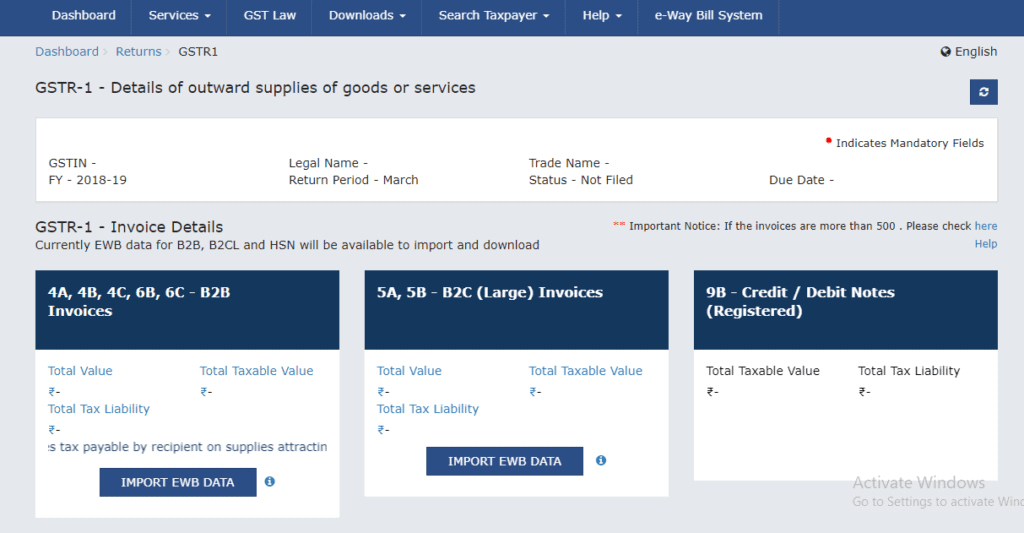

9. Import data from e-waybill portal.

GSTN has now linked GST portal with e-waybill portal and now it allows user to import data from e-waybill portal while filing GSTR-1. Accordingly, it will save time of user and also reduce chances of error due to least manual intervention.

10. Revocation of cancellation of registration

Any person who is providing Online information Database access and reterival service (OIDAR) or registered under section 51 or 52 of CGST Act or registered as non-resident taxable person, if applies for cancellation of registration under GST on suo-moto basis, then GSTN has now enable option to revoke such application for cancellation. Earlier this option was not available.

Formats for filing Annual Returns revised GSTR-9 and GSTR-9C