The Goods and Services Tax (GST) law aims to simplify and implement a taxpayer friendly indirect taxes regime in India. The GST law has brought several multi-tiered central and state taxes under its ambit. The GST has reduced the cascading effect on the prices of goods and services.

The GST law has paved for the way for increased levels of transparency in reporting, administration and governance. The GST has its backbone in the form of a widespread Information technology network infrastructure system called the GSTN (Goods and Service Tax Network).

The GSTN is equipped to facilitate the collection, storage, analysis and retrieval of huge influx of taxpayer data filed from time to time and contribute to the Revenue intelligence. The benefits of GST could be tangible, effective and widespread only if the taxpayers facilitated with a hassle-free compliance and reporting process.

The government has realized and has brought in several taxpayer friendly measures from time to time. While the process has kicked off in the right direction, one may have to wait for more time to let the dust settle down.

The GST law requires taxpayers to file periodical returns in order report their business transactions. In addition to the monthly/ quarterly returns filed, there is a requirement to file an Annual return under the GST law.

In this article, let us look at the overview of GST annual return, who should file annual returns, different annual return forms, due dates for filing, audit compliances under GST law and related legal provisions.

We shall also look through GSTR 9 and familiarise with various parts therein.

1. What is GST Annual Return

Annual return under the GST law is a summary return to be filed once in a year by the registered taxpayers.

The annual return consists of the details of supplies made and received during the financial year pertaining to all the tax heads – Central Goods and Services Tax (CGST), State Goods and Services tax (SGST) and Integrated Goods and Services tax (IGST).

The information mentioned in the Annual returns is predominantly a summary of the details furnished in various monthly and quarterly returns.

The annual return validates the monthly and quarterly returns filed by the taxpayers throughout the year.

2. Legal provision of annual return under GST law

As per Section 44(1) of the Central Goods and Services Tax Act, 2017 (‘CGST Act’), “specified taxpayers are required to file an annual return every year”.

In accordance with the provisions of Rule 80 of the Central Goods and Services tax Rules, 2017 (‘CGST Rules’), the government has notified the forms for filing annual return under the GST law.

3. Who should file annual return under GST law

Annual return under the GST law should be filed by all taxpayers registered under GST, except the following persons:

- Casual Taxable Person

- Input Service Distributor

- Non-Resident Taxable Person

- Persons liable to deduct tax at source (TDS)

- Persons liable to collect tax at source (TCS)

4. Audit compliance under GST law

Similar to the other laws, there is a requirement for certain categories of taxpayers to undergo annual audit under GST. As per Section 35(5) of the CGST Act read with rule 80(3) of the CGST Rules, “every registered taxpayer whose turnover exceeds INR 2 crores in a financial year is required to get the accounts audited by a practicing Chartered Accountant and submit a copy of the audited annual accounts and reconciliation statement in Form GSTR 9C.”

Accordingly, every taxpayer having turnover exceeding INR 2 crores is required to submit GSTR 9C duly certified by a practicing Chartered Accountant or a Cost Accountant along with GSTR 9. This certification is required once for every financial year.

In addition to the above, the GST law also has provisions for a department audit/ special audit by a practicing Chartered Accountant or Cost Accountant on a need basis.

5. Due dates for filing Annual return of GSTR 9

The annual returns under GST law for the financial year are due for filing on or before 31st December every year.

6. Revision of annual return

There are no specific provisions in the GST law to revise annual returns. Accordingly, based upon the current version of the law, it appears that the annual return once filed the cannot be revised.

7. Penalties and late fees for non-filing of GST Annual Return

There is no specific penalty prescribed for non-filing/ belated filing of Annual return under the GST law. However, late fees for delay in filing annual returns have been prescribed.

The late fees for not filing annual return within the due date is INR 100 per day for CGST and INR 100 per day SGST. Hence, any delay results in late fees of INR 200 per day of default. There is no late fee on IGST. The late fees is subject to a maximum cap of 0.25% of the turnover.

8. GSTR 9 – Annual return for Regular Taxpayers

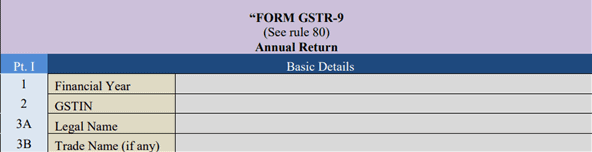

All regular taxpayers filing monthly/ quarterly GST returns should file the Annual return in GSTR 9. The GSTR 9 has 6 parts for reporting various details.

This part contains the basic details of the taxpayer like GSTIN, Legal and trade names. These details are auto populated.

8.1 Part – I (Basic Details)

This part contains the basic details of the taxpayer like GSTIN, Legal and trade names. These details are auto populated.

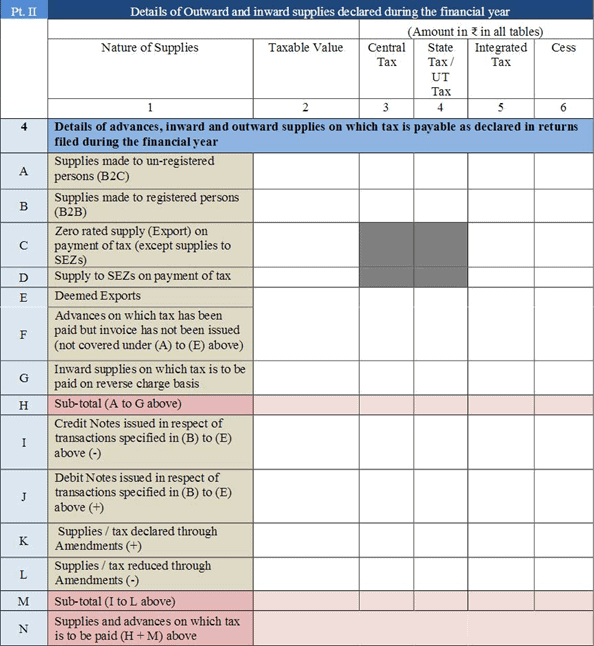

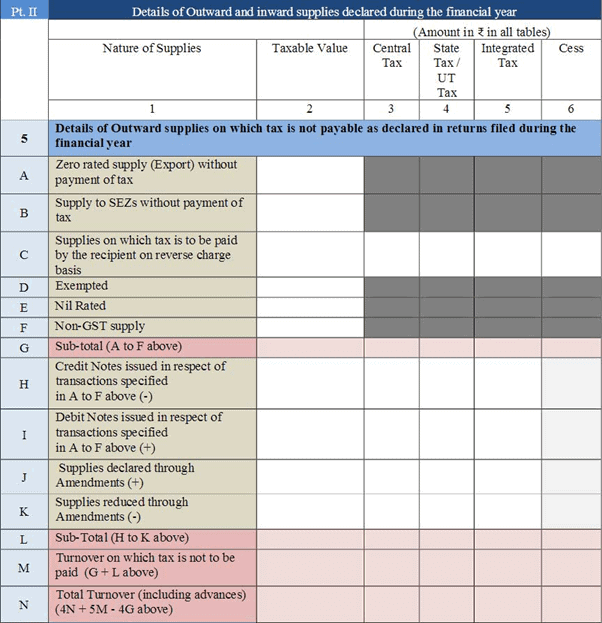

8.2 Part – II (Details of Outward and Inward supplies made declared during the financial year)

The details of all outward and inward supplies made during the year are reported in this part. These details should be collated by consolidating the data of the monthly/ quarterly returns filed thus far during the financial year.

8.2.1 Point 4 requires disclosure of aggregate supplies to B2C, B2B, exports/ SEZ sales on payment of taxes, deemed exports, advances liable to tax, inward supplies subject to reverse charge adjusted with the aggregate of debit/ credit notes and amendments, if any.

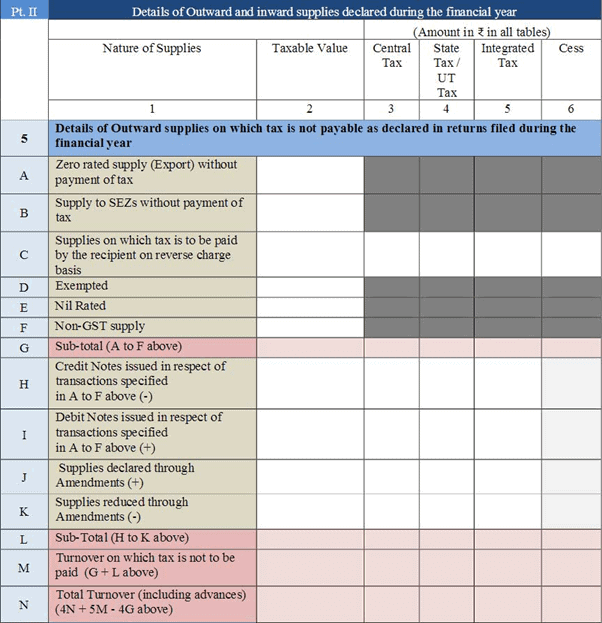

8.2.2 Point 5 requires disclosure of details pertaining to exports/ SEZ sales without payment of tax and Exempted/ nil rated/ non-GST supplies. The data needs to be adjusted with the aggregate of debit/ credit notes and amendments, if any.

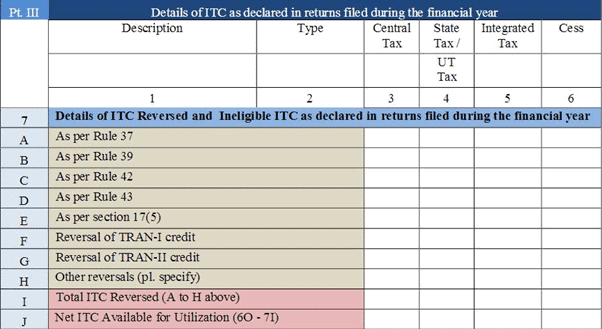

8.3 Part – III (Details of ITC declared in returns during the financial year)

This part contains details pertaining to Input Tax Credit (‘ITC’) and under two points.

8.3.1 Point 6 contains details of ITC received from various sources segregated under Inputs, Capital Goods and Input Services. Any transitional credit from the pre-GST regime in Forms TRAN I and TRAN II also needs to be reported.

8.3.2 Point 7 contains details of Input Tax credit reversed and otherwise ineligible, adjusted with reversals in the transitional credit from the pre-GST regime in Forms TRAN I and TRAN II.

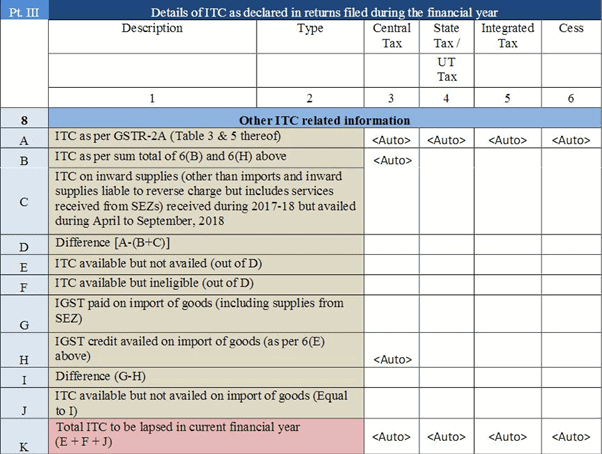

8.3.3 Point 8 predominantly contains details of reconciliation and differences between ITC auto populated from GSTR 2A with ITC disclosed in Point 6 above and attempts to compute the ITC to be lapsed during the year.

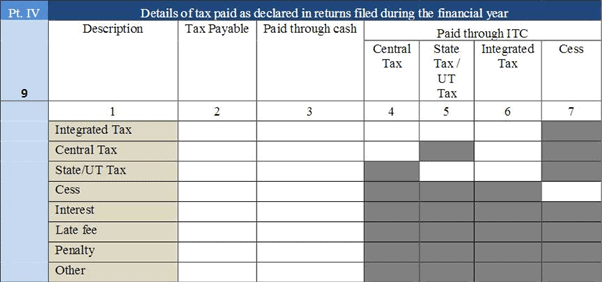

8.4 Part – IV (Details of tax paid as declared in returnsfiled during the financial year)

This part contains details of taxes paid under IGST, CGST, SGST and Cess along with Interest, late fees and penalties.

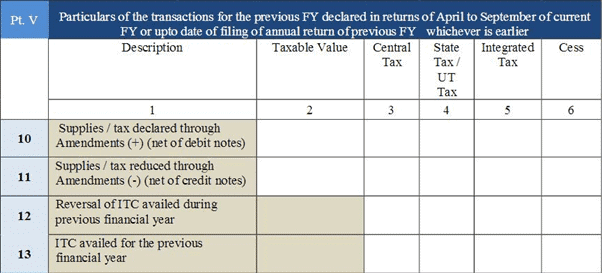

8.5 Part – V (Particulars of the transactions for the previous FY declared inreturns of April to September of current FY or up to date of filing of annualreturn of previous FY whichever is earlier)

This part contains the summary of all amendments/ omissions pertaining to the previous FY but reported in the subsequent FY. Any reconciliation to the details reported in the returns filed thus far in points 10 to 13 needs to be provided.

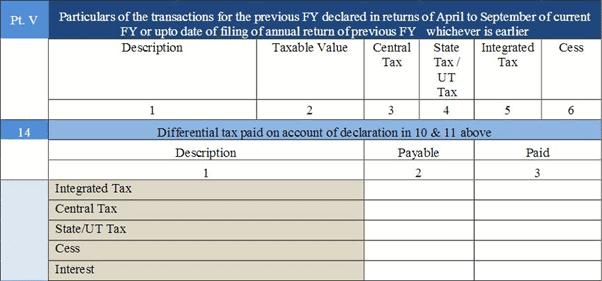

Any differential tax is payable/ paid on account of the reconciliation above needs to be disclosed under point 14.

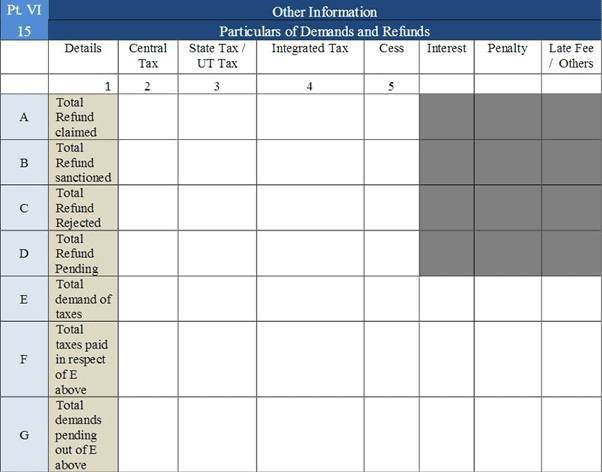

8.6 Part – VI (Other Information)

8.6.1 Point 15 contains particulars of refunds claimed, sanctioned, rejected and pending along with any demands paid/ outstanding in relation to the refunds claimed. The data needs to be disclosed separately for CGST, SGST, IGST and Cess.

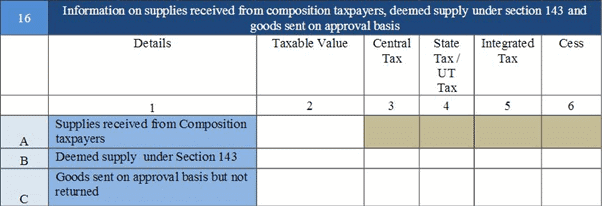

8.6.2 Point 16 contains details of other supplies received from composition dealers, deemed supplies and goods sent on approval basis

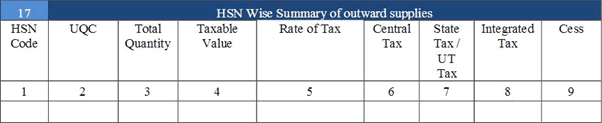

8.6.3 Points 17 and 18 contain details of HSN wise summary of outward and inward supplies.

8.6.3 Points 17 and 18 contain details of HSN wise summary of outward and inward supplies.

9. Conclusion

The GST annual return forms have had their own share of controversies since being notified. The annual returns forms still require disclosure of several data points. While the disclosure is just a summary, these require significant data backup for each clause separately. These details may not have been captured by all taxpayers at the time of recording transactions in the books of accounts.

For example:

- Details of amendments/ debit notes/ credit notes for exempt sales are sought in Point 5 of GSTR 9. However, there is no such requirement in GSTR 1.

- Details of ITC classified under Inputs, Capital Goods and Input Services are sought in Point 6 of GSTR 9. These details are being sought despite GSTR 2 not made available for filing.

- HSN wise summaries of outward and inward supplies are being sought in Points 17 and 18 of GSTR 9. The details of inward supplies are being sought even though the same cannot be extracted from GSTR 2A.

These requirements are being viewed as increased compliance burden on taxpayers. This adds to the significant delay in releasing the annual return filing utilities as on date. In doing so, the government would really be taking the representations of the taxpayers, consultants and industry at large into consideration. That is definitely one step in the direction to making GST a hassle-free and compliance-friendly regime for the taxpayers.

Read our other articles onFormats for filing Annual Returns revised GSTR-9 and GSTR-9C

Read our other articles on Missing information in Tax invoice leads to Penalties u/s 125 and 122